Cryptocurrency is no longer the domain of speculative retail traders and tech enthusiasts. Increasingly, small and mid-sized businesses are accepting crypto payments, holding digital asset portfolios on their balance sheets, or using blockchain technology in core operations. Yet while adoption grows, so does the complexity of staying compliant with tax law.

Cryptocurrency is treated very differently from fiat currency under the U.S. tax code. It is classified as property, not cash. This means that every transaction, no matter how small, could trigger a taxable event and impact your tax obligations. From accepting payments in bitcoin to paying vendors in Ethereum or swapping tokens on decentralized exchanges, each crypto transaction may carry significant tax implications.

Business owners and their accountants must understand these tax rules thoroughly to avoid compliance issues, IRS penalties, or missed deductions. The stakes are high, especially as tax enforcement around digital assets continues to ramp up. In 2023 alone, the IRS issued thousands of crypto tax-related audits and added new reporting requirements. Looking ahead to 2025, additional reporting requirements are expected to take effect.

At Madras Accountancy, we work closely with CPA firms across the U.S. to help them support their crypto-active business clients with accurate bookkeeping, strategic tax planning, and audit-ready documentation. This guide will walk you through everything a business needs to know about crypto tax compliance, from income recognition and capital gains tax to payroll, mining, and staking scenarios.

The IRS classifies cryptocurrency as property, not currency. This foundational rule, issued in Notice 2014-21, has wide-reaching tax implications for how digital asset transactions are taxed. The property classification means that:

Each unit of cryptocurrency must be treated like a separate capital asset, similar to stock or real estate. This makes tracking basis, holding periods, and transaction history critically important for tax purposes.

If a business accepts cryptocurrency as payment, it must recognize revenue at the fair market value on the day of receipt. That value then becomes the basis for future capital gains or losses if the business holds and later disposes of the crypto.

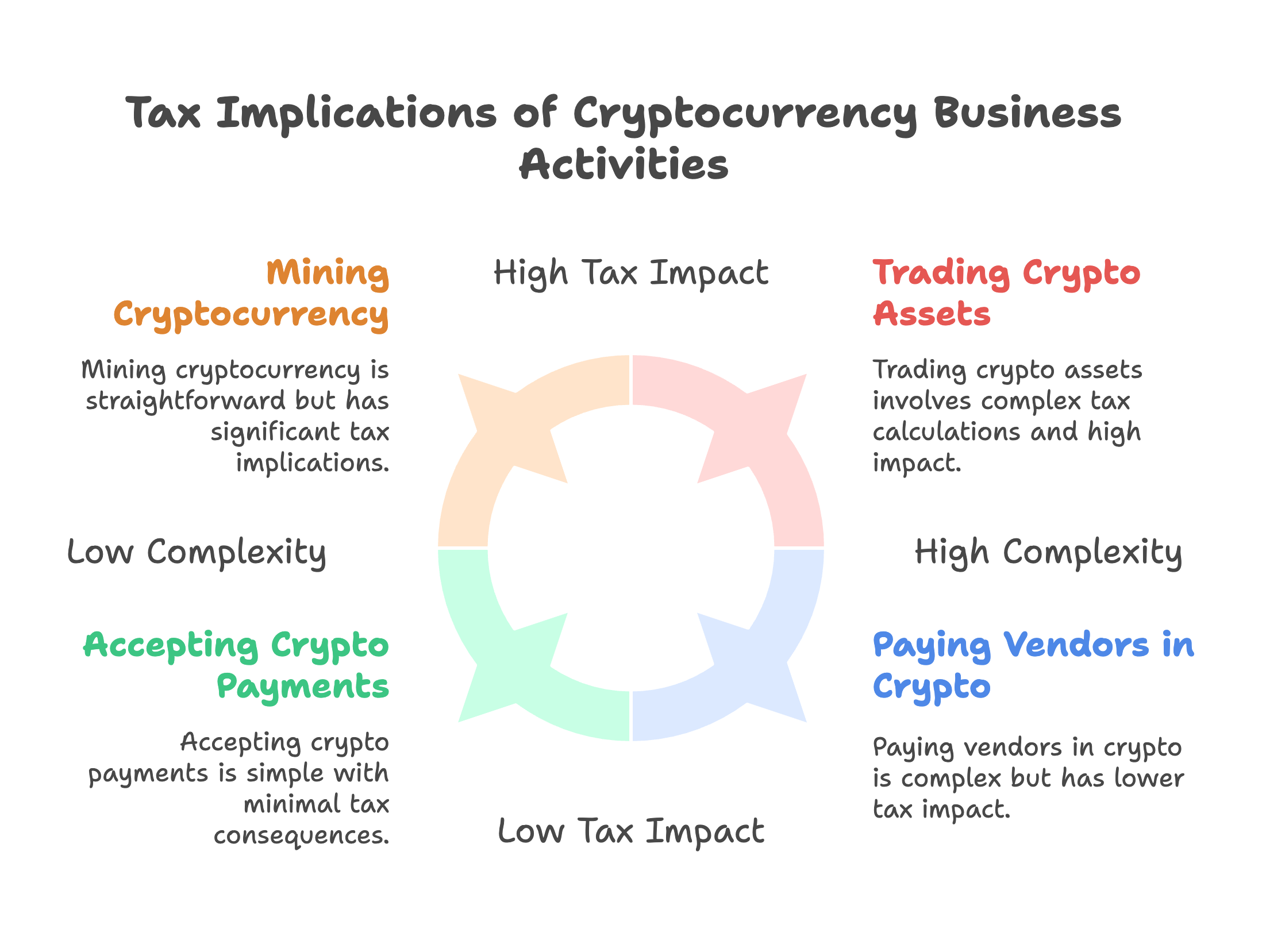

The tax treatment of cryptocurrency varies based on how the business interacts with it. Below are common activities that may trigger a taxable event and require you to pay taxes.

When a business receives cryptocurrency in exchange for goods or services, it must:

Example: You sell a product for 0.05 bitcoin when the market value is $2,500. You must report $2,500 in income. If you later sell the 0.05 bitcoin for $2,800, you recognize a $300 capital gain or loss.

If you pay a contractor or supplier in cryptocurrency, this is a disposal of a capital asset. The business must:

Example: You acquired ETH at $1,500 and pay a vendor when it is worth $2,000. You have a $500 capital gain subject to capital gains tax.

Even crypto-to-crypto transactions are taxable. Swapping bitcoin for ETH is considered a sale of bitcoin and a purchase of ETH.

You must:

This applies even when using decentralized exchanges, wallets, or DeFi platforms, and each cryptocurrency transaction must be tracked for tax reporting.

If your business mines cryptocurrency, the IRS treats the mined tokens as self-generated income.

Tax treatment:

Staking and airdrop rewards are generally treated as ordinary income at the time they are received.

Proper accounting is essential for businesses dealing with crypto. Unlike cash transactions, crypto requires a detailed trail for every token received, moved, or sold to properly report your crypto activities.

A business must determine whether crypto assets are held:

Inventory is accounted for under cost basis rules like FIFO or LIFO, while investment property typically follows the specific identification or FIFO method for gain calculations.

Each transaction must be recorded at fair market value in U.S. dollars at the time of the event. This includes:

Reliable pricing tools and APIs like CoinMarketCap or CoinGecko can help establish IRS-acceptable FMV records for tax compliance.

Cost basis is essential for calculating capital gains tax or losses. You must know:

The IRS requires consistent use of an accounting method such as:

Lack of proper basis tracking can lead to overpaying tax or facing audits.

Some businesses choose to pay employees or contractors in cryptocurrency. This creates several tax obligations that you need to report.

Crypto paid as wages is subject to:

The IRS treats this the same as cash wages. Employers must withhold and remit taxes in dollars, not crypto.

If you pay freelancers or service providers in crypto:

Paying in crypto does not remove your tax reporting responsibilities.

To remain compliant, businesses dealing with crypto must stay ahead of reporting obligations and understand when they need to report various activities.

Businesses must use Form 8949 to report each disposal of cryptocurrency on their tax return, including:

This information rolls up into Schedule D on the business tax return.

Businesses may receive or issue Form 1099s:

Note: Beginning in 2025, exchanges must issue Form 1099-DA, a new crypto-specific form designed to improve crypto tax reporting.

If a business receives more than $10,000 in crypto in a single transaction (or related transactions), it must file Form 8300 within 15 days. This helps prevent money laundering and mirrors rules for large cash transactions.

Non-compliance carries steep penalties that can significantly impact your tax liability.

The tax rate applied to cryptocurrency depends on how long you hold the digital asset and your overall income level.

The distinction between short-term and long-term holding periods can significantly impact your tax obligations for each tax year.

Certain crypto activities are subject to ordinary income tax rates rather than capital gains treatment:

Most U.S. states follow federal guidelines for crypto taxation. However, businesses should check:

California, New York, and a few other states have introduced digital asset regulation proposals that may impact tax reporting in future years, including 2025 and beyond.

Just like gains, losses from crypto can be used to offset income and reduce your overall tax burden.

If a crypto token becomes worthless due to a project collapse or security failure, it may qualify as a capital loss. The IRS does not currently allow for "write-offs" of lost or hacked coins unless ownership can be verified and loss is documented.

Abandoned wallet access, project shutdowns, or delisted tokens must be carefully documented to claim a loss on your tax return.

Staying compliant with taxes on crypto requires more than annual reporting. It demands real-time tracking and proactive planning.

Platforms like CoinLedger, Koinly, and Bitwave integrate with exchanges, wallets, and accounting systems to:

These tools reduce human error and help businesses keep a real-time view of tax liabilities.

The IRS expects businesses to retain:

This documentation is critical during audits or tax reviews and helps you accurately report your crypto activities.

Not all CPAs are experienced in crypto tax matters. Partner with a tax professional that:

Madras Accountancy works with U.S. firms to provide offshore crypto tax support, reducing workload and improving audit-readiness.

Tax planning is critical for any crypto-active business. Here are some strategies to explore for managing your tax obligations.

Choosing the right business structure can reduce tax liability. For example:

Always consult with a tax professional before making changes.

The timing of crypto sales can significantly affect tax outcomes. Harvesting losses in down markets can reduce overall liability. Holding assets for over 12 months can also shift gains and losses from short-term (higher tax rate) to long-term (lower rate).

Timing crypto-based bonuses or payments around valuation swings can help manage both employer and employee tax exposure. Delayed vesting may also defer income recognition to a future tax year.

Looking ahead to 2025, several changes are expected in crypto tax reporting:

Businesses should prepare for these changes by:

Businesses accepting crypto for goods or services must:

Firms holding crypto as investments need to:

Crypto mining businesses must:

Cryptocurrency is an exciting frontier for business innovation, but it brings extensive tax implications. Every transaction, payment, or reward has the potential to trigger a tax event. Businesses must treat digital assets like any other capital asset class — with precision, planning, and compliance.

The key to success lies in:

With the right systems and advisors, small and mid-sized businesses can use cryptocurrency confidently while staying tax compliant and managing their tax obligations effectively.

Understanding when you need to report crypto activities, how to calculate gains and losses, and what tax rate applies to different transactions is essential for any business dealing with digital assets. Whether you're accepting bitcoin payments, mining cryptocurrency, or trading various tokens, proper tax planning and compliance should be a priority.

At Madras Accountancy, we support CPA firms in the U.S. with offshore tax, accounting, and crypto-specific bookkeeping. Our team helps you serve crypto clients with accurate reporting, clean records, and audit-proof documentation.

Need help with crypto tax tracking or reporting? Let us handle the heavy lifting so your firm can grow with confidence while ensuring all clients properly pay taxes on their cryptocurrency activities.

Question: How are cryptocurrency transactions taxed for businesses and what records must be maintained?

Answer: Business cryptocurrency transactions are taxed as ordinary income when received and subject to capital gains treatment when sold or exchanged. Businesses must track the fair market value of cryptocurrency at receipt time, maintain detailed records of all transactions including dates, amounts, values, and business purposes. Required documentation includes wallet addresses, transaction IDs, exchange records, and valuation support for each transaction. Revenue from crypto sales, mining activities, or payment acceptance creates taxable income, while business expenses paid in cryptocurrency are deductible at fair market value when paid.

Question: What accounting methods should businesses use for cryptocurrency transactions?

Answer: Businesses should use consistent accounting methods for cryptocurrency transactions, typically following GAAP principles treating crypto as intangible assets. Most businesses use specific identification method for tracking individual cryptocurrency units and their basis, though FIFO (first-in, first-out) method is also acceptable. Record transactions at fair market value when received, track basis adjustments for each unit, and calculate gains or losses when disposed. Maintain separate records for different cryptocurrencies, document valuation methods used, and ensure consistency across accounting periods. Consider professional guidance for complex situations involving multiple cryptocurrencies or high transaction volumes.

Question: How should businesses handle cryptocurrency payments from customers for tax purposes?

Answer: Cryptocurrency payments from customers create immediate taxable income at fair market value when received, requiring businesses to report income and track basis for future disposition. Businesses must convert cryptocurrency values to USD using reliable exchange rates at transaction time, maintain records of conversion rates used, and track each payment separately for basis purposes. Consider whether to hold received cryptocurrency or immediately convert to cash, as holding creates potential capital gains or losses. Implement systems for real-time valuation, maintain customer payment records, and ensure proper income recognition timing for tax compliance.

Question: What are the tax implications of business cryptocurrency mining activities?

Answer: Business cryptocurrency mining creates ordinary income equal to fair market value of mined cryptocurrency when received, subject to self-employment tax for sole proprietorships. Mining businesses can deduct ordinary business expenses including equipment costs, electricity, internet, facility expenses, and depreciation on mining equipment. Track basis in mined cryptocurrency for future capital gains calculations when sold or exchanged. Mining pools require allocation of income and expenses among participants. Consider entity structure implications, quarterly estimated tax requirements, and equipment depreciation methods. Professional mining operations may qualify for business deductions not available to hobby miners.

Question: How do businesses handle cryptocurrency employee compensation and payroll taxes?

Answer: Cryptocurrency employee compensation creates taxable wages subject to income tax withholding, payroll taxes, and employment tax reporting requirements. Businesses must calculate wage amounts using fair market value at payment time, withhold appropriate taxes, and report compensation on Forms W-2. Payroll tax deposits and quarterly returns must include cryptocurrency compensation values converted to USD. Consider timing issues for variable cryptocurrency values, implement systems for accurate valuation and withholding, and maintain detailed records for each payroll period. Employee equity compensation in cryptocurrency may have additional complexities requiring professional guidance.

Question: What business expense deductions are available for cryptocurrency-related costs?

Answer: Businesses can deduct ordinary and necessary expenses related to cryptocurrency activities including transaction fees, exchange fees, wallet software costs, security measures, and professional services for tax compliance. Equipment purchases for mining or trading may qualify for immediate expensing under Section 179 or depreciation over time. Legal and accounting fees for cryptocurrency compliance are deductible, as are educational expenses for staff training. Marketing costs for cryptocurrency acceptance and integration expenses for payment systems qualify as business deductions. Maintain detailed records linking expenses to business purposes and cryptocurrency activities.

Question: How should businesses report cryptocurrency transactions to the IRS?

Answer: Businesses report cryptocurrency transactions through various forms depending on activity type and entity structure. Include cryptocurrency income on appropriate business tax returns (1040 Schedule C, 1065, 1120, etc.), report capital gains and losses on Form 8949 and Schedule D, and answer cryptocurrency questions on tax returns. High-volume traders may need to file additional forms or elections. Maintain comprehensive records supporting all reported amounts, including transaction logs, valuation documentation, and business purpose explanations. Consider voluntary disclosure for past non-compliance and professional assistance for complex reporting situations.

Question: What compliance challenges do businesses face with cryptocurrency taxation?

Answer: Cryptocurrency taxation compliance challenges include valuation difficulties, record-keeping complexities, unclear regulatory guidance, and integration with traditional accounting systems. Businesses struggle with determining fair market values for obscure cryptocurrencies, tracking basis through multiple exchanges, and maintaining adequate documentation for all transactions. Regulatory uncertainty creates compliance risks, while software limitations may require manual tracking and calculations. International transactions add complexity for global businesses. Address challenges through robust documentation systems, professional guidance, conservative positions on unclear issues, and regular compliance reviews to identify and correct potential problems.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.