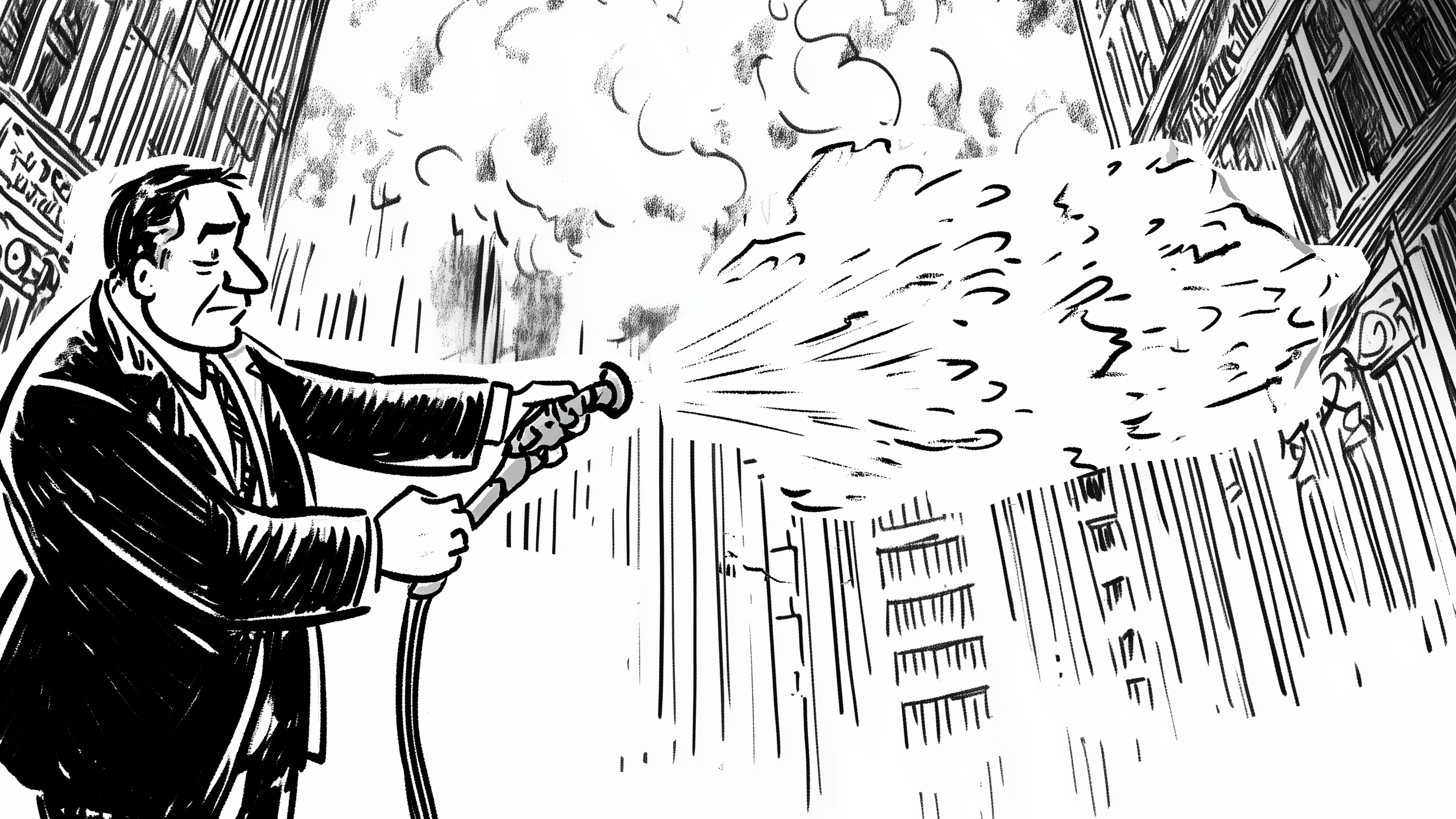

From Firefighter to Fire Marshal: How Fractional CFOs Can Stop Fighting Financial Fires

Every Fractional CFO knows the drill: A client's QuickBooks integration breaks down right before a board meeting. Another client's AP process is suddenly throwing up red flags. And three different companies need cash flow projections... by tomorrow.

You didn't become a fractional CFO to fight fires. You became one to prevent them.

The Hidden Costs of Crisis Mode

When you're constantly in reaction mode, the real costs go far beyond just time:

Strategic guidance gets delayed while you fix urgent but routine problems

Growth planning takes a back seat to system maintenance

Risk assessment becomes reactive instead of proactive

Your expertise is diluted across tactical challenges

What Prevention Looks Like in Practice

Take Sarah, one of our clients at Madras Accountancy, who was juggling seven different accounting systems across twelve clients. Every month end was a marathon of reconciliations, system checks, and manual report generation. She was working 70-hour weeks just to keep up.

After implementing our outsourced accounting solution:

Her system management time dropped by 75%

Monthly closes happen automatically

Reports are standardized and delivered on schedule

She added four new clients without adding hours

Now, she said she has an entire extra 8-hour workday available to do as she pleases. Imagine going from working 70-hour weeks to 32. Sounds like a dream, right?

The Real Numbers Behind Prevention

The outsourced accounting approach is transforming how fractional CFOs work. At Madras Accountancy, we've seen consistent results:

Reduction in system management time: 60-80%

Increase in available strategic planning hours: 15-20 hours per week

Client reporting delivery speed: 3x faster

Average client portfolio growth: 40% in first year

How Modern Prevention Works

Today's outsourced accounting solutions go far beyond basic bookkeeping. A strong partner provides:

Multi-system expertise across all major platforms

Automated data flow between different client systems

Standardized reporting regardless of source system

Proactive monitoring and issue detection

Regular system maintenance and updates

Building Your Prevention System

Identify Your Biggest Time Drains

Which systems cause the most headaches?

Where do you spend most of your reactive time?

What routine tasks keep you from strategic work?

Calculate the Real Cost

Hours spent on system management

Delayed response time to strategic opportunities

Limited capacity for new clients

Impact on work-life balance

The Bottom Line

Your value as a fractional CFO isn't in fighting fires—it's in preventing them and growing your clients' businesses. Modern outsourced accounting doesn't just handle the routine work; it gives you the infrastructure to scale your practice while maintaining quality.

Mark, a fractional CFO who partners with Madras Accountancy, puts it this way: "I used to spend my Sundays prepping for the week, checking systems, and catching up on reconciliations. Now I spend them with my family. My practice has grown 40% this year, and I'm working less than I was before."

Ready to stop fighting fires and start preventing them? At Madras Accountancy, we provide the comprehensive support that lets you build a practice that scales without the stress. Our team handles the systems while you handle the strategy.

Contact us to learn how Madras Accountancy's proven approach can transform your fractional CFO practice from reactive to proactive, from firefighting to fire prevention.