BOI Reporting Deadline Alert: Key Facts Every Business Owner Needs to Know

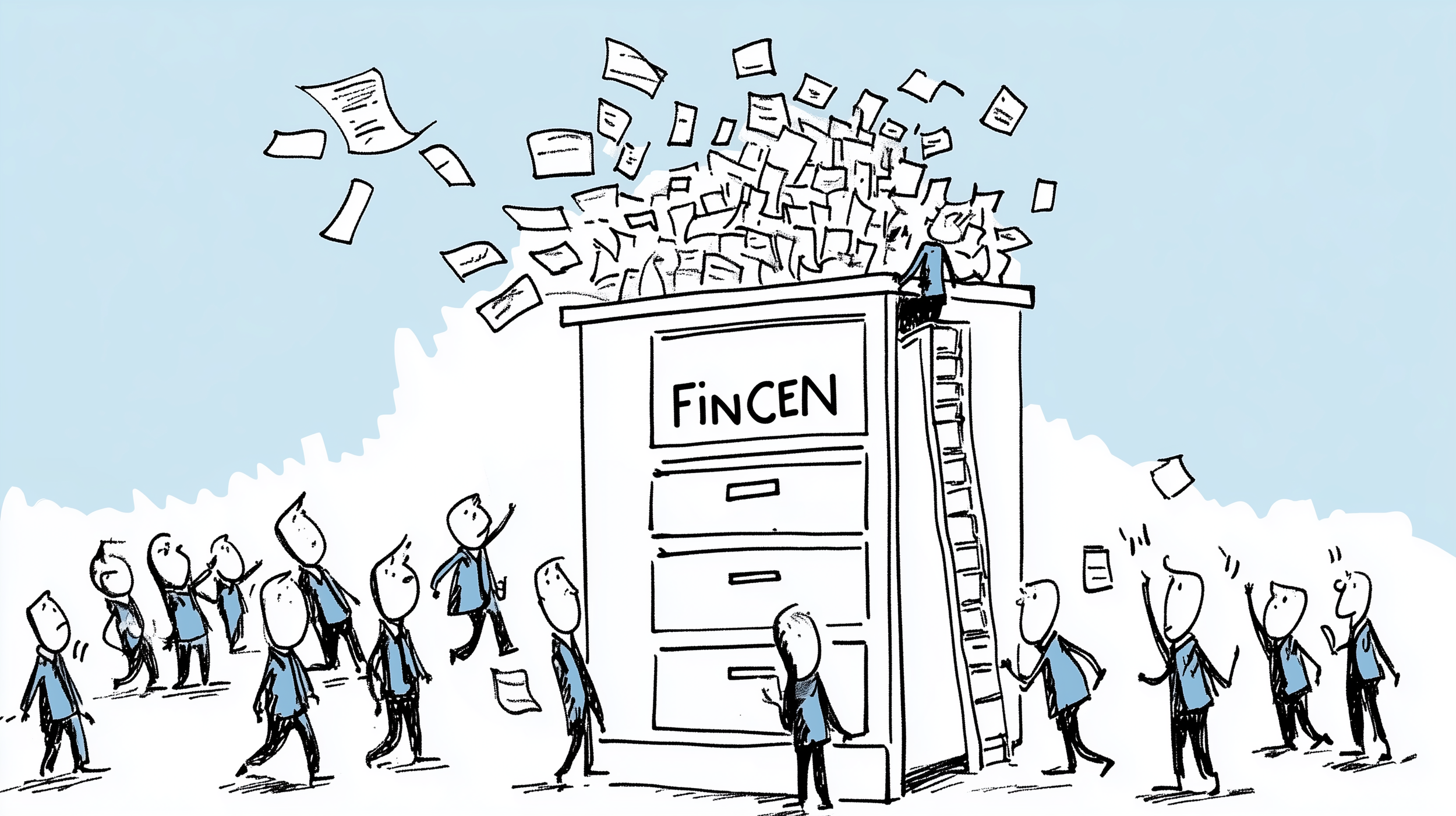

The numbers are stark: only 6.5 million out of an expected 32 million beneficial ownership information (BOI) reports have been filed with FinCEN. While the AICPA has requested Congress delay the deadline, the requirements currently remain in effect, and businesses need to prepare.

What is BOI Reporting? Under the Corporate Transparency Act, most small businesses must report information about their beneficial owners to FinCEN. This anti-money-laundering initiative requires detailed disclosure of ownership information and subsequent updates when changes occur.

Critical Deadlines:

Pre-2024 companies must file by January 1, 2025

Companies created in 2024 have 90 days from creation to file

Companies created after January 1, 2025, must file within 30 days

All ownership changes require updates within 30 days

The Challenge

The AICPA's recent letter to Congress highlights significant concerns about compliance. With unclear requirements and tight deadlines, many businesses risk becoming "accidentally and unknowingly delinquent," according to AICPA CEO Barry Melancon.

How Madras Can Help Our team specializes in BOI compliance. We manage the entire reporting process, from initial filings to tracking and updating ownership changes. Our systematic approach ensures businesses meet all deadlines and requirements without disrupting their regular operations.

Our BOI Services

Initial BOI report preparation and filing

Ongoing compliance monitoring

Timely updates for ownership changes

Documentation maintenance

Planning for Compliance

Whether or not Congress grants an extension, BOI reporting requirements aren't going away. Businesses need a reliable system for meeting these obligations. Madras Accountancy has already our clients successfully navigate BOI requirements, maintaining perfect compliance with current deadlines.

Contact us to ensure your business meets its BOI reporting obligations efficiently and accurately. Our team is ready to handle the complexities of compliance while you focus on running your business.