In 2025, the finance world is changing, and so are the careers built within it. A growing number of seasoned CFOs and senior finance leaders are stepping away from rigid corporate roles and embracing something more flexible, more varied, and often, more fulfilling: the fractional CFO model.

Whether it's burnout from the 60-hour executive grind, a desire for work-life balance, or a passion for helping small businesses scale with clarity, becoming a fractional CFO offers an opportunity to stay at the top of your game, while working on your own terms.

But it's not a simple pivot.

To succeed in this model, you'll need more than technical expertise. You'll need business acumen, strong client management, and the ability to add strategic value across multiple industries, sometimes with limited face time.

This guide breaks it all down:

If you're a finance professional ready to take ownership of your time, skills, and future, this could be your next chapter.

A Fractional CFO is not just a part-time CFO or an interim CFO. It's a strategic partner role occupied by a highly experienced chief financial officer who supports multiple businesses at once, usually on a project-based or recurring retainer model.

In a time where financial decisions have to be faster, leaner, and data-driven, fractional cfo services offer the perfect blend of financial expertise, flexibility, and cost-efficiency. Business owners can access strategic financial leadership without the cost and commitment of hiring a full-time CFO.

This fractional role is no longer a fallback for CFOs nearing retirement, it's a forward-thinking career choice for finance leaders who want more ownership of their time, income, and the impact they make. Many fractional CFOs find this to be a rewarding career path that allows them to help businesses achieve their business goals.

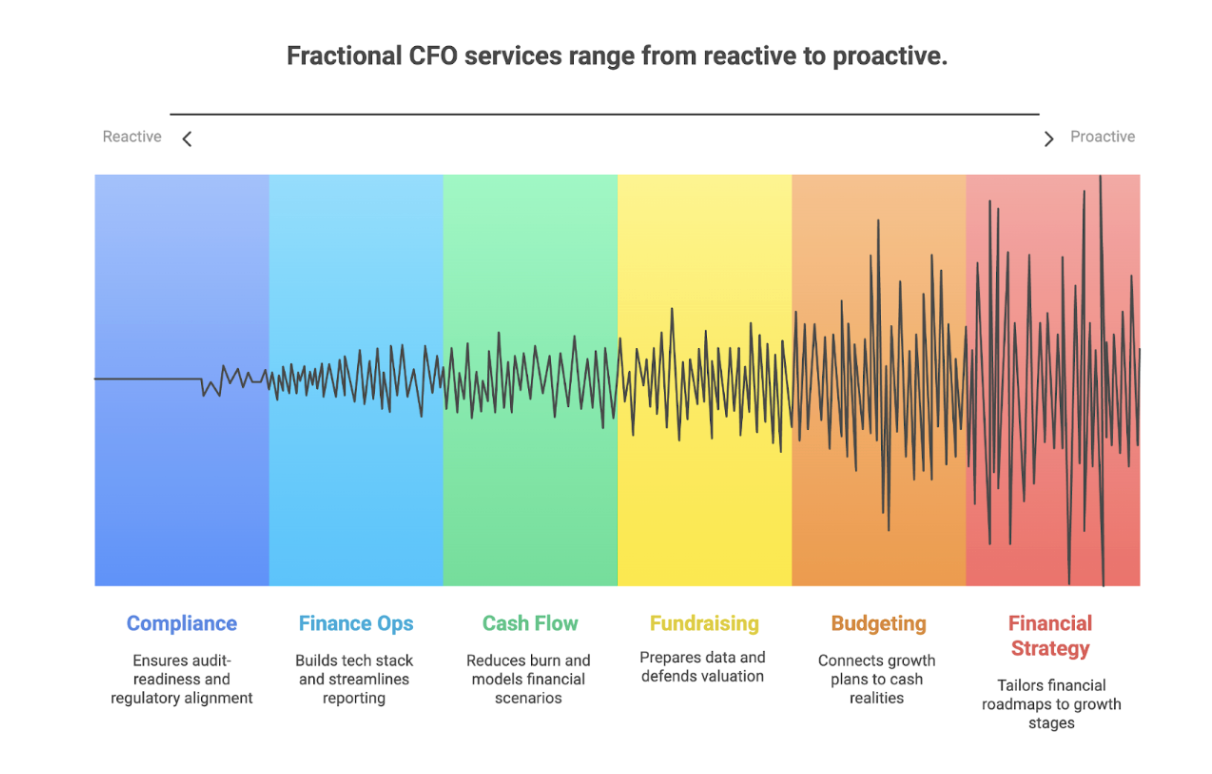

A fractional CFO isn't just a part-time finance executive; they're a strategic force multiplier for growing businesses. The role of a fractional CFO encompasses both traditional CFO work and strategic business planning.

Here's what that looks like in practice:

Instead of a one-size-fits-all approach, a fractional CFO tailors financial roadmaps based on where the business is: pre-seed, Series A, or mid-scale.

For example, an early-stage SaaS startup may need help prioritizing product-market fit metrics, while a post-Series A company might focus on optimizing burn vs runway for the next 18 months.

Fractional CFOs build rolling forecasts that connect the dots between growth plans and cash realities. Not just spreadsheets, but strategic tools founders can use to make informed decisions with confidence.

Think of it as building a runway, with fuel checkpoints every 3 months, not a guess for the year.

This is survival 101 for most startups. A good CFO doesn't just monitor burn, they help reduce it strategically without stalling momentum. They also model out scenarios for different hiring plans, product launches, or fundraising timelines.

From prepping data rooms to building investor-ready financial models, fractional CFOs play a quiet but critical role during a raise. They know what VCs care about, and how to defend a valuation or show sustainable growth.

Some even act as the "founder's translator," turning vision into numbers and helping with investor Q&A.

A lot of fractional CFOs come in when the books are messy or the startup has outgrown a single accounting tool. Working with a controller when needed, they'll build the right tech stack, think QuickBooks + Ramp + Mosaic + NetSuite, and streamline reporting without creating friction for the team.

No founder wants to get tripped up on taxes, regulatory filings, or missed compliance deadlines. A fractional CFO ensures the business is audit-ready and aligned with IRS and GAAP standards, without bogging the team down.

It's like having the guardrails without the red tape.

A fractional CFO brings the mindset of a full-time CFO, but works like a consultant with a startup's urgency. They're not "just accountants," they're operators who know how to translate numbers into smart business decisions.

Not every CFO can transition to a fractional role, and that's a good thing.

Success as a fractional CFO isn't about doing "less" of what you did in a full-time role. It's about doing more of what matters, faster, leaner, and across multiple businesses that expect clarity, not just competency.

Let's break down the non-negotiables if you want to not just survive, but thrive in this model.

Fractional CFOs are not operationally embedded in a single org. You won't be in daily standups or sitting outside the CEO's office. That means you must know how to prioritize what matters most, fast.

You won't have the luxury of months of onboarding or a finance team to delegate to. You're often walking into chaos: unclear books, no cash visibility, no financial plan.

What makes you successful is:

The days of 40-tab spreadsheets that no one touches after the board meeting? Done.

As a fractional CFO, your models have to:

You're not just building forecasts, you're creating decision engines.

That means knowing when to go deep on CAC/LTV vs. when to zoom out on GTM capital efficiency. Successful fractional CFOs aren't Excel artists. They're business translators who help clients navigate complex financial decisions.

In a corporate CFO role, your experience buys you time. In fractional work? It buys you a 15-minute Zoom to prove value.

Clarity is your currency:

Remember: you don't have time to "ease in." You create trust by delivering clarity early and often.

No one talks about this enough.

As a fractional CFO, you're not just doing the work. You're:

The best fractional CFOs don't underprice themselves. They lead with outcomes, not hours. And they structure retainers or projects that balance value with capacity.

Don't know how to sell? Learn. It's as critical as your FP&A skills for finding new clients and building a sustainable fractional CFO practice.

This is where many CFOs trip up.

A full-time finance professional can succeed by being a strong technician. If you want to be a fractional CFO, you need to act like a founder ally.

That means:

If you can't speak the language of product, sales, and marketing, you'll always feel like an outsider.

Fractional CFOs who win? They own the outcome, not just the report.

You won't be in the building, but you'll be on call, in some form.

Great fractional CFOs:

If a founder says "you just get our business," you've done your job.

The fractional CFO career isn't easier than being full-time, it's just different. It rewards strategic thinkers, confident communicators, and people who know how to own outcomes across contexts.

Considering becoming a fractional CFO? The transition requires both technical competence and business development skills. Here's how to start as a fractional CFO successfully:

While not always required, most successful fractional CFOs have:

To succeed as a fractional CFO, you need a deep understanding of:

Many professionals who want to be a fractional CFO start by:

The demand for fractional CFO services continues to grow as more businesses need strategic financial leadership without the cost of a full-time hire.

If you've ever wondered whether switching to fractional CFO work is financially viable, or just a passion project, here's the real-world breakdown for U.S.-based finance professionals in 2025:

The average hourly rate depends heavily on your experience and the type of work:

Real talk: You're not billing for number-crunching, you're billing for high-leverage insight. That's why senior fractional CFOs confidently charge $400+/hour on premium engagements.

For ongoing strategic partnerships, most Fractional CFOs shift to retainer models:

That's roughly 10–40 hours/month, giving flexibility for both part-timers and those working with multiple clients.

How you package your offering matters:

Your earnings will reflect:

Many fractional CFOs often find they can earn comparable or higher income than the cost of a full-time CFO position, while maintaining better work-life balance.

Becoming a successful fractional CFO requires more than technical skills. Here are key strategies:

Successful client acquisition involves:

Fractional CFOs often manage several client relationships simultaneously. This requires:

To succeed as a fractional CFO long-term:

The role of a fractional CFO continues to evolve as more businesses recognize they need strategic financial leadership without the cost and commitment of a full-time hire.

If you've made it this far, one thing is clear: the fractional CFO path isn't just a side hustle or a trend, it's a strategic career shift rooted in financial expertise, autonomy, and real business impact.

In 2025, companies, especially startups and lean mid-market firms, don't just need compliance or finance hygiene. They need judgment. A fractional CFO brings seasoned decision-making to the table, providing guidance without the cost and operational overhead of hiring a full-time CFO. That's exactly where your opportunity lies.

But here's the key: becoming a successful fractional CFO isn't just about having a CPA or corporate background. It's about developing cross-functional instincts, building trust with founders, communicating clearly, and bringing structure to chaos.

And yes, the road comes with its own challenges, client acquisition, time management, navigating different business models, but the upside? You own your time, you stay close to strategy, and you choose the kind of CFO leadership that energizes you.

At Madras Accountancy, we don't just talk about the fractional CFO model, we help professionals like you make it real. Whether you're exploring your first client or scaling your practice, our U.S.-focused services give you the structure, systems, and strategic support to grow with confidence.

For those who start as a fractional CFO or are looking to transition to a fractional career, we provide the operational support that allows you to focus on high-value CFO work. We help you help clients achieve their strategic objectives while building a sustainable practice.

If you're a business owner looking to hire a fractional CFO or a cfo for a company, let's talk.

📩 Contact us and see what's possible.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.