Accounting departments used to rely on manual data entry, spreadsheets, and disconnected systems that slowed down financial reporting and increased the chance of human error. Today, the push toward automation is no longer optional. Businesses and CPA firms need efficiency, accuracy, and visibility across every financial process.

At the heart of this transformation is one technology: APIs.

Application Programming Interfaces (APIs) are not just for developers. In the context of accounting, they act as bridges between software platforms, allowing them to exchange data in real time without manual intervention. Whether it is syncing bank feeds, automating invoice entries, or updating payroll records, APIs are the invisible engine behind streamlined financial operations.

In this article, we explain how API integration works in the accounting world, what benefits it brings to small and mid-sized firms, how to implement it correctly, and where offshore support from firms like Madras Accountancy can assist.

An API, or Application Programming Interface, is a set of protocols that allows different software applications to talk to each other. In simpler terms, APIs allow two different systems to exchange information automatically.

Imagine you use QuickBooks Online for bookkeeping, Bill.com for managing payables, and Gusto for payroll. Without APIs, your team would need to manually download data from one system and upload it to another. With APIs, these platforms can sync automatically, ensuring that updates in one tool are reflected across the others.

In accounting, API integrations are used to:

Instead of scattered data, you get a unified, accurate, and timely view of your finances.

Accounting is built on precision and timeliness. Any delay or inconsistency in data can result in late filings, incorrect reporting, or misinformed decisions. This is especially true for CPA firms managing multiple client accounts and deadlines.

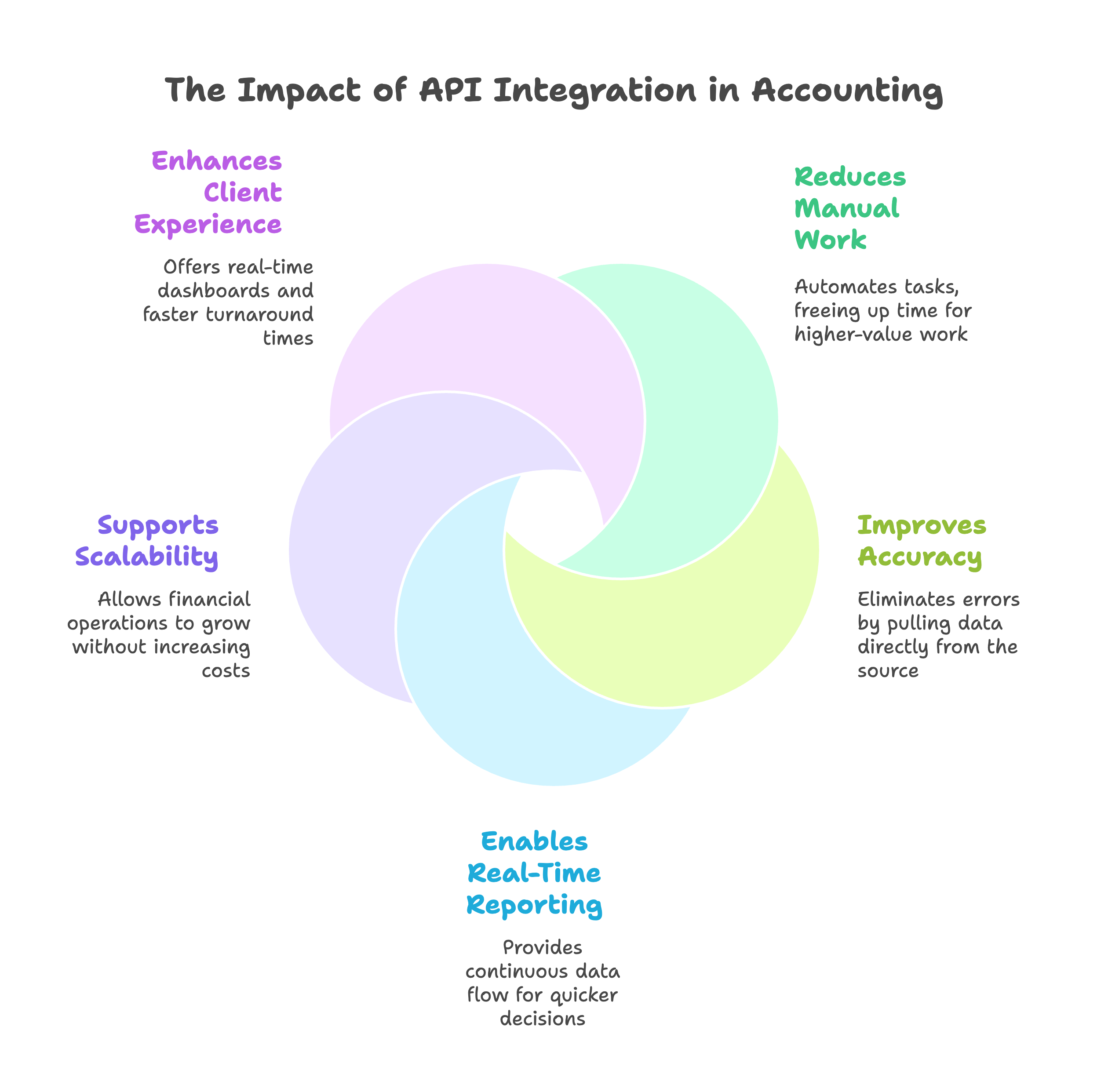

Here is why API integration has become essential for accounting operations:

Manually entering or reconciling data between systems takes time and introduces risk. APIs automate these tasks, freeing up your team for higher-value work.

APIs eliminate copy-paste errors or file upload mismatches. Data is pulled directly from the source, reducing human involvement and error rates.

With integrated systems, financial data flows continuously. You no longer have to wait until the end of the month to generate reports or track KPIs. This empowers quicker decisions.

As your business or client base grows, manual systems cannot keep up. API integrations allow you to scale financial operations without increasing headcount or back-office costs.

CPA firms that offer real-time dashboards, proactive insights, and faster turnaround times stand out. API-driven workflows support client demands for speed and transparency.

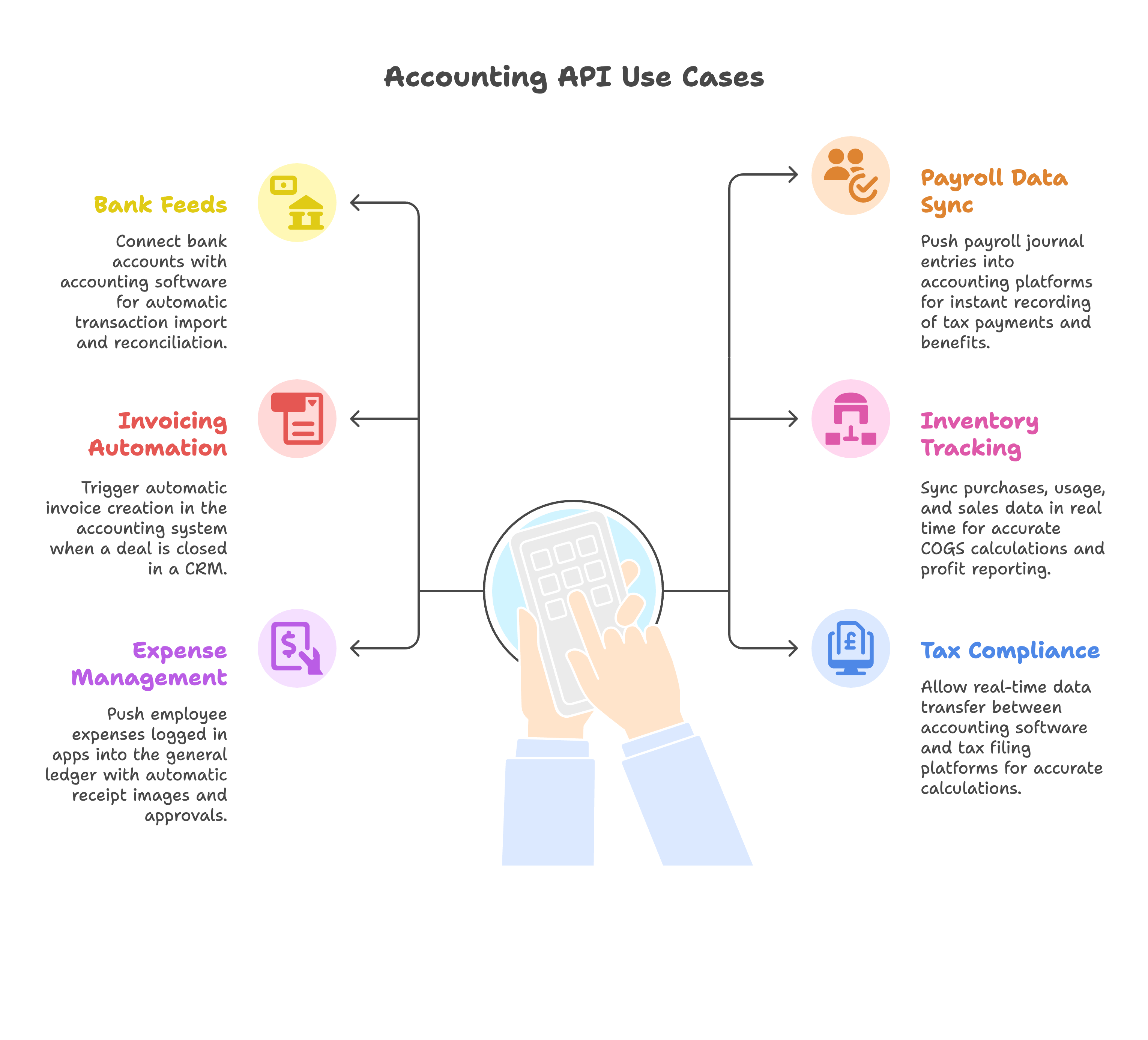

Here are some practical scenarios where APIs transform accounting workflows:

APIs connect bank accounts with accounting software like QuickBooks, Xero, or NetSuite. Transactions are imported daily, categorized automatically, and matched with invoices or bills. This reduces reconciliation time from hours to minutes.

Payroll tools such as Gusto or ADP can push payroll journal entries into accounting platforms through APIs. Tax payments, employee benefits, and deductions are recorded in the correct accounts instantly.

When a deal is marked as closed in a CRM like Salesforce, an API can trigger automatic invoice creation in the accounting system. You save time, improve billing accuracy, and shorten the revenue cycle.

APIs connect inventory management tools with accounting systems. Purchases, usage, and sales data sync in real time, ensuring accurate COGS calculations and profit reporting.

Employee expenses logged in apps like Expensify or Zoho Expense can be pushed into the general ledger. Receipt images, categories, and approvals flow automatically into bookkeeping records.

APIs allow real-time data transfer between your accounting software and tax filing platforms. Sales tax, income tax estimates, and deductions are calculated without waiting for manual updates.

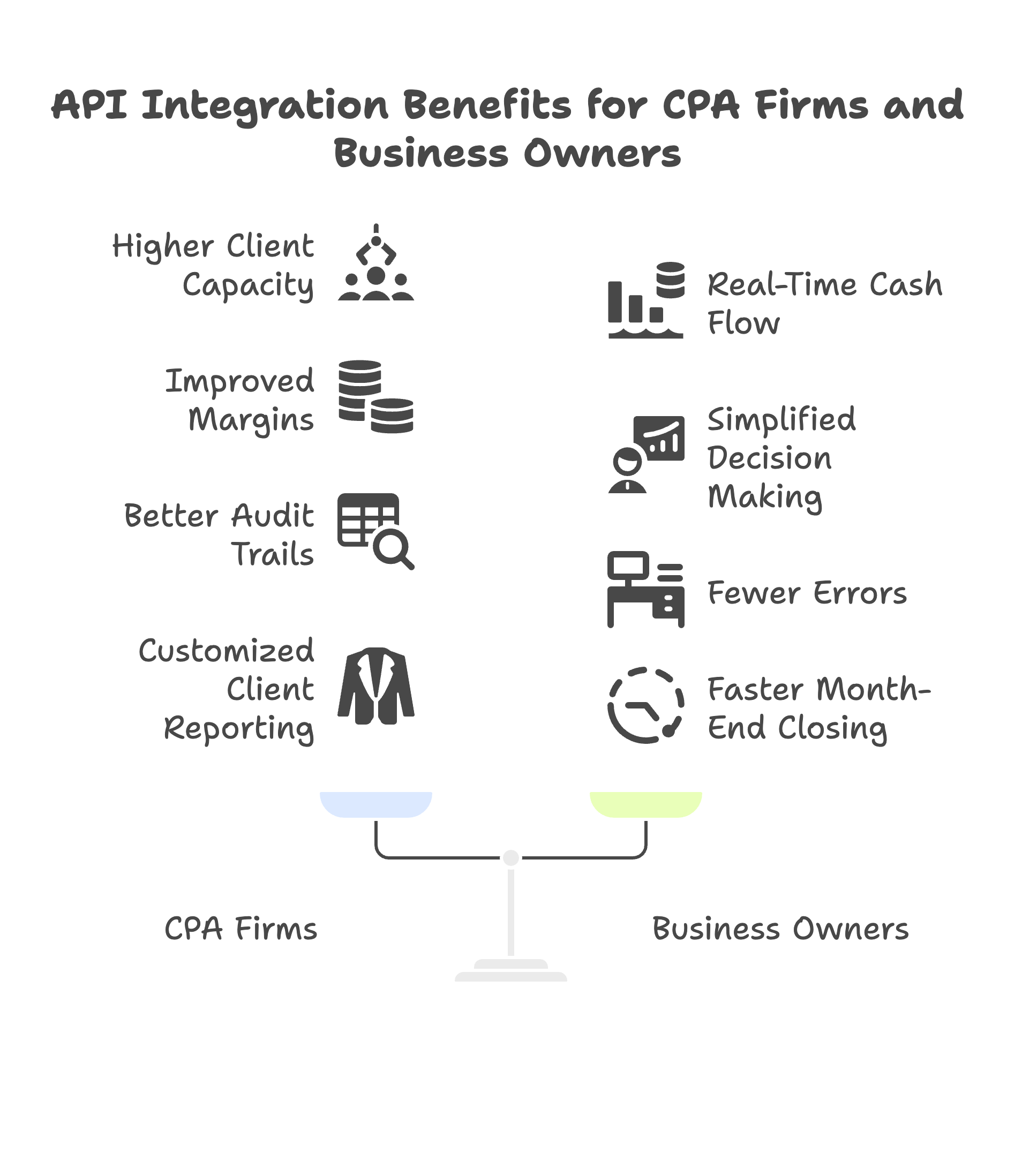

API integration does more than reduce workload. It can fundamentally change how a CPA firm operates and serves clients.

Some accounting platforms are built with APIs at their core. Choosing tools with robust integration capabilities ensures a smoother implementation.

Most of these tools offer REST APIs, which are modern, secure, and easy to integrate with other systems.

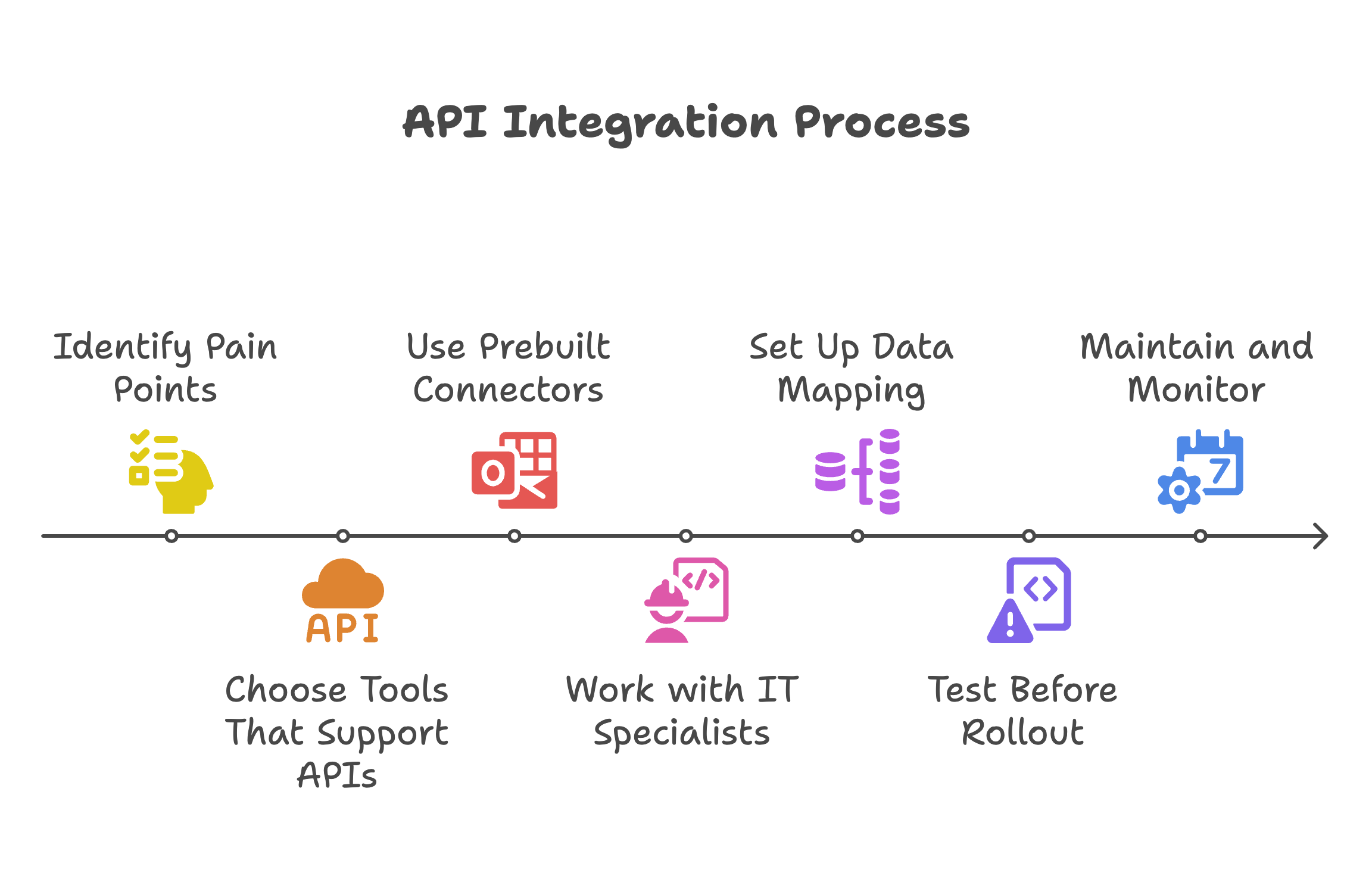

API integration offers major benefits, but only if implemented correctly. Here are key steps for successful adoption.

Start by listing repetitive, manual accounting tasks that slow down your team. This will help prioritize which integrations will deliver the most impact.

Avoid legacy software that does not support modern integration. Choose cloud-based tools with published API documentation.

Many platforms offer out-of-the-box integrations with common tools. These reduce implementation time and do not require custom coding.

Complex setups may require technical help. If your internal IT team is stretched thin, consider offshore integration support from firms like Madras Accountancy.

Ensure that data flows correctly between systems. Map chart of accounts, expense categories, and naming conventions before going live.

Run pilots to identify syncing errors or delays. Validate reports for consistency. Once confirmed, roll out to the broader team or client list.

APIs evolve, and software updates can break connections. Schedule regular checks and updates to avoid disruptions.

Data security is critical when connecting financial platforms. Poorly implemented APIs can open doors to data breaches.

Here are best practices to protect sensitive financial information:

When working with third-party accountants or offshore teams, ensure proper access governance and NDA protections are in place.

Many CPA firms hesitate to implement API workflows because they lack the technical expertise or in-house bandwidth. Offshore accounting partners like Madras Accountancy can help by:

This allows your internal team to focus on advisory and client-facing roles while gaining the efficiency of integrated workflows.

The future of accounting lies in real-time, AI-enhanced automation. API integration will remain a foundational layer, enabling:

Businesses that embrace automation now will have a competitive advantage in both speed and financial visibility.

API integration is no longer a nice-to-have for accounting teams. It is a strategic necessity. Whether you run a CPA firm juggling multiple client accounts or a growing business looking to streamline operations, APIs bring automation, accuracy, and scalability.

By choosing the right tools, implementing secure connections, and partnering with experienced support providers, you can build a modern accounting workflow that saves time and supports better decisions.

At Madras Accountancy, we help firms leverage API integrations to eliminate bottlenecks, reduce manual errors, and build financial systems ready for the next decade. If you want to upgrade your accounting operations with automation that works, we are ready to help.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.