Growing businesses face a common dilemma: they need executive-level financial expertise but can't justify the $150,000-$300,000 cost of a full-time CFO. Fractional CFO services bridge this gap, providing strategic financial leadership on a part-time basis. This comprehensive guide explores how fractional CFO services can transform your business operations and drive sustainable growth.

A fractional CFO is an experienced financial executive who provides high-level strategic guidance on a part-time or project basis. Unlike traditional accountants who focus on compliance and reporting, fractional CFOs deliver strategic financial leadership that drives business growth and profitability.

Key Characteristics:

This model democratizes access to sophisticated financial expertise, allowing small and mid-sized businesses to compete with larger companies that have full-time CFOs.

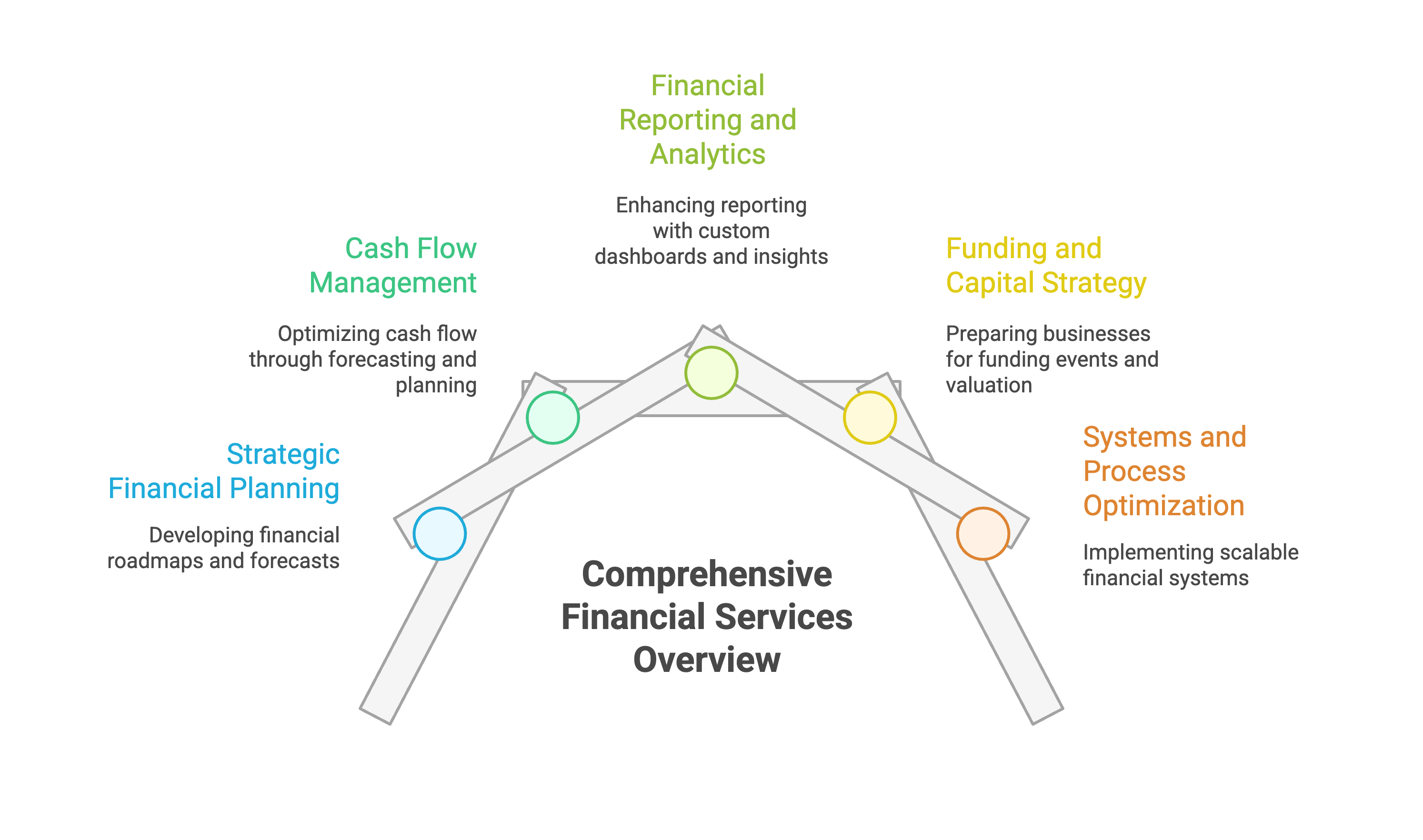

Fractional CFOs develop comprehensive financial roadmaps aligned with business objectives. This includes creating detailed forecasts, scenario planning for multiple market outcomes, and establishing realistic growth projections based on industry benchmarks.

Professional cash flow optimization typically improves operating cash flow by 20-35% within six months through:

Transform your financial reporting with:

Fractional CFOs excel at preparing businesses for funding events:

Implement scalable financial systems that grow with your business:

Rapid expansion creates financial complexity that often overwhelms existing capabilities. Signs include:

Whether seeking bank financing or investor capital, fractional CFOs significantly improve outcomes:

When financial results don't meet expectations:

Major business changes require sophisticated financial analysis:

Businesses with fractional CFO support typically experience:

Fractional CFO services typically cost 25-40% of full-time CFO expenses:

Choose a fractional CFO with direct experience in your sector. Financial challenges vary significantly across industries, and specialized knowledge delivers better outcomes.

Look for professionals with:

Part-time ongoing: Regular weekly or monthly engagement for continuous strategic oversight

Project-based: Intensive 3-6 month engagements for specific initiatives like funding preparation or financial restructuring

Hybrid approach: Higher initial engagement transitioning to maintenance-level support

Evaluate the candidate's ability to:

Establish specific, measurable goals for the fractional CFO engagement:

Track progress against established objectives:

Focus: Financial foundation buildingTypical commitment: 2-3 days per weekKey deliverables: System implementation, process design, initial forecasting

Focus: Scaling and funding preparationTypical commitment: 1-2 days per weekKey deliverables: Strategic planning, funding support, performance optimization

Focus: Strategic oversight and advisoryTypical commitment: 4-8 hours per weekKey deliverables: Board reporting, strategic guidance, special projects

Modern fractional CFO services leverage technology to maximize efficiency:

Many businesses benefit from comprehensive financial service packages that combine fractional CFO expertise with supporting functions like bookkeeping, tax preparation, and compliance management. This integrated approach ensures seamless coordination between strategic financial leadership and day-to-day operational support.

Consider the total value proposition:

Most businesses see measurable results within:

The fractional CFO model continues evolving with several key trends:

Technology Integration: Advanced analytics and AI tools enhance traditional expertise, providing deeper insights and more efficient service delivery.

Specialized Expertise: Increasing specialization in specific industries, business stages, and functional areas.

Integrated Service Models: Comprehensive financial service packages combining strategic leadership with operational support.

Global Accessibility: Remote collaboration tools enable access to top-tier talent regardless of geographic location.

Ready to explore how fractional CFO services could benefit your business? The key is finding a provider who understands your industry challenges and can deliver measurable results.

At Madras Accountancy, we've helped countless businesses bridge the gap between basic accounting and strategic financial leadership. Our team of experienced financial professionals combines CFO-level expertise with comprehensive accounting and tax services, ensuring seamless integration between strategic planning and day-to-day operations.

Whether you're preparing for growth, seeking funding, or need strategic financial guidance, our fractional CFO services can provide the expertise you need without the full-time commitment. We specialize in helping businesses implement scalable financial systems, optimize performance, and achieve their strategic objectives.

Contact us today to discuss how our fractional CFO services can transform your business's financial operations and drive sustainable growth. Let's explore whether this strategic partnership could be the catalyst your business needs to reach its next level of success.

Fractional CFO services represent a powerful solution for businesses seeking executive-level financial expertise without full-time executive costs. By providing strategic financial leadership scaled to your specific needs, these services can transform business operations, improve financial performance, and accelerate growth.

The key to success lies in selecting the right partner who understands your industry, business stage, and strategic objectives. With proper implementation and clear performance measurement, fractional CFO services deliver measurable returns through improved profitability, enhanced decision-making, and accelerated achievement of business goals.

As the business landscape becomes increasingly complex, access to sophisticated financial expertise becomes a competitive necessity rather than a luxury. Fractional CFO services democratize this access, enabling businesses of all sizes to compete effectively while maintaining the financial health and strategic focus necessary for long-term success.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.