If you're buying inventory to resell in Texas, whether you run a retail store, dropshipping business, or even a service that uses goods, there's one piece of paperwork you don't want to skip: the resale certificate.

It sounds like just another form, but here's the deal: without it, you're probably paying sales tax on purchases you shouldn't. That means tighter margins, unnecessary expenses, and potential issues if the state ever comes knocking.

A Texas resale certificate is a document that allows businesses to purchase goods tax-free if they intend to resell them. Simple in theory but like most compliance tools, the details matter. Use it wrong, and you could face audits or penalties.

Skip it entirely, and you're paying taxes twice.

This guide breaks down:

If you're trying to get this right the first time without digging through the state website, you're in the right place.

Let's get into it.

A Texas resale certificate is a legal form that lets your business to purchase goods or taxable services without paying sales tax, but only if you plan to resell those items or include them in a taxable transaction with your customer.

Instead of charging you tax at the time of sale, the seller accepts a properly completed certificate as proof that the sales tax will be collected later, when you resell the item.

It's not a loophole. It's how Texas ensures sales or use tax is only paid once, by the final customer.

Let's say you run an online clothing business in Texas. You buy blank T-shirts from a distributor to print and sell. If you provide your supplier with a resale certificate instead of paying sales tax, they don't charge you sales tax. Later, when you sell the printed shirts to your customer, you collect sales tax from them and send it to the state.

In short:

That's the resale certificate in action.

Under Texas Administrative Code §3.285, a resale certificate can be used when purchasing:

Common examples include:

The resale certificate is only valid when the item will not be used by your business , even temporarily.

A resale certificate is not:

To use a Texas resale certificate, you must already have a valid Texas Sales and Use Tax Permit, or a comparable permit from another state if you're based outside Texas.

You also can't use a resale certificate to buy office supplies or equipment for business use, even if they're related to your operations (like furniture, or software for internal use). Doing so is considered misuse and may trigger penalties.

To be accepted, a resale certificate must include:

The seller must receive this form at or before the time of sale, and keep it on file to prove why tax was not collected.

As per 34 Tex. Admin. Code §3.285(e), a seller is not liable for tax on a sale made under a valid resale certificate if the form is filled out properly and accepted in good faith.

No, Texas resale certificates do not have an automatic expiration date.

But they must remain accurate and up to date. If your business address, entity structure, or sales tax permit number changes, you must provide an updated certificate. Otherwise, the seller may reject it or risk audit exposure.

If you're buying goods for resale and not using a resale certificate, you're paying sales tax that you don't have to, and then collecting it again from your customer. That's double taxation. It eats into your margins and creates unnecessary complexity in your reporting.

If you do use a resale certificate improperly, like for personal or business use, it can be treated as tax fraud, with interest, penalties, or legal action.

That's why getting this right from the start isn't optional, it's essential for proper tax compliance.

Technically, no , you can legally buy goods for resale in Texas and pay sales tax at the time of purchase. But that means you'll also have to collect sales tax again when you resell those items to your customers.

So while a resale certificate isn't mandatory, it is the only way to avoid double taxation on the same item.

Most Texas businesses that deal in resold goods , especially retailers, wholesalers, eCommerce stores, and service providers , do need a resale certificate as standard practice. Without one, you're hurting your margins and risking confusion during audits.

In short: If you're buying anything with the intent to resell, and you want to avoid paying sales tax twice, yes, you need a resale certificate.

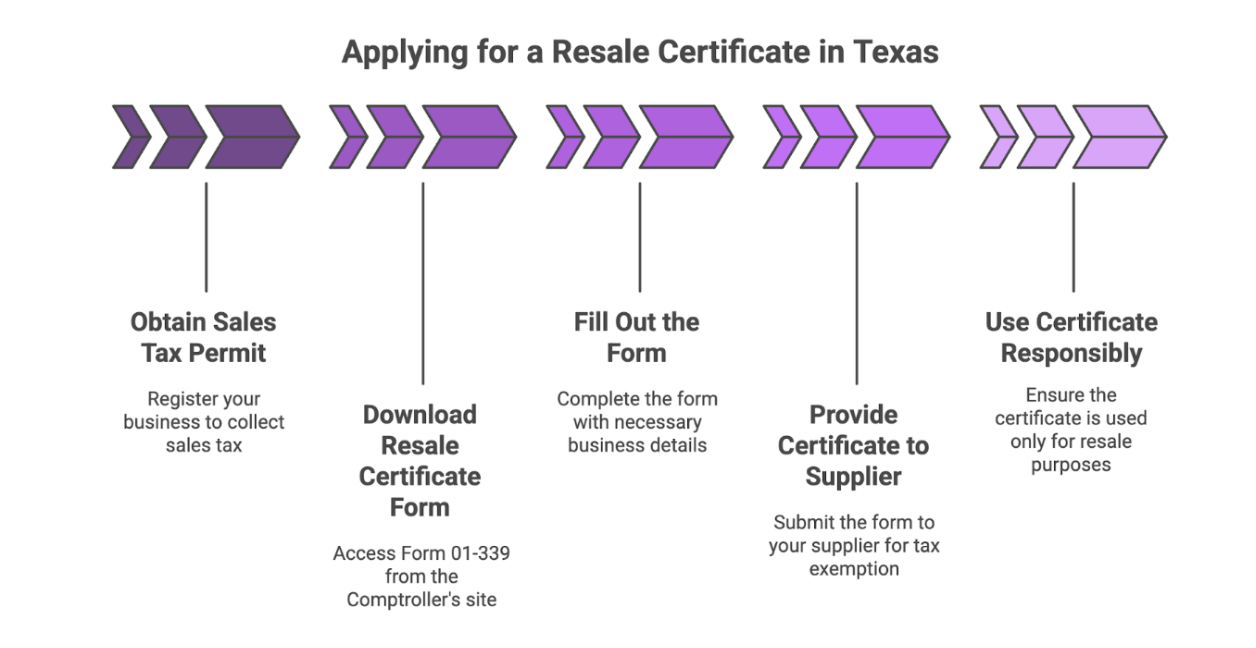

Good news: applying for a resale certificate in Texas is free, and the resale certificate process is fairly straightforward , if you know where to go and what to fill in.

Let's walk through it step by step.

Before you can issue a resale certificate in Texas, your business must first be registered to collect and remit Texas sales tax.

That means you need an active Texas Sales and Use Tax Permit, issued by the Texas Comptroller.

If you don't have one yet, you can apply online through the Texas eSystems portal. Processing usually takes 2–3 weeks.

Out-of-state sellers: You may still be able to use a resale certificate in Texas if you're registered for sales tax in another state and have nexus in Texas.

Texas does not issue a resale certificate directly. Instead, businesses complete and provide Form 01-339, also known as the Texas Sales and Use Tax Resale Certificate / Exemption Certificate.

You can get a resale certificate from the official Comptroller site:

This form is not submitted to the state. It's provided directly to your supplier when making a tax-exempt purchase.

Here's what you'll need to complete the form properly:

The Texas Comptroller requires that the resale certificate be properly completed, signed, and dated before the sale; otherwise, the seller is legally required to charge tax.

Give the completed Form 01-339 certificate to suppliers before or at the time of purchase. This lets them exempt the sale from sales tax and keep the certificate on file as proof.

You do not send the form to the Texas Comptroller; it's strictly between you and the seller.

Pro tip: Keep a copy for your own records in case of an audit later.

You can only use a resale certificate when the items you're buying will:

Using the certificate to avoid tax on purchases for personal or internal business use (like machinery and equipment used internally or office tools) is considered misuse and can result in fines or interest charges.

Used correctly, this certificate saves you money and protects your business from double taxation.

The use of resale certificates requires understanding both the legal obligations and the proper certificate management practices. When you purchase taxable items using a resale certificate, you're entering into a legal framework that governs how these transactions should be handled.

A resale certificate is used when businesses need to purchase goods tax-free for resale purposes. The property purchased must be intended for resale in the regular course of business or resold in the normal course of your business operations.

Valid uses include:

The use of the certificate is restricted to legitimate resale situations. You cannot use it for:

Understanding these rules and regulations helps ensure compliance and avoid potential penalties.

Businesses often wonder whether to use a blanket resale certificate for ongoing relationships with suppliers. A blanket certificate covers multiple transactions with the same vendor, provided the types of products being purchased remain consistent and are all intended for resale.

This approach can streamline certificate management for businesses that regularly purchase the same types of items from the same suppliers.

If you sell taxable goods or services in Texas and a buyer hands you a resale certificate, don't just file it away and move on. That document protects you from liability, but only if it's filled out properly and you accept resale certificates in good faith.

Here's how to handle it the right way.

In Texas, if you don't collect sales tax, you're expected to have a valid resale certificate on file to explain why.

If you accept a resale certificate that's:

…you could owe tax plus penalties and interest, even if your buyer said all the right things.

That's why this isn't just paperwork. It's legal protection.

Texas requires particular legal information on the resale certificate:

You can use Form 01-339, the standard resale certificate format from the Comptroller's site.

Don't wait until after the transaction. If the state audits you, they'll expect to see the resale certificate dated on or before the sale. Late paperwork won't protect you.

You're expected to accept the certificate in good faith. That means the seller accepts a properly completed certificate only when it looks reasonable.

Example: If a buyer claiming to sell office supplies tries to use a resale certificate to buy catering equipment, that's a red flag. If you accept it anyway, you're at risk.

Texas law requires you to keep the certificate in your records for a minimum of four years after the sale. If the buyer is a regular customer, you can accept a blanket certificate for ongoing purchases, but it still needs to be specific, complete, and up to date.

You can always verify a Texas tax permit number through the Comptroller's permit verification tool.

When in doubt? Collect the tax. It's safer than trying to defend a bad resale certificate in an audit.

As a seller, it's on you to collect valid resale certificates and make sure they match the nature of the transaction. If everything checks out, you're protected. If not, the tax bill could end up in your lap.

If your business operates outside Texas, you'll need to navigate the complexities of different state requirements. Each state has its own rules for resale certificates, and what's valid in Texas may not be acceptable in other jurisdictions.

Some businesses face unique challenges with resale certificates:

While resale certificates are the most common type of exemption certification, Texas recognizes other exemptions for specific situations:

Each has its own requirements and proper documentation.

Modern businesses often use technology to streamline their certificate management:

These tools can help ensure compliance while reducing administrative burden.

Resale certificates might seem like a small piece of paperwork, but in practice, they touch your margins, compliance risk, and how clean your business looks when it's time to report or raise.

Done right, they help you avoid double taxation, streamline vendor relationships, and stay fully compliant with Texas law. Done wrong, or ignored entirely, and you could be looking at penalties, interest, or a scramble during audit season.

That's why resale certificates shouldn't be treated in isolation. They're part of a broader system, one that includes sales tax tracking, documentation, accurate books, and proactive financial controls.

And that's exactly where Madras Accountancy fits in.

We support U.S.-based startups, small businesses, and accounting firms with:

All delivered by a secure, well-managed offshore team that integrates seamlessly into your workflow

If you're figuring out how resale certificates fit into your growing business, and want a system that's built to scale without breaking, we can help.

The paperwork matters. But the process behind it matters more.

Question: What is a Texas resale certificate and how does it work for businesses?

Answer: A Texas resale certificate is an official document that allows businesses to purchase goods tax-free when those items will be resold to customers or used as components in products for resale. The certificate enables qualified businesses to avoid paying sales tax on inventory purchases by providing the document to suppliers instead of paying sales tax at purchase. Businesses must then collect and remit sales tax when selling these items to end customers. This system prevents double taxation and helps businesses manage cash flow by not paying tax on inventory investments.

Question: Who is eligible to obtain a resale certificate in Texas and what are the requirements?

Answer: Texas resale certificates are available to businesses registered for sales tax with the Texas Comptroller, including retailers, wholesalers, manufacturers, and service providers who sell taxable goods or services. Eligible businesses must have a valid Texas sales tax permit, regularly engage in resale activities, and intend to resell purchased items in the ordinary course of business. The business must be actively engaged in selling goods or services subject to Texas sales tax and maintain proper records of resale transactions. Non-profit organizations and businesses not engaged in regular sales activities typically cannot obtain resale certificates.

Question: How do you apply for a resale certificate in Texas and what documents are required?

Answer: Apply for a Texas resale certificate by registering for a sales tax permit through the Texas Comptroller's website using Form AP-201 (Texas Application for State Tax Registration). Required information includes business name, address, federal EIN or SSN, business structure, description of goods/services sold, and estimated monthly sales tax liability. Once approved for sales tax registration, businesses automatically receive authority to issue resale certificates. No separate application is needed for the resale certificate itself - registration for sales tax includes resale certificate privileges for qualified transactions.

Question: What information must be included on a valid Texas resale certificate?

Answer: Valid Texas resale certificates must include the purchaser's name and address, Texas sales tax permit number, seller's name and address, description of items being purchased, reason for exemption (resale), purchaser's signature, and date of transaction. The certificate must clearly state that items are being purchased for resale in the ordinary course of business. Businesses can use the Texas Comptroller's standard Form 01-339 (Texas Sales and Use Tax Resale Certificate) or create their own forms including all required information. Certificates must be legible, complete, and properly signed to be valid.

Question: What are the penalties for misusing Texas resale certificates?

Answer: Misusing Texas resale certificates can result in significant penalties including payment of unpaid sales tax, interest charges, and additional penalties up to 50% of the tax owed. Fraudulent use of resale certificates may result in criminal charges and civil penalties. Common violations include using certificates for personal purchases, buying items not intended for resale, or providing false information on certificates. The Texas Comptroller actively audits businesses and can assess penalties retroactively for improper certificate usage. Businesses should maintain detailed records and only use certificates for legitimate resale transactions.

Question: What records must businesses maintain when using Texas resale certificates?

Answer: Businesses using Texas resale certificates must maintain comprehensive records including copies of resale certificates issued to suppliers, invoices showing tax-exempt purchases, records of subsequent sales to customers, and documentation proving items were resold or used in taxable products. Keep detailed inventory records tracking purchased items from acquisition through sale, customer invoices showing sales tax collection, and sales tax returns filed with the Texas Comptroller. Records must be kept for at least four years and be available for audit purposes. Proper documentation protects businesses during tax audits and demonstrates legitimate certificate usage.

Question: Can Texas resale certificates be used for out-of-state purchases?

Answer: Texas resale certificates cannot be used for out-of-state purchases as they are only valid for Texas sales tax exemptions. However, Texas businesses purchasing goods from out-of-state vendors may owe use tax on those purchases unless the items qualify for other exemptions or the vendor is registered to collect Texas sales tax. For multi-state operations, businesses need separate resale certificates for each state where they're registered for sales tax. Consult tax professionals for complex multi-state transactions and ensure compliance with both Texas and other states' sales tax requirements.

Question: How long is a Texas resale certificate valid and when must it be renewed?

Answer: Texas resale certificates remain valid as long as the business maintains an active sales tax permit with the Texas Comptroller. There's no separate renewal requirement for resale certificates - they automatically remain valid when sales tax permits are kept current. However, businesses must file required sales tax returns and maintain good standing with the Comptroller to preserve certificate privileges. If sales tax permits are canceled or suspended, resale certificate authority is also terminated. Regularly review sales tax permit status and maintain compliance with all Texas tax obligations to ensure continued resale certificate validity.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.