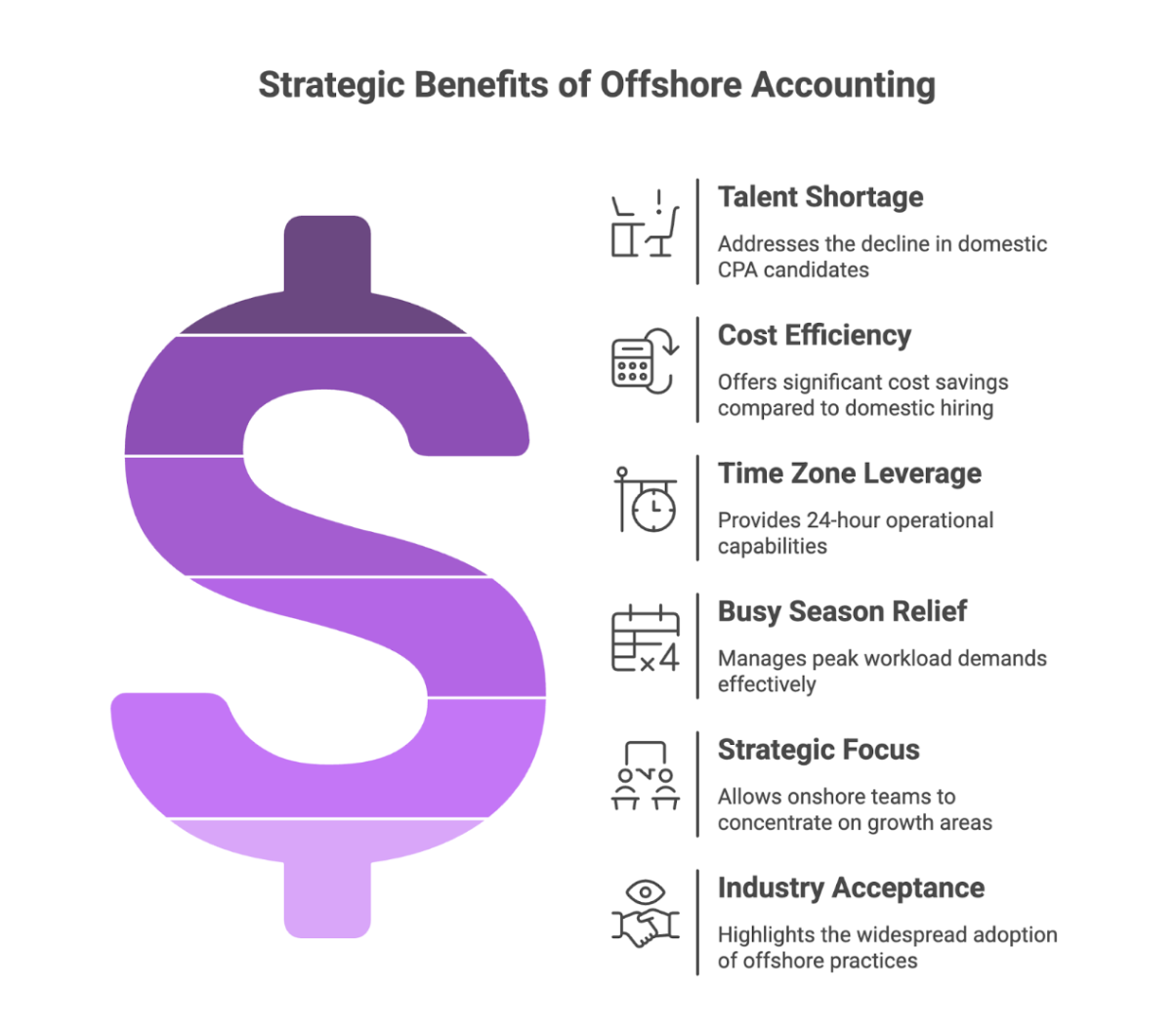

For CPA firms navigating today's tight labor market, offshore CPAs have gone from a cost-cutting experiment to a strategic move for growing your firm.

Faced with rising salaries, mounting compliance demands, and a persistent shortage of skilled professionals, many accounting firms are turning to offshore talent to maintain profitability without compromising quality. What was once seen as a workaround is now a deliberate choice, and for good reason.

When you hire offshore accounting professionals, you gain access to highly qualified experts at a fraction of U.S. costs, while also enabling around-the-clock operations and flexible offshore staffing during peak seasons. Whether you're a solo practitioner overwhelmed during tax season or a mid-sized firm looking to scale your operations without bloating overhead, offshore hiring can unlock a serious operational edge.

But it's not just about cost savings. When done right, offshore accounting becomes an extension of your core team, seamlessly integrated into your workflows, tech stack, and client service model.

In this guide, we'll break down everything CPA firms need to know about offshore hiring: why it works, what roles to delegate, how to evaluate vendors, and how to get started confidently.

Let's dive in.

Offshore staffing isn't a trend. It's a response to structural pressure.

CPA firms today are navigating a perfect storm: shrinking domestic talent pools, margin compression, higher client expectations, and an aging partner base with succession problems. Hiring offshore has emerged not as a shortcut, but as a strategic operating model for firms that want to scale without breaking.

Let's break down why the shift is happening, and why it's not just about saving money.

The number of CPA talent candidates in the U.S. is in long-term decline. Between exam changes, student debt, and more attractive roles in tech and finance, fewer graduates are entering public accounting. Meanwhile, experienced accounting professionals are retiring faster than firms can replace them.

That leaves firms scrambling during tax season, overworking existing teams, and, increasingly, saying "no" to new clients. When you hire offshore accounting talent, you get access to a stable supply of qualified professionals who are often trained in U.S. standards and hungry for long-term career paths.

Offshore isn't about replacement. It's about continuity, keeping client work moving when your local bench can't stretch any further.

Let's talk numbers. In most metro markets, the cost of hiring a staff accountant now runs $65K–$90K base. Add another 25–30% for benefits, office space, software licenses, and compliance. And even then, you're competing with Big 4 and industry roles that can outbid you.

Offshore locations, particularly in India and the Philippines, offer CPA-trained talent at 40–60% lower cost, often bundled with infrastructure, supervision, and training. This allows mid-sized firms to reduce costs while growing headcount.

You know that 10 p.m. scramble to finalize a return or clean up a messy set of books? Offshore workers can pick up that file while you sleep.

A 12-hour time zone difference means you can run a true 24-hour work cycle. U.S.-based teams handle client-facing work by day. Offshore teams handle prep, processing, and review at night. That's not just faster, it's operational efficiency.

For firms offering client accounting services, this turnaround speed becomes a competitive advantage.

Every firm hits the same wall: January through April becomes a pressure cooker. Clients need deliverables, staff burnout spikes, and partners start losing sleep.

Hiring an offshore CPA gives you surge capacity without long-term commitments. You can scale up for tax season, then scale down, or keep key offshore roles in place for monthly work like bookkeeping, payroll, or sales tax compliance.

It turns tax season from chaos into cadence.

Here's what most firms get wrong: they try to offshore everything at once. The smarter move? Start with one standardized, repeatable task, like data entry, 1040 prep, or bank reconciliations.

This frees up your senior staff to focus on core competencies:

In other words: the stuff that grows your firm.

10 years ago, offshore staffing felt experimental. Now? It's institutional.

Major outsourcing firms serve thousands of CPA practices. Cloud-based tools have made collaboration seamless. Even the AICPA has acknowledged the offshore shift, offering guidance on security and oversight rather than questioning the model itself.

The real risk today isn't trying offshore, it's falling behind firms that are already leveraging offshore talent.

This isn't about outsourcing for outsourcing's sake. It's about redesigning how your firm operates so that you're not hostage to domestic hiring cycles, burnout-prone teams, or narrow margins.

Offshore accountants let you scale smartly, while your competitors stay stuck.

Here's the reality: most CPA firms don't have a hiring problem. They have a structural problem.

Your senior staff is spending 30–40% of their time on work that doesn't need to be done in-house. Offshore accounting professionals are how you fix that, by separating high-value client work from high-effort operational work.

But offshore doesn't mean "cheap labor for grunt work." Done right, these professionals become part of your workflow, handling real deliverables, syncing with your tech stack, and operating to U.S. standards.

Let's break it down by service line, with real examples of what CPA firms are delegating.

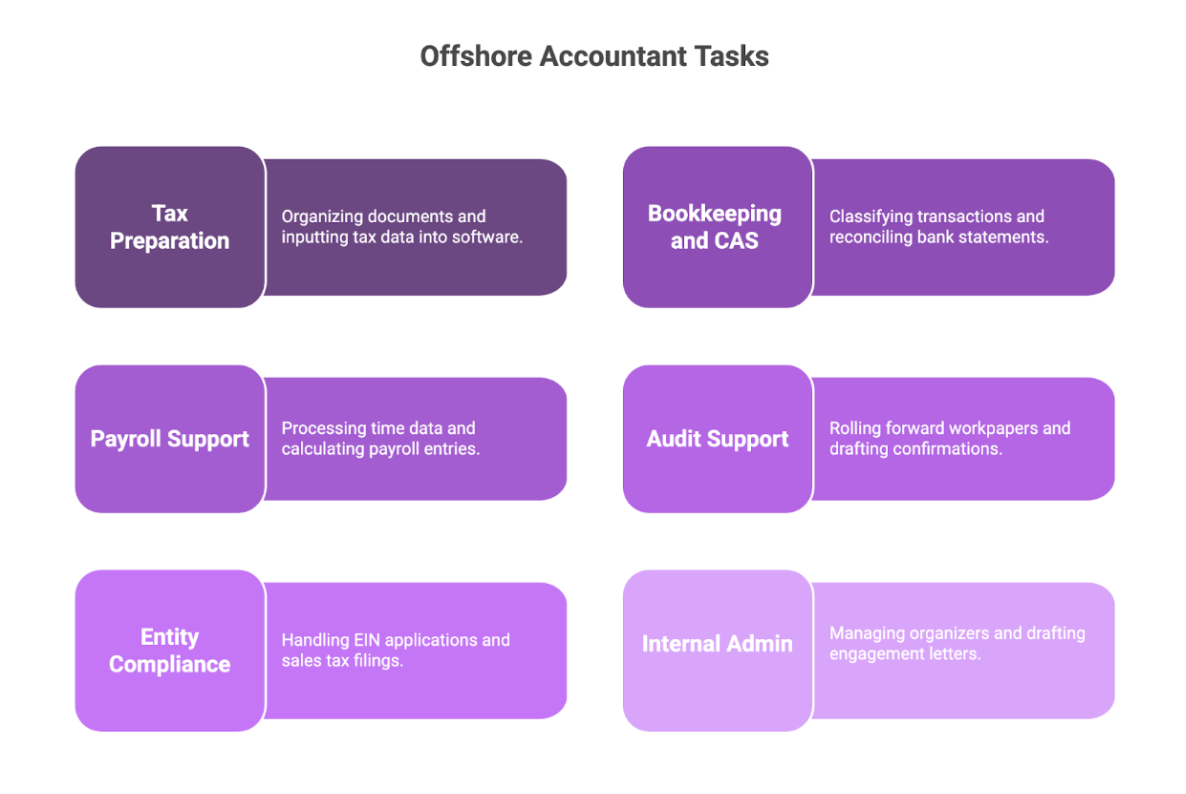

This is the most obvious (and powerful) use case for offshore tax accountants.

What you can offshore:

Firms working with offshore tax professionals typically have returns 60–80% complete before they even hit a partner's desk. That turns tax season from a crisis into a pipeline.

✅ Ideal for: High-volume 1040 practices, small business returns, extension prep

❌ Avoid offshoring: Highly complex or high-risk returns involving legal strategy or sensitive client dynamics

Bookkeeping is the engine behind monthly recurring revenue, but it kills your team's capacity if done in-house.

What you can offshore:

Some firms build entire offshore CAS pods, with a full month-end process run offshore, and client communication handled in-house.

✅ Ideal for: Firms offering fixed-fee monthly accounting or virtual CFO services

❌ Avoid offshoring: Client-facing advisory or CFO-level planning, keep the insights, outsource the inputs

Payroll is critical but repetitive. Offshore teams can't legally submit payroll in the U.S., but they can do everything up to that point.

What you can offshore:

This reduces your admin load and ensures that your payroll team isn't scrambling every Friday.

✅ Ideal for: Multi-client payroll environments or firms offering white-label payroll

❌ Avoid offshoring: Final submissions, payment authorizations, and sensitive corrections, those require domestic control

This is where offshoring gets interesting, and underused.

What you can offshore:

For larger firms, offshore audit assistants work closely with seniors, handling prep and formatting, freeing your core team for fieldwork and analytics.

✅ Ideal for: Assurance practices with repeat clients and standardized workflows

❌ Avoid offshoring: Final fieldwork, material judgment calls, or direct client inquiries

These aren't glamorous, but they're margin killers if done manually by your team.

What you can offshore:

This type of recurring admin work is where firms see serious time savings, especially those handling multi-entity clients.

✅ Ideal for: High-entity-count clients, franchise or real estate portfolios

❌ Avoid offshoring: Client signature steps, legal filings, or state-specific consultations

You can also offshore internal processes that drain your client-facing staff's time:

Offshoring these roles gives partners and managers back their calendar.

✅ Ideal for: Any firm that wants to grow without burying partners in admin

❌ Avoid offshoring: Client escalation handling, sensitive billing conversations

There's power in delegation, but also discipline.

Some things should stay in-house:

Think of it this way: offshore what's repeatable, keep what's relational or risky.

The "where" of offshore hiring matters just as much as the "who." You're not just choosing a country, you're choosing a talent ecosystem, work culture, infrastructure standard, and long-term scalability potential.

In the last decade, four regions have emerged as the primary hubs for offshore accounting talent. Each brings different strengths and operational tradeoffs depending on your firm's goals, service lines, and management style.

India is the most established offshore destination for accounting. You'll find everyone from solo practitioners to 500+ employee firms offering everything from tax prep to audit support.

Strengths:

Best fit: Firms looking to build recurring capacity for tax preparation, monthly bookkeeping, and structured audit support. India works well when you value precision, cost-efficiency, and high documentation discipline.

The Philippines has become a preferred option for firms that need stronger verbal communication, real-time support, or client-facing offshore roles.

Strengths:

Operational tradeoffs:

Best fit: Firms seeking day-to-day collaboration, hybrid roles, or virtual admin support. Ideal for client accounting services, internal operations, and low-complexity tax tasks that require clarity over depth.

Countries like Mexico, Colombia, and Argentina are increasingly being tapped for nearshore accounting roles, especially by firms prioritizing time zone alignment and direct collaboration.

Strengths:

Operational tradeoffs:

Best fit: Firms doing a lot of real-time collaborative work, e.g., daily standups, ongoing client calls, fast-moving internal projects. Especially effective for firms starting to offshore for the first time and want minimal friction.

While less common among U.S. CPA firms, countries like Poland, Romania, and Ukraine offer a compelling mix of technical capability and professionalism, especially for specialized expertise work.

Strengths:

Operational tradeoffs:

Best fit: Firms with complex reconciliations, international clients, or hybrid financial operations needing clean workpapers, spreadsheet modeling, or EU/U.S. dual compliance.

The goal isn't to find "the best country." It's to build the best offshore team for the way your firm operates.

There are two ways to get offshore hiring wrong:

The middle path, the one successful CPA firms follow, is about alignment, not just outsourcing. You want offshore partners who understand your firm's workflow, match your standards, and deliver consistently without burning your internal team.

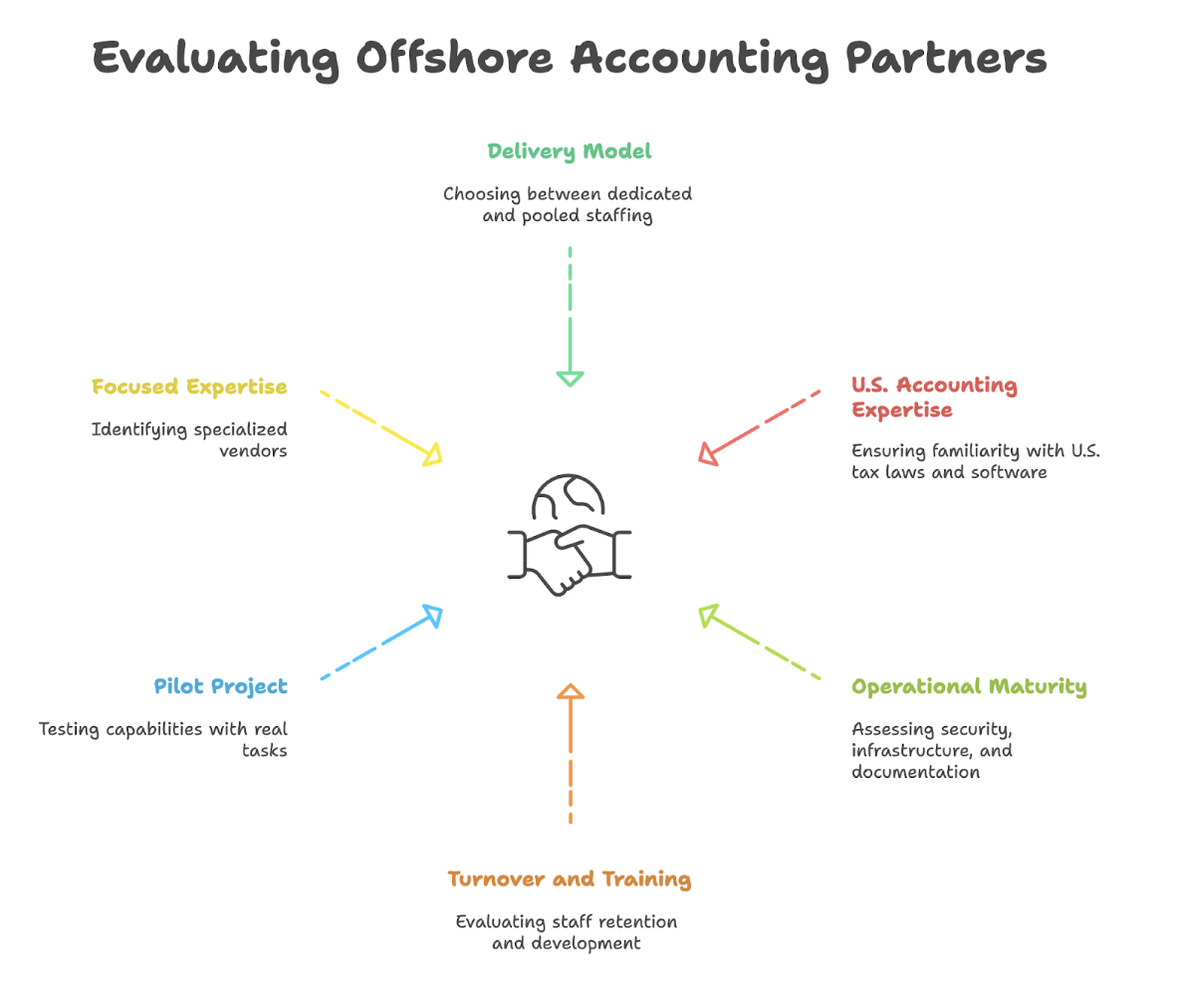

Here's how to evaluate offshore accounting vendors before you bring them into your ecosystem.

This is the foundation, and most firms don't ask it clearly enough.

Dedicated staffing means your offshore accountant works only for your firm. Same login, same tools, long-term.

Pooled or task-based models assign your work to whoever's available.

Smart firms mix both: a dedicated team for recurring work, and pooled help during tax season or large audit cycles.

It's not enough that they can handle U.S. work, you want to know if they specialize in it.

Ask directly:

If their team serves a mix of Australian, UK, and Indian clients, you'll constantly run into mismatched expectations and retraining needs.

Look for:

A smooth sales call means nothing if the backend is chaos.

Here's how to test operational maturity:

Security & compliance: Do they follow SOC 2, GDPR, or ISO standards? How is sensitive financial information stored, transmitted, and audited?

Infrastructure: Do staff work from offices or home? What controls exist for remote work?

Documentation: Ask to see their onboarding playbooks or SOP examples. If they don't have any, you'll be training them from scratch.

Escalation path: Who do you call if something breaks? Is there a U.S.-based contact or just a generic project manager?

Green flag: They can walk you through onboarding, show example workflows, and provide references from similar firms.

Red flag: They over-promise in week one, then disappear in week three.

You're not hiring a task robot. You're building a bench.

Ask:

If they can't answer that, you're hiring an hourly vendor, not a long-term partner.

The best offshore firms treat their accountants as career professionals, not commodities. That shows up in your team's quality, reliability, and ability to scale with you.

Before you sign a 12-month contract or onboard five offshore staff, run a structured 2–4 week pilot:

Use this phase to test:

A reputable offshore partner will welcome the pilot. A poor one will rush to close the deal.

Some offshore vendors will say yes to anything:

Tax prep? Yes. Bookkeeping? Yes. CFO strategy? Sure. Payroll? Of course. ESG reporting for a private equity firm? Let's try.

That's a red flag.

Instead, look for focused vendors who know your niche. For example:

When a partner is clear about what they don't do, you can actually trust what they say they do.

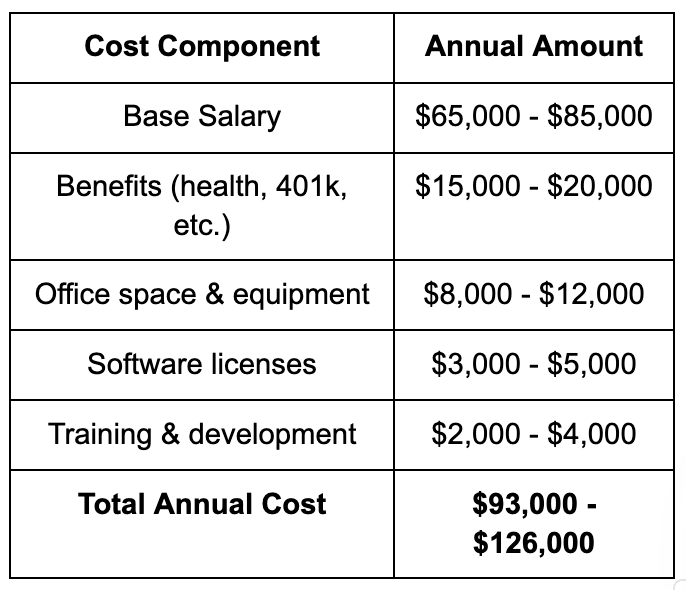

Let's cut to the chase. Most CPA firms don't start offshore hiring because they want to, it's because the economics of traditional hiring in the U.S. have become unsustainable.

But if you only think of offshoring as "cheaper labor," you're missing the point. The real value lies in restructuring your cost base while preserving (or even improving) output. Let's walk through the real math, beyond the hourly rates.

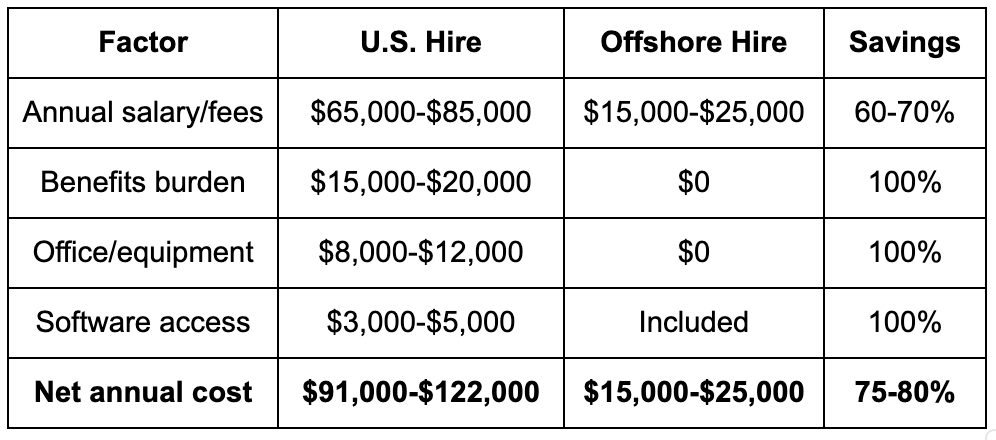

Here's the true cost of hiring a full-time, entry-to-mid-level CPA in the U.S.:

And that's if you're fully staffed. If you're in a talent-short market like New York, SF, or Chicago, expect the numbers to lean higher, even for junior staff.

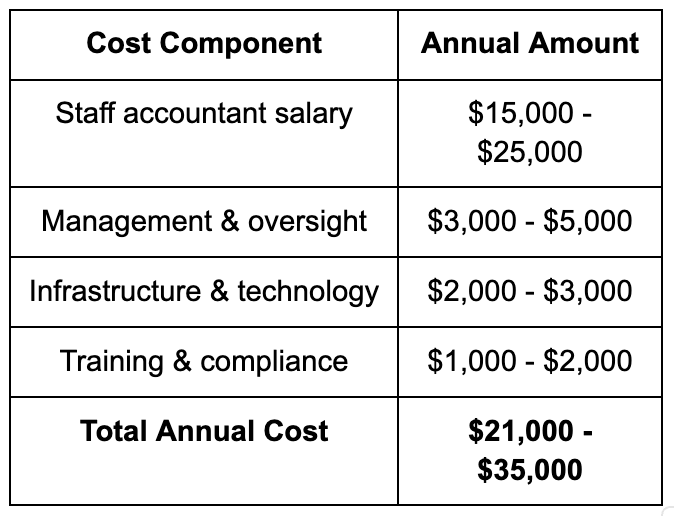

Let's compare that to hiring through a reputable offshore provider:

This includes infrastructure, training, equipment, and supervision, especially if you're using a structured offshore vendor.

Even if you go direct (hiring your own offshore contractor), your total outlay will rarely exceed $40,000/year unless you're building a senior-level offshore role.

Offshore hiring isn't just about spending less. It's about freeing up margin and internal capacity so that:

Let's say you move 50% of your tax prep to offshore staff. If your firm does 1,000 returns a year, and the offshore team saves you $150 per return in labor cost, that's $150,000 back in margin. Every year.

Here's the reality: quality issues cost money too. If offshore work leads to more reviews, rework, or client confusion, you burn those savings fast.

That's why the true ROI depends on:

Firms that take this seriously consistently report net margin increases of 10–25% within the first 18 months of offshore hiring.

Offshore staffing makes strategic sense, but it also brings real concerns that partners can't afford to ignore. From security to quality control, the risks are legitimate. The good news? High-performing firms address these risks through systems, not guesswork.

Here are the four concerns we hear most often, and how firms are solving them at scale.

The concern: "How can I trust someone across the world with my clients' tax IDs, bank data, and P&Ls?"

This is the #1 blocker, especially for firms that serve HNIs, regulated industries, or enterprise clients.

What leading firms do:

Tip: Before hiring, ask to review the vendor's security policy. If they can't provide one in writing, walk away.

The concern: "What if the offshore work comes back messy, or worse, wrong?"

Firms that fail here usually didn't define expectations. Accuracy offshore depends less on geography, and more on process.

How firms ensure quality:

Tip: Quality issues often surface in week 1. That's why most firms run a paid 2–4 week pilot with clear metrics before scaling up.

The concern: "Will clients be upset if they know their taxes are being prepped offshore?"

It depends on how you handle it. Most clients care about timeliness and accuracy, not location.

What works:

Tip: If offshoring helps you deliver faster and with fewer errors, client satisfaction usually goes up, not down.

The concern: "Are we just replacing technical debt with management debt?"

Offshore teams can create management drag if not properly integrated. But firms that embed them well often see net reduction in partner workload after the initial ramp-up.

What makes it work:

Tip: Offshore doesn't remove the need for management. It shifts the focus from micromanaging tasks to managing outcomes.

The concern: "Will communication issues slow us down or create errors?"

Working with offshore accounting professionals requires establishing clear communication channels and protocols.

How successful firms handle this:

Many offshore CPAs have excellent written English skills and experience working with U.S. firms, making language barriers less of an issue than firms initially expect.

The concern: "Are we still compliant if offshore staff are preparing returns?"

This is a valid concern that requires careful attention to reporting standards and oversight.

Best practices for staying compliant:

The key is that offshore teams prepare and support, but licensed professionals maintain responsibility and oversight.

Handled proactively, these concerns don't justify avoiding offshore, they create the roadmap for making it work.

Successfully implementing offshore hiring requires more than just finding good people. It requires thoughtful integration that enables CPA firms to focus on strategic advisory work while ensuring quality and compliance.

Start with one clear, repeatable process rather than trying to offshore multiple functions at once. This allows you to:

When you hire offshore, you're not just reducing costs, you're repositioning your firm to focus on core competencies that drive growth:

The advantages of hiring offshore accountants become clear when you establish strong partnerships rather than just vendor relationships. Look for partners who:

Leveraging the expertise of global talent requires understanding how to maximize the benefits while minimizing risks:

The decision to hire offshore accounting professionals is becoming less about whether to do it, and more about how to do it effectively. As more firms to hire offshore accounting talent, the competitive advantage shifts to those who implement it most strategically.

When implemented thoughtfully, working with offshore professionals allows firms to:

Firms that successfully leverage offshore talent position themselves for sustainable growth by:

Offshore hiring has shifted from a cost-cutting tactic to a strategic move for CPA firms facing rising overheads, shrinking talent pools, and unpredictable workloads. Done right, it frees up your local team for higher-value work, improves turnaround times, and boosts profitability, without compromising control or quality.

The key isn't volume. It's alignment: finding offshore partners that understand U.S. accounting standards, integrate into your workflow, and scale with your pace.

That's where Madras Accountancy comes in.

With over a decade of experience supporting 60+ CPA firms, Madras delivers dedicated offshore accounting talent trained specifically for U.S. tax, audit, and bookkeeping workflows. Their team operates under rigorous security controls (SOC 2, GDPR, ISO standards) and works entirely on secure virtual desktops, ensuring that when you hired offshore CPA professionals through them, your client data stays protected.

If you're looking for a low-friction way to test offshore hiring, Madras offers flexible pilots, responsive onboarding, and a deep bench of tax-season-ready staff.

📩 Start a conversation with us today, reach out directly to info@madrasaccountancy.com.

Let offshore talent become your firm's quiet advantage, so your partners can focus on what actually moves the needle.

FAQs

Question: What types of accounting work can be effectively outsourced to offshore accountants?

Answer: Offshore accountants can effectively handle bookkeeping, accounts payable and receivable processing, bank reconciliations, financial statement preparation, payroll processing, and tax return preparation. They excel at data entry, transaction categorization, monthly closing procedures, audit support work, and compliance reporting. More complex tasks include financial analysis, budget preparation, cash flow forecasting, and specialized industry accounting. However, client-facing advisory work, strategic planning, and complex technical consultations typically remain with domestic staff. The key is matching offshore capabilities with appropriate work types while maintaining quality and compliance standards.

Question: How much do offshore accountants cost compared to domestic accounting staff?

Answer: Offshore accountants typically cost 50-70% less than domestic equivalents when considering total compensation including salaries, benefits, training, and overhead. Offshore accounting professionals earn $8,000-25,000 annually depending on experience and location, compared to $40,000-80,000 for similar domestic positions. However, consider additional costs including management oversight, technology infrastructure, training, and potential productivity differences during initial periods. Total cost savings often range from 40-60% after accounting for all expenses, making offshore hiring attractive for routine accounting work while maintaining domestic staff for client interaction and complex advisory services.

Question: What qualifications should CPA firms look for when hiring offshore accountants?

Answer: CPA firms should seek offshore accountants with relevant accounting degrees, professional certifications like CPA, ACCA, or local equivalents, and experience with US GAAP or international accounting standards. Essential qualifications include proficiency in accounting software like QuickBooks, Xero, or NetSuite, strong English communication skills, and experience with US tax regulations and business practices. Look for candidates with bachelor's degrees in accounting or finance, 2-5 years of relevant experience, technology proficiency, and demonstrated ability to work independently. Cultural fit, reliability, and commitment to professional development are also important selection criteria.

Question: How do CPA firms manage and communicate effectively with offshore accounting teams?

Answer: Effective management of offshore accounting teams requires structured communication protocols, clear expectations, regular check-ins, and appropriate technology tools. Establish daily or weekly reporting procedures, use project management software for task tracking, and schedule regular video conferences for relationship building. Provide detailed work instructions, standard operating procedures, and quality checklists to ensure consistency. Use collaboration tools like Slack, Microsoft Teams, or Zoom for ongoing communication, and maintain shared access to accounting systems and documents. Cultural sensitivity, patience during adjustment periods, and recognition of achievements help build strong working relationships.

Question: What are the main challenges of hiring offshore accountants and how can they be addressed?

Answer: Main challenges include communication barriers, time zone differences, cultural adjustment periods, quality control concerns, and initial training requirements. Address communication challenges through clear written procedures, regular video calls, and language training if needed. Manage time zone differences by establishing overlap hours and asynchronous work processes. Quality control requires systematic review procedures, performance monitoring, and ongoing feedback. Initial training investments in systems, procedures, and company culture are essential for long-term success. Patience, clear expectations, and comprehensive onboarding programs help overcome initial challenges.

Question: How should CPA firms structure employment arrangements with offshore accountants?

Answer: CPA firms can structure offshore arrangements through direct employment, contractor relationships, or partnerships with offshore service providers. Direct employment offers most control but requires local legal compliance and administrative overhead. Contractor arrangements provide flexibility but may limit control and integration. Service provider partnerships offer comprehensive solutions with reduced administrative burden but less direct control over individual staff. Consider factors like control requirements, administrative capabilities, legal compliance obligations, and scalability needs when choosing employment structures. Consult legal and tax professionals for guidance on international employment arrangements.

Question: What technology and security considerations apply to hiring offshore accountants?

Answer: Technology considerations include providing secure access to accounting software, ensuring reliable internet connectivity, implementing VPN connections, and maintaining data security protocols. Security measures require multi-factor authentication, encrypted communications, regular security training, and compliance with data protection regulations. Provide necessary software licenses, hardware if needed, and technical support for system issues. Implement monitoring systems for data access and usage, maintain backup procedures, and ensure compliance with client data security requirements. Regular security audits and updates help maintain protection standards throughout the engagement.

Question: How can CPA firms measure success and ROI when hiring offshore accountants?

Answer: Measure success through cost savings analysis, productivity metrics, quality indicators, client satisfaction scores, and timeline improvements. Track direct cost savings compared to domestic alternatives, calculate return on investment including training and management costs, and monitor productivity measures like completed tasks per hour or accuracy rates. Quality metrics include error rates, rework requirements, and client feedback scores. Assess timeline improvements in tax season completion, monthly closing speed, and project delivery times. Regular performance reviews and goal setting help maintain focus on key success indicators and continuous improvement opportunities.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.