The traditional accounting office filled with piles of paper, overflowing file cabinets, and manual document retrieval systems is becoming obsolete. As regulatory demands grow and businesses seek efficiency, going paperless is no longer just a forward-thinking move—it is a strategic necessity.

Paperless accounting allows firms to save time, reduce overhead, improve security, and ensure faster access to financial data. Whether you run a small CPA practice or manage accounting operations for a mid-sized business, transitioning to a digital system can streamline operations while improving client service and regulatory compliance.

This guide provides a comprehensive, step-by-step blueprint to help your organization implement a paperless accounting system from scratch. We cover everything from document digitization and software tools to security protocols and employee training. If you are serious about modernizing your practice, reducing paper clutter, and unlocking new efficiencies, this guide is your starting point.

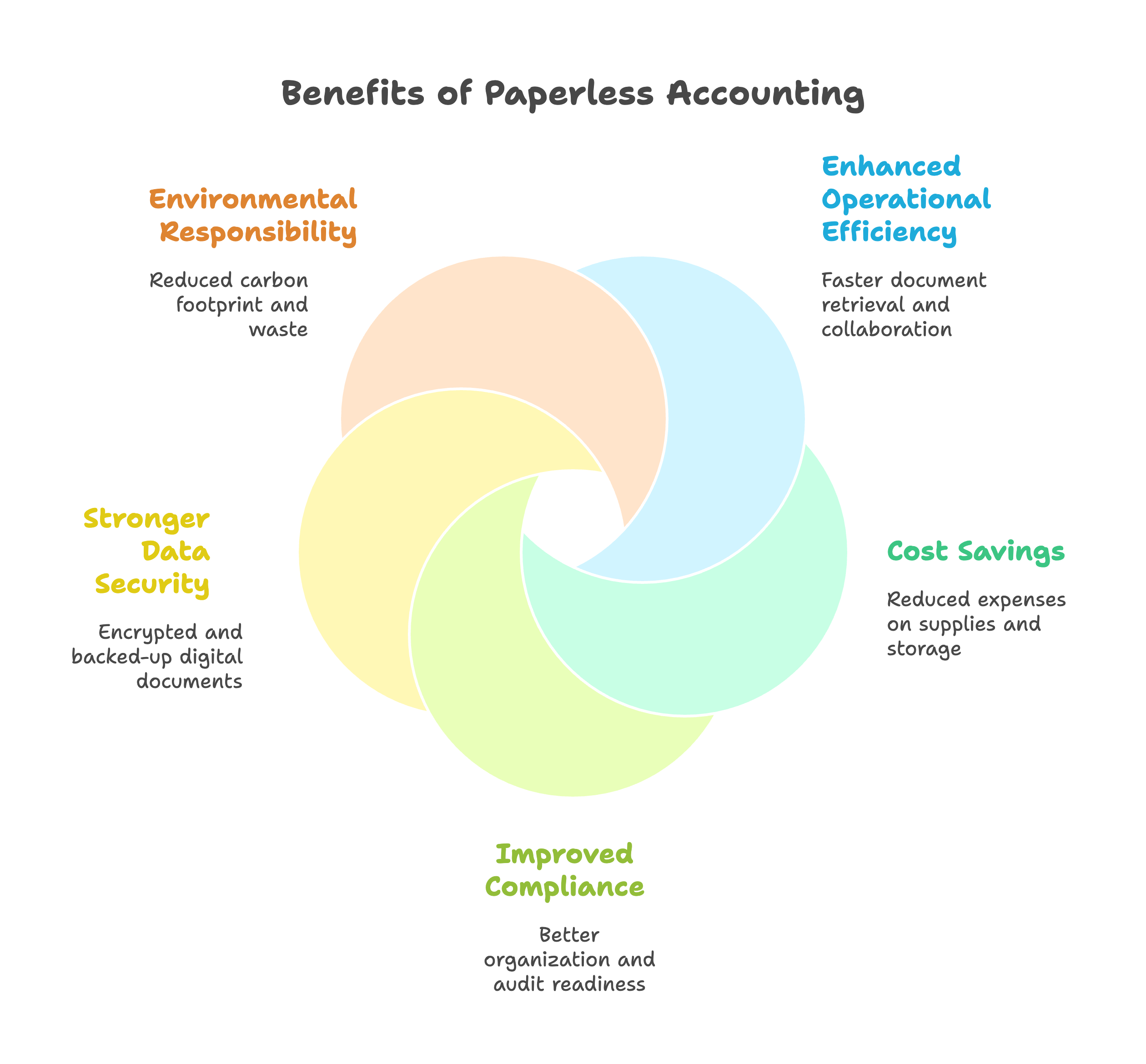

Before diving into the steps, it is important to understand why a paperless accounting office is worth the investment. The advantages are both operational and strategic.

Paper-based processes slow down workflows. Searching for physical files, mailing invoices, or manually archiving documents adds hours of inefficiency each week. A paperless system enables:

Paper, ink, printers, file cabinets, and physical storage all add up. By digitizing records and workflows, businesses can save on:

These savings can be reinvested into other areas such as technology upgrades or staff development.

Digital systems allow for better organization, version control, and backup. During audits or regulatory reviews, firms can quickly access required documents and demonstrate adherence to retention policies.

Storing sensitive financial records in paper form introduces risks of theft, fire, water damage, or misplacement. Digital documents can be encrypted, access-restricted, and backed up offsite to ensure long-term integrity.

Going paperless reduces a firm’s carbon footprint. Fewer paper purchases and reduced waste align with sustainability goals and demonstrate social responsibility.

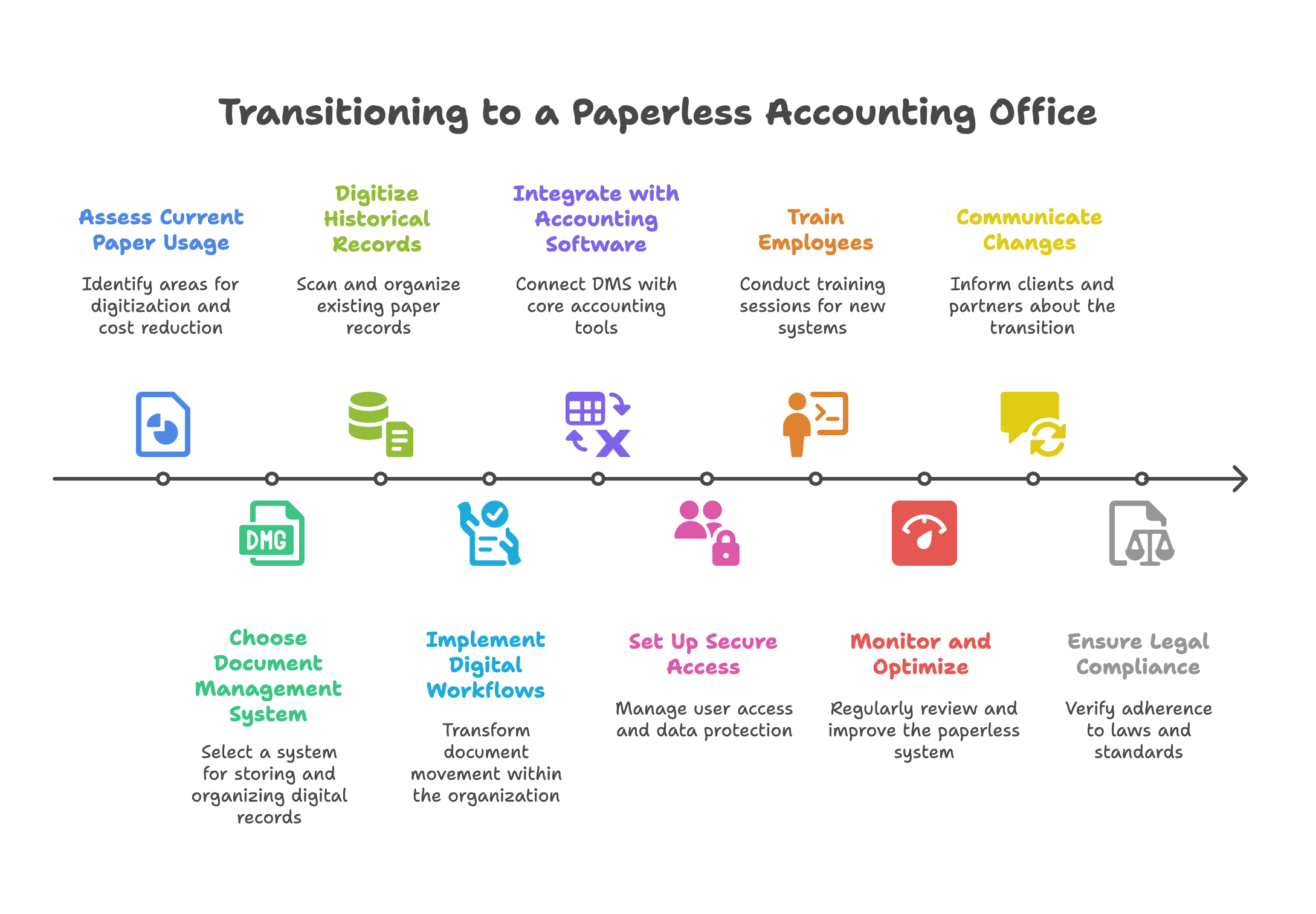

Transitioning to a paperless accounting office requires planning, investment in the right tools, and proper change management. Below is a structured approach.

Start by understanding where and how paper is used within your organization. This step helps identify key opportunities for digitization and cost reduction.

Interview staff to uncover pain points or delays caused by paper-based processes. The goal is to map out your current workflows and identify all touchpoints where paper enters the system.

A Document Management System is the core infrastructure of a paperless office. It stores, organizes, and enables access to digital records.

Popular DMS options include:

Ensure that the DMS is secure and complies with data protection laws such as HIPAA, GLBA, or GDPR if applicable.

Once you have a DMS in place, begin scanning existing paper records. Prioritize documents based on frequency of use, regulatory importance, and client activity.

This is a time-consuming task, so consider outsourcing bulk scanning to a professional service provider if you lack internal capacity.

Going paperless is not just about scanning documents. It involves transforming how documents move through your organization.

Workflow tools such as Zapier, Monday.com, or custom automation within your DMS can reduce manual work and human error.

A successful paperless office depends on seamless data integration. Your DMS, CRM, and project management tools should connect to your accounting platform.

This integration eliminates double entry and ensures that financial data flows smoothly from input to reporting.

With digital systems, access management becomes crucial. Each user should only see the files and folders relevant to their role.

Data privacy is non-negotiable in accounting, and proper controls protect both your clients and your firm.

Technology is only effective when people use it properly. Conduct structured training sessions to onboard staff to the new systems.

Monitor usage patterns for the first few weeks and provide feedback to improve adoption. Make it clear that paper-based workarounds are no longer acceptable unless required by law.

A paperless system should be regularly audited for gaps, bottlenecks, or misuse.

Use analytics from your DMS and workflow tools to uncover trends and drive further process improvements. You can even run monthly reports to see how much paper was saved or how many digital workflows were completed successfully.

Your clients may also need to adjust their interactions with your firm. Provide clear communication about the transition.

Encourage digital collaboration by making it easier for clients to participate in the new system.

Finally, ensure that your digital document handling meets all relevant laws and industry standards. In accounting, document retention, audit trails, and data protection are critical.

Work with a compliance consultant if needed to certify your system.

For CPA firms and accounting departments that are short on time or internal IT resources, offshore teams can offer critical support during the transition.

At Madras Accountancy, we support U.S.-based CPA firms with:

Our team helps you move faster while staying compliant, without increasing your overhead or workload.

Going paperless is not a trend—it is the future of accounting. Firms that make the shift position themselves to operate more efficiently, serve clients better, and respond faster to regulatory demands.

The key to success lies in clear planning, the right tools, proper employee training, and ongoing oversight. With a step-by-step implementation, your firm can reduce clutter, cut costs, and modernize its operations without sacrificing accuracy or security.

If your firm is ready to go digital but needs help getting started, Madras Accountancy can provide the back-office support and technical expertise to make it seamless.

Question: What are the benefits of implementing a paperless accounting office?

Answer: Paperless accounting office benefits include significant cost savings from reduced paper, printing, and storage expenses, improved efficiency through faster document retrieval and processing, enhanced security with encrypted digital storage and access controls, and better disaster recovery capabilities. Additional benefits cover reduced physical storage requirements, improved collaboration through shared digital access, enhanced audit trails with timestamp and version control, and environmental sustainability. Paperless operations enable remote work capabilities, faster client service, and improved organization through searchable digital archives. Cost savings often include 40-60% reduction in printing and storage costs while improving productivity through faster document processing and retrieval. Professional image enhancement and competitive advantages also result from modern, efficient operations.

Question: What technology infrastructure is required for a paperless accounting office?

Answer: Paperless accounting office infrastructure requires high-speed internet, cloud storage solutions, document management systems, high-quality scanners, and secure backup systems. Essential components include multifunction printers with scanning capabilities, tablets or mobile devices for digital signatures, reliable network infrastructure, and cybersecurity measures including firewalls and antivirus software. Cloud-based accounting software, document management platforms like SharePoint or Box, and electronic signature solutions are fundamental requirements. Consider redundant internet connections, uninterruptible power supplies, and mobile device management systems. Professional IT support helps design appropriate infrastructure, ensure security compliance, and provide ongoing maintenance. Scalable solutions accommodate growth while maintaining performance and security standards throughout the digital transformation process.

Question: How should accounting firms choose document management software for paperless operations?

Answer: Choose document management software by evaluating security features, integration capabilities with accounting systems, search functionality, and compliance with professional standards. Essential features include version control, audit trails, user access controls, and backup/recovery capabilities. Consider integration with tax software, accounting platforms, and email systems for seamless workflow automation. Evaluate mobile access capabilities, collaboration features, and client portal functionality for enhanced service delivery. Security requirements include encryption, multi-factor authentication, and compliance with data protection regulations. Cost considerations cover licensing fees, implementation costs, and ongoing support requirements. Trial periods and vendor demonstrations help evaluate usability and feature suitability before making final selections. Professional consultation ensures chosen solutions meet both current needs and future growth requirements.

Question: What is the step-by-step process for implementing paperless accounting operations?

Answer: Implement paperless accounting through systematic phases including planning and assessment, technology selection and setup, document digitization, staff training, and gradual transition from paper processes. Begin with current process documentation, technology needs assessment, and budget planning. Select and implement document management systems, scanning equipment, and security measures. Digitize existing documents systematically, establish naming conventions and filing structures, and create backup procedures. Train staff on new systems, develop standard operating procedures, and implement quality control measures. Gradually transition client processes, test workflows thoroughly, and gather feedback for improvements. Monitor performance metrics, address issues promptly, and celebrate milestones to maintain momentum. Complete implementation typically takes 3-6 months depending on firm size and complexity.

Question: How should firms handle client communication and onboarding for paperless processes?

Answer: Handle client communication for paperless processes through advance notification, clear benefit explanations, comprehensive training materials, and ongoing support throughout the transition. Communicate changes well in advance, emphasizing benefits like faster service, enhanced security, and improved accessibility. Provide training on client portals, electronic signature processes, and document submission procedures. Create user guides, video tutorials, and FAQ documents for client reference. Offer multiple communication channels for questions and support during transition periods. Implement gradual rollouts starting with tech-savvy clients before expanding to all clients. Maintain temporary paper options for clients requiring additional transition time. Professional change management ensures smooth client adoption while maintaining service quality and client satisfaction throughout the digital transformation process.

Question: What security measures are essential for paperless accounting offices?

Answer: Essential security measures for paperless accounting include multi-factor authentication, data encryption, regular security audits, and comprehensive backup systems. Implement role-based access controls, secure VPN connections for remote access, and regular software updates for all systems. Use encrypted cloud storage, maintain offline backup copies, and establish incident response procedures. Train staff on security best practices, implement email security measures, and maintain current antivirus and firewall protection. Consider cyber liability insurance, conduct regular security assessments, and maintain compliance with professional standards and regulations. Document security procedures, establish monitoring systems for unusual access patterns, and implement physical security measures for equipment and facilities. Professional security consultation helps ensure comprehensive protection appropriate for sensitive financial data.

Question: How can accounting firms measure ROI from paperless office implementation?

Answer: Measure paperless office ROI by calculating cost savings from reduced paper, printing, postage, and storage expenses, plus productivity improvements from faster document processing and retrieval. Track time savings from elimination of filing, copying, and document searching activities. Calculate space savings from reduced storage requirements and improved collaboration efficiency. Measure client satisfaction improvements through faster service delivery and enhanced accessibility. Consider revenue increases from improved capacity and service capabilities. Typical cost savings range from 20-40% on administrative expenses while productivity improvements often exceed 25%. Factor in implementation costs including technology, training, and transition expenses when calculating payback periods. Most firms achieve positive ROI within 12-18 months through operational efficiencies and cost reductions.

Question: What ongoing maintenance and best practices ensure successful paperless operations?

Answer: Ensure successful paperless operations through regular system backups, software updates, staff training refreshers, and continuous process improvement. Maintain current backup procedures, test disaster recovery systems regularly, and keep security measures updated. Conduct regular staff training on new features and best practices while gathering feedback for process improvements. Monitor system performance, track key metrics, and address issues promptly. Maintain vendor relationships for technical support and stay current with technology updates and new features. Regularly review document retention policies, archive old files appropriately, and maintain compliance with professional standards. Continuous improvement based on user feedback and operational metrics helps optimize paperless operations while maintaining security and efficiency standards throughout the organization.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.