Most startups don't fail because the idea was bad. They fail because they ran out of money, or didn't realize they were about to.

That's the quiet risk no one warns founders about. You're focused on growth, product, and hiring. Meanwhile, cash flow is bleeding, compliance deadlines are slipping, and your runway math is built on guesswork.

It starts small: a spreadsheet here, a missed 1099 there. Then one day, you're prepping for a fundraise, and an investor asks for financials you can't produce. Or worse, the IRS sends a letter you weren't expecting.

That's when startup founders realize: finance isn't something you figure out later. It's something that quietly makes or breaks your company from day one.

This is where a CPA for a startup changes the game.

Not the once-a-year tax preparer, but a certified public accountant who understands early-stage chaos and helps you turn that chaos into clarity.

The good news?

You don't need a full-time hire. With the right outsourced accounting partner, you get the expertise without the overhead. And you can finally make financial decisions with confidence, not crossed fingers.

In this guide, we'll break down exactly when and why your startup needs an accountant, what they do (beyond taxes), and how to find a CPA that can help your startup thrive.

If you're figuring this out right now, Madras Accountancy can help.

Let's be honest: "CPA" doesn't sound exciting.

But if you're running a startup, having the right accountant on your side could be the difference between raising your next round and getting stuck cleaning up a year's worth of messy books.

And no, it's not just about filing taxes.

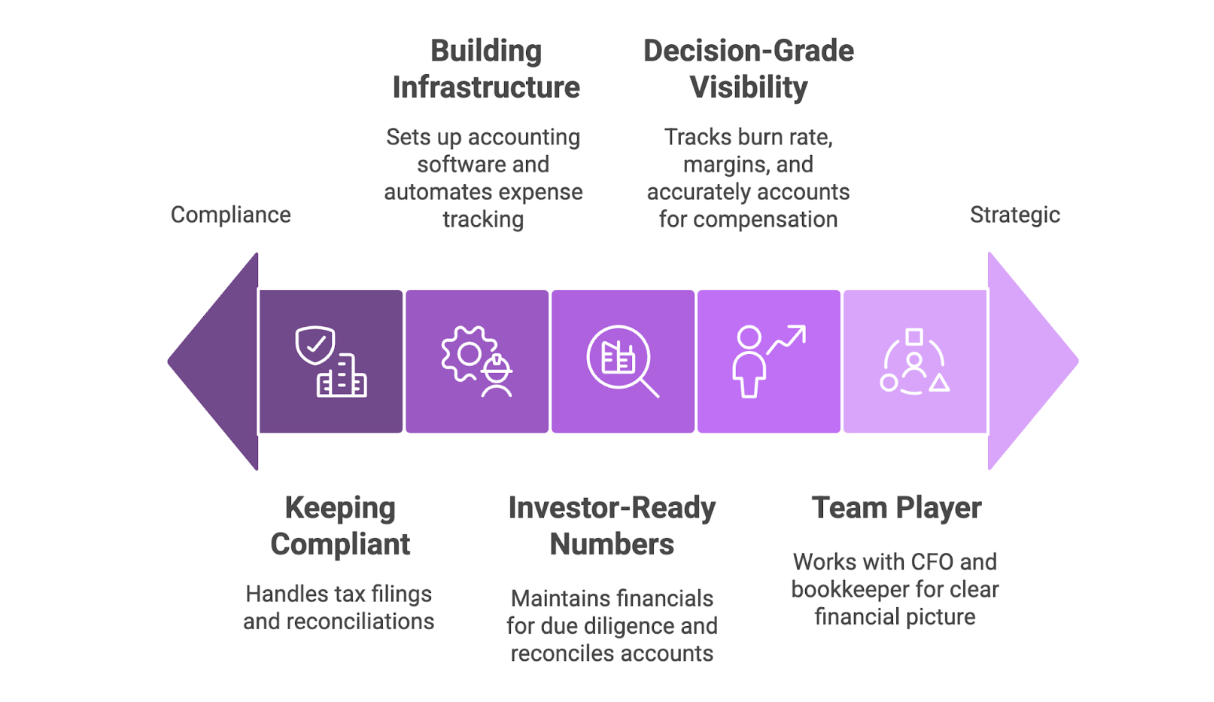

An accountant working with startups plays a strategic role across five key areas:

Startups don't just need clean books, they need a system. A startup-savvy accountant helps:

This isn't busywork, it's the foundation for smart financial decisions that help startups succeed.

Missed a franchise tax? Forgot a 1099 deadline? It happens. But the IRS doesn't care.

A startup accountant handles:

You stay compliant with tax compliance requirements, and you stop Googling "what happens if I miss a tax deadline."

At some point, someone's going to ask for your P&L, balance sheet, and burn rate projections. And that someone might be holding your next check.

A good accountant will:

This isn't about "looking good on paper." It's about being trustworthy with capital and maintaining your financial health.

Burn rate. Gross margins. CAC payback. Tech startups especially need more than bank balances.

Your accountant makes sure:

You don't need to be a finance expert, but your decisions need to be built on real numbers.

The best results come when your accountant isn't working in isolation.

Madras Accountancy, for example, often brings CPA, fractional CFO services, and bookkeeping into one tight loop, so everything runs clean, fast, and audit-ready from day one.

Startup founders shouldn't have to chase three vendors to get a clear financial picture. It should just work.

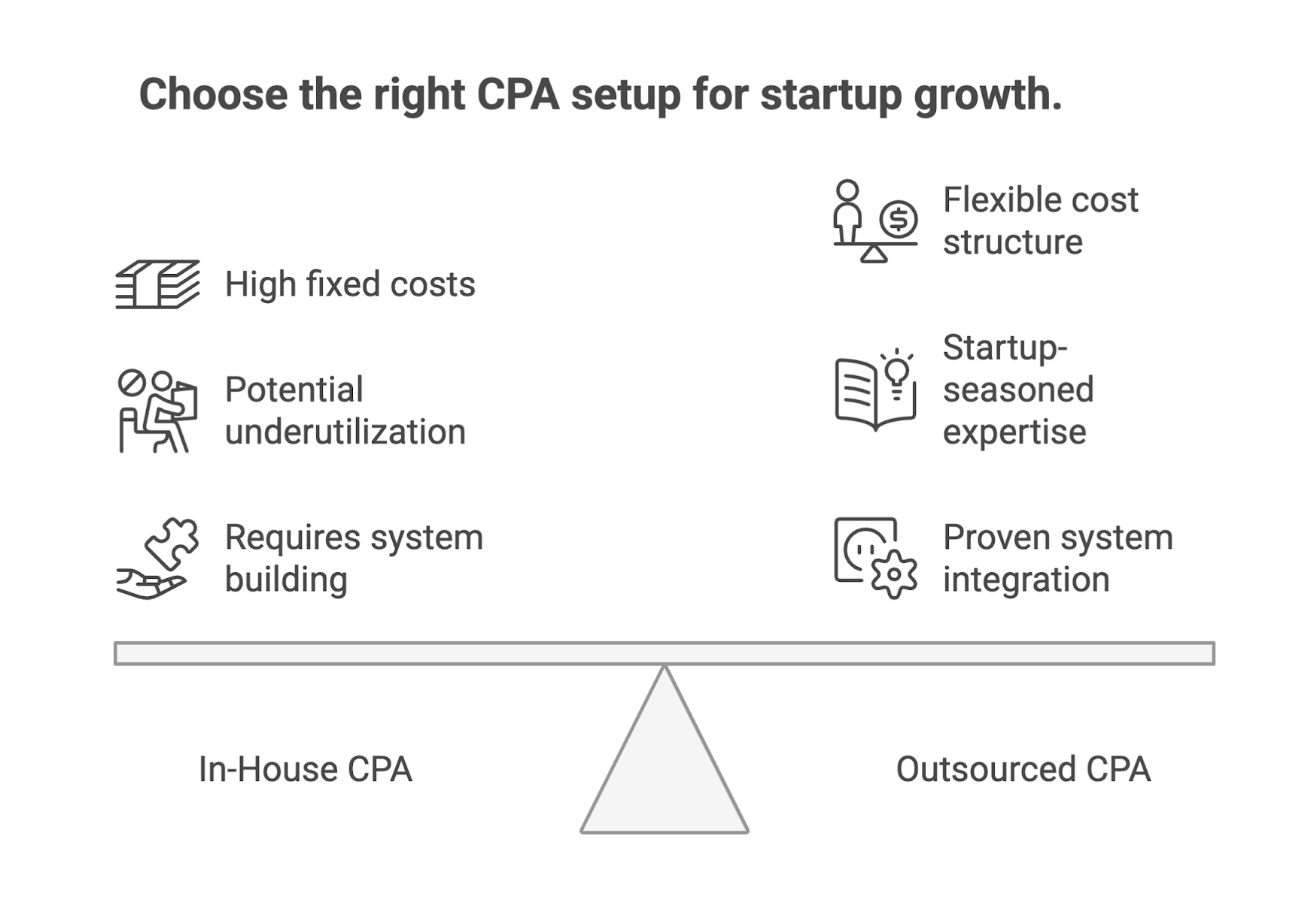

Every founder hits this question at some point:

"Should I hire an accountant in-house, or outsource it for now?"

It sounds tactical, but it's actually a big strategic call. Because it affects how your entire finance stack scales, how you respond to investor asks, and how much chaos builds up before someone notices.

Let's unpack this with a real lens, based on how startups actually operate.

Once your startup starts making real money or prepping to raise, it's tempting to assume you need someone full-time. Maybe your books are messy. Maybe a friend at another startup just hired a controller.

But here's the catch: Hiring in-house too early is usually a panic move. You're reacting to the mess, not designing a system. And unless you know exactly what this person will own (vs. a bookkeeper or a CFO), you risk hiring someone overqualified for basic tasks or underqualified for strategic ones.

Plus:

This isn't about cost-cutting. It's about startup-stage fit.

With accounting services for startups, you get a leaner, more flexible setup:

More importantly, the best CPAs for startups aren't just doing the books. The right ones:

That's what Madras does for early-stage startups: you don't need to explain your business from scratch. You get a full-stack financial system, without hiring three separate people.

If you're:

But early on, outsourcing your CPA function is usually faster, cleaner, and more scalable, especially if they're part of a coordinated finance team.

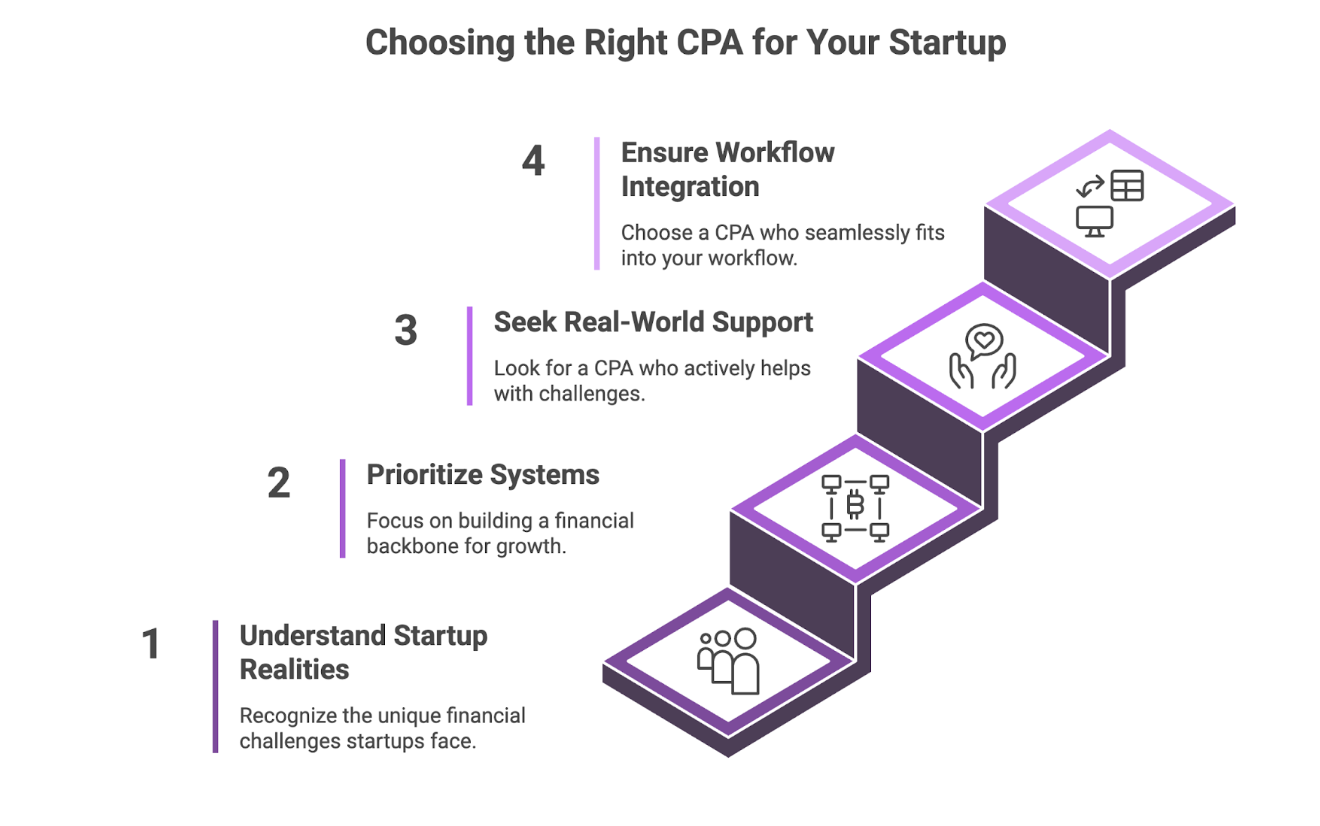

The smartest founders don't just "get someone to do the taxes." They build a financial engine that can handle growth.

A lot of founders delay hiring an accountant because they assume it's just a tax thing. Then tax season hits, or they prep for a fundraise, and suddenly, they're scrambling for clean books, accurate burn numbers, or a compliance report they've never heard of.

At that point, any accountant looks like a lifeline.

But not all accountants are built for startups. And choosing the wrong one, a generalist accounting firm that doesn't understand how fast your business moves, can leave you with the same financial fog you were trying to escape.

Here's how to make the right choice when you need to find a CPA.

Startups don't operate like traditional small businesses. You're burning capital, experimenting with revenue models, dealing with investor asks, and shifting gears constantly.

So you need an accountant who's seen all that before, someone who gets:

At Madras Accountancy, the team has worked across early-stage SaaS, D2C services, and even VC-backed startups, so they know the difference between bookkeeping for a bakery and burn tracking for a seed-stage startup.

A good accountant won't just fix your books at year-end. They'll build a financial backbone that supports how your startup grows.

That means:

At Madras Accountancy, accounting services aren't offered in isolation; they're integrated with bookkeeping and Virtual CFO support. So your tax strategy, monthly reports, and investor updates all flow from the same source of truth.

Here's what separates a real partner from a paper pusher: when things go wrong (and they will), do they step in or step back?

Business owners should ask:

You want a team that doesn't just tick boxes, but actually thinks through your edge cases.

Firms like Madras Accountancy work with fast-growing startups every day, so they've seen this mess before. Their job is not just to clean it up, but to prevent it from happening again.

Startups don't operate in spreadsheets and binders anymore. Your accountant should be fluent in tools like QuickBooks, Gusto, Ramp, and Xero, and comfortable syncing with other team members asynchronously.

If you have to manage your accountant like a project, it's not helping.

Madras's approach is to become part of your finance workflow, coordinating with your internal operators, bookkeepers, or external CFOs so you're not the middleman. The goal is visibility, not vendor management.

The startup ecosystem operates differently from traditional businesses, and generic accounting firms often miss the nuances that matter most to funded startups and venture-backed startups.

Cash Flow Complexity: Unlike traditional businesses, startups often have irregular revenue patterns, significant upfront costs, and complex funding structures that require specialized accounting knowledge.

Rapid Scaling: A dynamic startup can go from 5 employees to 50 in months, requiring accounting systems designed for startups that can handle explosive growth.

Investor Requirements: VC-backed startups need specific financial reporting that goes beyond basic accounting to include metrics like burn rate, runway analysis, and unit economics.

Regulatory Navigation: From understanding when to register in new states to maximizing the R&D tax credit, startups face unique compliance challenges.

Industry Expertise: The best startup CPAs understand your business model, whether you're in SaaS, e-commerce, or hardware.

Speed and Flexibility: Traditional CPA firms often move slowly. Startup accounting firms understand that timing matters in the startup world.

Technology Integration: Modern startups need accountants who are comfortable with cloud-based tools and can integrate with your existing tech stack.

Strategic Thinking: Beyond basic accounting, startups need financial advisors who can help position your startup for growth and future funding rounds.

Many accounting firms focus on specific regions, but startups are distributed across all major startup hubs from Silicon Valley to Austin to New York. The best accounting firms for startups can serve clients nationwide, understanding both federal requirements and state-specific nuances.

At Madras Accountancy, we work with startups throughout the United States, bringing consistent expertise whether you're in a major tech hub or building your company in a smaller market.

Let's be real: most founders hesitate to bring in an accountant because of one thing, the cost.

Especially in the early stages, every dollar is under scrutiny. You're weighing engineering hires, marketing budgets, and extending runway.

So it's easy to look at CPA services and think, "We'll manage without it for now."

But the truth is that not having a proper financial setup is costing you, in ways that don't always show up in your burn report.

Pricing varies depending on your stage, complexity, and whether you need tax-only support or full-stack financial ops.

Here's a rough breakdown:

Early-stage (pre-revenue to $1M ARR): Expect to pay $500–$1,500/month for outsourced CPA support. This typically includes monthly reconciliations, tax prep, compliance filings, and some light advisory.

Growth-stage (post-raise, scaling ops): Pricing goes up to $2,000–$5,000/month, especially if you need quarterly reviews, forecasting support, or tight integration with CFO services.

At Madras Accountancy, startup packages are flexible. You're not locked into a bloated retainer. You get what you need, no more, no less, and the model scales as your business does.

You're not just paying for forms and filings. You're paying for:

Visibility: Know your true burn, margins, and runway without waiting until the end of the year.

Credibility: Show investors clean financials, proper tax handling, and maturity even at an early stage.

Time: Stop worrying about IRS letters, franchise taxes, or digging through receipts.

Speed: When diligence hits, you're already ready.

Opportunity: Maximize tax credits and deductions that could save your company thousands.

Bad financial hygiene has real costs: penalties, delayed fundraises, broken trust with investors, or strategic decisions made on bad data.

Founders often realize, too late, that the cost of fixing financial chaos is far higher than preventing it.

Beyond basic accounting, the right startup accounting firm offers specialized services that address the unique needs of startups:

Many tech startups and funded startups qualify for significant R&D tax credits but miss out because they don't have the right guidance. A startup-focused CPA can:

Venture-backed startups have complex equity structures that require specialized knowledge:

As startups grow and hire remote employees, they often trigger compliance requirements in multiple states:

Investors expect specific financial reporting that goes beyond basic accounting:

The best accounting firms for startups don't just serve individual companies, they're active participants in the startup community. This means:

Understanding Trends: They see patterns across hundreds or thousands of startups and can share insights about what works.

Network Effects: They can connect you with other service providers, investors, or potential partners.

Industry Knowledge: They understand your industry's specific challenges and opportunities.

Best Practices: They bring lessons learned from other successful startups to your company.

The relationship between a startup and its CPA should go beyond basic accounting. The best partnerships include:

Strategic Advisory: Help with major financial decisions, funding strategies, and growth planning.

Risk Management: Identify potential financial risks before they become problems.

Operational Efficiency: Streamline financial processes to support rapid growth.

Exit Planning: Prepare your company for eventual acquisition or IPO.

Startup accounting isn't just about staying compliant; it's about moving faster with fewer mistakes. And when you have the right accountant in your corner, that clarity turns into real outcomes.

Just ask the founders and partners who've worked with Madras Accountancy:

"Their team's expertise in tax preparation and review, combined with their meticulous attention to detail, has significantly enhanced our efficiency during peak seasons." Prasanna G. Kidambi, CPA, MBA – Tax Partner at Stowe & Degon

For fast-growing firms, Madras becomes more than a service provider; they become a dependable extension of the team.

"Balaji and his exceptional team have enabled us to focus on growing our business and strengthening our client relationships... Their personal touch and commitment to excellence have made them an integral part of our firm's story." Jonathan McCormick, EA, MST – Co-Founder & COO at Hillhurst Tax Group

This kind of partnership isn't just about deliverables, it's about unlocking time, trust, and strategic headspace.

"Madras quickly became our primary offshore provider... Their proactive communication, attention to detail, and ability to deeply understand our unique needs have made them indispensable to our operations." Dave Myers – COO

In every case, the result is the same: less firefighting, more financial clarity, and more time to actually run the business.

For Unprofitable Startups: Proper financial tracking helps you understand your path to profitability and communicate effectively with investors about your progress.

For Scaling Companies: As you add employees, enter new markets, or launch new products, your accountant helps ensure your financial systems can handle the complexity.

For Fundraising: Whether you're raising your first round or your Series C, having clean financials and experienced support makes the process smoother and more successful.

When evaluating hiring a startup CPA, you want more than just technical competence. You want a firm that understands the unique challenges of building a company from the ground up.

Madras Accountancy has worked with startups across stages, from bootstrapped builders to venture-backed operators, and brings several key advantages:

Our team doesn't just offer generic financial services. We provide:

Rather than piecemeal solutions, we offer accounting and bookkeeping services that work together:

We understand that startups operate in the cloud and need accountants who do too:

We've helped startups navigate every stage of growth and understand the accounting and financial management challenges that come with rapid scaling.

Startups run on speed. But speed without clarity is a gamble, and when it comes to your finances, that's a risk you can't afford to take.

The truth is, most founders don't get burned because they ignored taxes or forgot a form. They get burned because they waited too long to bring in someone who could see around corners. Someone who could spot the gaps before they became problems.

That's what the right accountant for startups does.

They don't just clean up your books. They help you run a company that's investor-ready, audit-proof, and built to grow with control.

And no, you don't need to hire in-house. You just need a partner who gets it.

At Madras Accountancy, we work with founders across stages, from bootstrapped builders to venture-backed operators, offering CPA, Virtual CFO, and bookkeeping services that move at startup speed.

Our firm for your startup provides the expertise you need without the overhead you can't afford. We understand the needs of startups and have helped thousands of startups build strong financial foundations that support sustainable growth.

If you're at that stage where things are starting to feel messy, or you just want to make smarter financial calls without second-guessing, we're here to help.

Let's get your finance engine working like the rest of your company: clean, sharp, and ready to scale. Contact Us Right Now.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.