A single-member LLC (SMLLC) can be one of the simplest business structures for running your business, but when it comes to taxes, many owners misunderstand how it actually works.

Does your single-member LLC file its own tax return? Are you double-taxed? Do you pay yourself a salary, or just take distributions?

Here's the core truth: By default, the Internal Revenue Service treats a single-member LLC as a "disregarded entity." This means your business income flows directly onto your personal income tax return, and the LLC does not pay taxes separately from its owner. But there's more nuance around self-employment taxes, potential S Corp elections, and how your state views your LLC for tax purposes.

In this guide, we'll break down:

Whether you're a freelancer, consultant, or small business owner, understanding single-member LLC taxation can help you reduce surprises, optimize your tax strategy, and stay compliant as you grow.

When you form a single-member LLC, you gain legal separation between your personal assets and business activities. However, for federal income tax purposes, the IRS does not view your LLC as a separate business entity by default.

This treatment is called "disregarded entity" status, and it shapes how your income is reported, how taxes are calculated, and what filings you need to complete each year.

Your LLC's business activities are reflected on Schedule C (Profit or Loss from Business), which is attached to your individual tax return.

In some cases, your LLC may use:

Example: If your single-member LLC earns $80,000 in gross revenue with $20,000 in deductible expenses, you will report $60,000 of net business income on your personal income tax return.

Because you are not an employee of your own LLC, you will owe self-employment tax on your net business earnings. The owner of a single-member LLC must pay self-employment taxes on all business profits.

This tax:

Many first-time LLC owners overlook self-employment taxes, leading to underpayment issues if not planned for properly.

While your single member limited liability company can use your Social Security Number (SSN) for tax filings, there are situations where obtaining an Employer Identification Number (EIN) is necessary:

This default tax treatment allows you to keep federal tax compliance straightforward while leveraging the legal protection of your LLC structure.

However, as your business grows, there may come a point where electing a different tax classification (like S Corporation status) can help reduce taxes and optimize your income strategy.

By default, your single-member LLC is treated as an entity disregarded as separate from its owner for tax purposes, with profits flowing directly onto your individual federal income tax return. However, as your income and business complexity grow, electing a different tax treatment can help reduce your overall tax burden or align your structure with your growth plans.

Here's how it works:

The IRS will treat an LLC differently if you choose to be taxed as either:

These elections don't change your LLC's legal structure but change how your profits are taxed by the IRS.

Why consider it? Electing to be taxed as an s corporation is popular among LLC owners who want to reduce self-employment taxes while retaining the benefits of pass-through taxation.

What changes with an S Corp election:

How to elect S Corp status:

Example: If your single-member limited liability company earns $120,000 in net profit and you pay yourself a reasonable salary of $60,000, only the salary is subject to Social Security and Medicare taxes. The remaining $60,000 can be distributed as dividends, avoiding self-employment tax and potentially saving you thousands each year.

Benefits of S Corp election:

Why consider it? A C Corp election is less common for single-member LLCs but can be beneficial for businesses planning to reinvest profits heavily or attract outside investors.

What changes when taxed as a c corporation:

How to elect C Corp status:

Benefits of C Corp election:

Consider an S Corp or C Corp election if:

Tax elections should be made with a clear understanding of your current business income, cash flow needs, and long-term growth strategy. It is strongly recommended to consult with your accountant or tax advisor before making these changes to ensure alignment with your business goals and to avoid compliance missteps.

A major part of understanding single-member LLC taxation is grasping how self-employment (SE) taxes work. Many first-time business owners assume only income tax applies, but SE tax can significantly impact your take-home pay if you don't plan for it correctly.

Self-employment tax covers your Social Security and Medicare contributions, which, for traditional employees, are split between the employer and employee. However, when you operate as a single-member LLC under default tax treatment, you are considered self-employed, meaning you pay both portions yourself.

The SE tax rate is 15.3% on your net business earnings, broken down as:

The process begins by calculating your net earnings from self-employment, which is your total business revenue minus all deductible business expenses. The resulting figure is what your 15.3% SE tax is applied to, and this tax is in addition to your regular federal and state income taxes.

For example, if your single-member LLC earns $100,000 in revenue and you have $20,000 in deductible expenses, your net earnings would be $80,000. You would then owe approximately $12,240 in SE tax on top of your income tax obligations.

Self-employment tax often catches new business owners off guard, as there is no employer automatically withholding these taxes for you. If you don't plan for SE taxes, you may face cash flow challenges or underpayment penalties when filing your return.

Because of this, single-member LLC owners are generally required to make quarterly estimated tax payments to cover both income tax and SE tax obligations throughout the year. This helps spread out the tax burden and avoids large lump-sum payments during tax season.

One of the reasons many single-member LLC owners consider electing S Corporation status is to reduce self-employment tax liability. Under an S Corp election, the owner pays themselves a reasonable salary, which is subject to Social Security and Medicare taxes, while any additional profits can be distributed as dividends that are not subject to SE tax.

For instance, if your single-member LLC earns $120,000, and you pay yourself a salary of $60,000, only that salary will be subject to payroll taxes. The remaining $60,000, taken as distributions, avoids SE tax, potentially saving thousands annually while remaining compliant.

However, this strategy comes with additional administrative work, such as running payroll, filing separate tax returns for the S Corp, and maintaining accurate salary and distribution documentation to satisfy IRS requirements.

When considering business structures, many entrepreneurs compare an LLC and a sole proprietorship. Both single-member LLCs and sole proprietorships offer simplicity, but they differ significantly in legal protection and tax implications.

A sole proprietorship is the simplest business structure where you operate a business as an individual without forming a separate business entity. Like single-member LLCs, sole proprietorships are also disregarded as separate entities for federal tax purposes.

Key characteristics of sole proprietorships:

While both structures have similar tax treatment by default, there are important differences:

Liability Protection:

Formation Requirements:

Business Tax Implications:

Credibility:

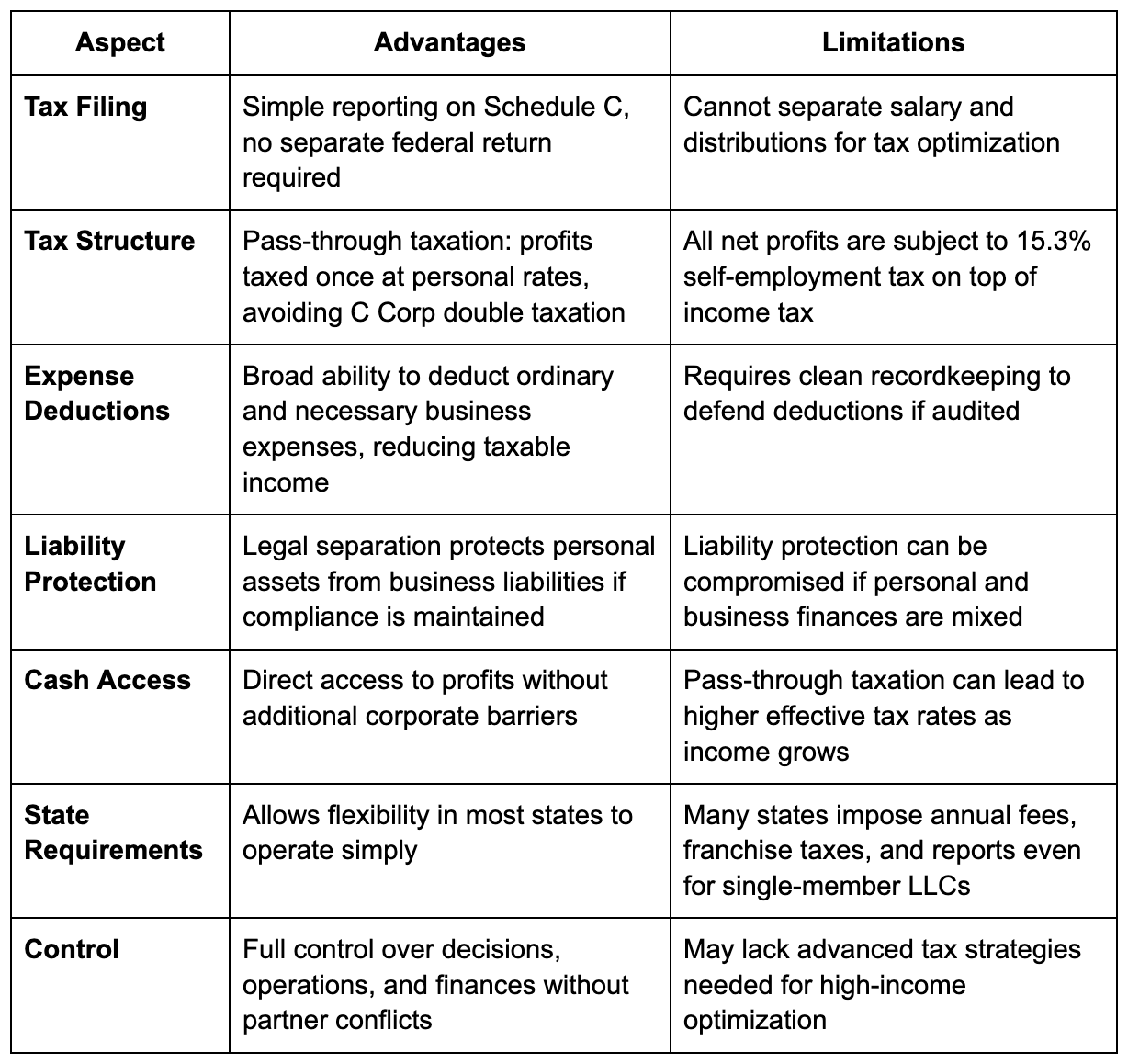

While single-member LLCs offer many benefits, there are some disadvantages of a single-member LLC to consider:

Choose a sole proprietorship if:

Choose a single-member LLC if:

Understanding how your business structure affects your taxes helps you make informed decisions about the best entity for tax purposes for your specific situation.

While federal taxation for single-member LLCs is clear, state-level taxation can vary dramatically depending on where you operate. Understanding your state's tax requirements is essential for accurate budgeting and compliance.

Some states align with the federal approach, treating your single-member LLC as a disregarded entity for income tax purposes, meaning the income passes through to your personal state tax return without a separate state-level filing.

However, many states impose additional taxes, fees, or reporting requirements on limited liability companies regardless of federal tax treatment. These state-level obligations can include:

California: Requires an annual minimum franchise tax of $800, plus an additional LLC fee if your income exceeds certain thresholds.

New York: Imposes an annual filing fee based on your LLC's gross income, with a minimum fee even if your LLC has no income.

Texas: Requires a franchise tax report, but exempts many small LLCs under a specific revenue threshold.

Delaware: Requires an annual report and a flat annual LLC tax but does not impose state income tax on LLCs not operating within the state.

These differences highlight why it's crucial to research and understand your specific state's LLC tax rules rather than assuming uniformity across states.

While most states tax LLC profits as pass-through income on your personal state return, a few states have elective pass-through entity (PTE) taxes that allow LLCs to pay state taxes at the entity level, helping owners bypass the federal $10,000 SALT (state and local tax) deduction cap. This strategy can benefit higher-income LLC owners in states like New York, California, and Illinois, where elective PTE tax regimes are available.

Aside from taxes, your LLC may be required to:

Failing to meet these requirements can lead to penalties, interest charges, or administrative dissolution of your LLC.

State-level compliance is a critical part of your tax strategy, especially as your single-member LLC grows and expands into new states. Consulting your tax advisor or CPA can help you optimize your compliance approach while ensuring you don't miss any state-specific obligations.

A single-member LLC doesn't just give you operational flexibility—it offers powerful opportunities to reduce your tax bill legally. By claiming deductible business expenses, you directly lower your taxable income, which lowers both your income tax and self-employment tax obligations.

But to benefit fully, you need to know what you can deduct, how these deductions work, and how to avoid common pitfalls.

Your LLC's net income—the figure used to calculate your taxes—is not just your revenue. It's revenue minus deductible expenses.

Every qualified business expense you track and claim:

For LLC owners who often underestimate their tax bills, maximizing deductions can mean the difference between scrambling for funds at tax time and maintaining a healthy, predictable cash position.

The IRS allows deductions for ordinary and necessary expenses related to your trade or business. For single-member LLC owners, these often include:

1. Home Office Deduction: If you have a dedicated space used regularly and exclusively for business, you can deduct a portion of your rent or mortgage, utilities, insurance, and repairs. This can add up to substantial savings for freelancers, consultants, and service businesses run from home.

2. Business Vehicle Expenses: If you use your car for business purposes, you can deduct either:

Keep detailed mileage logs or use tracking apps to support your claims.

3. Supplies, Equipment, and Software: Computers, printers, office supplies, and business-specific software subscriptions are fully deductible when used for business.

4. Marketing and Advertising: Costs for promoting your business—such as Google Ads, social media ads, website hosting, and graphic design—are deductible and essential for growth.

5. Professional Services: Payments to accountants, legal advisors, or consultants are fully deductible and can often prevent bigger expenses later by ensuring compliance.

6. Business Insurance Premiums: Coverage for liability, professional errors, or property insurance related to your business can be deducted.

7. Travel and Meals: Business travel expenses, including flights, lodging, and transportation, are deductible. Business meals are generally 50% deductible when directly related to business activities.

8. Continuing Education and Training: Courses, certifications, and workshops that improve your business skills can be deducted.

9. Retirement Contributions: Contributing to a Solo 401(k) or SEP IRA can help you reduce taxable income while building your retirement savings.

Consider this example:

Your taxable business income drops to $70,000. This lower amount is used to calculate:

The combined tax savings can be significant, especially as your business income grows.

While this guide focuses on single-member LLCs, it's worth understanding how taxation changes when an LLC with multiple members is formed. When you have one member, the LLC is treated as a disregarded entity, but an LLC with multiple members follows different tax rules.

Unlike a single-member LLC that reports on the owner's individual tax return, an LLC with multiple members is taxed as a partnership for federal income tax purposes by default. This means:

The key difference is that while a single-member LLC is disregarded as separate from its owner, a multi-member LLC is treated as an entity for tax purposes that must file its own tax form, even though it's still a pass-through entity.

For purposes of employment tax and certain excise taxes, both single-member and multi-member LLCs follow similar rules. Members typically must pay self-employment taxes on their distributive share of partnership income, similar to how a sole proprietor must pay self-employment taxes.

Like single-member LLCs, multi-member LLCs can also elect to be taxed as a corporation (either S Corp or C Corp) if it benefits their tax situation.

Running a single-member LLC means wearing many hats: founder, operator, marketer—and recordkeeper. Many small business owners underestimate how critical clean recordkeeping and consistent compliance are, not just for taxes, but for protecting your LLC's liability shield and ensuring long-term business health.

Your LLC legally separates your personal and business assets, shielding your personal property from business liabilities. However, courts can "pierce the corporate veil" if your business and personal finances are intertwined, exposing your personal assets during lawsuits or creditor actions.

Meticulous recordkeeping demonstrates:

In short, recordkeeping isn't a tax-season-only task—it's year-round protection for your business and personal financial security.

The Internal Revenue requires you to maintain records that support all income, deductions, and credits you claim on your tax return. This includes:

1. Income Documentation:

2. Expense Documentation:

3. Vehicle and Mileage Records:

4. Payroll Records (If Applicable):

5. Contracts and Agreements:

6. Tax Filings and Notices:

How long should you keep records?

While a single-member LLC can often use your Social Security Number (SSN) for federal filings, obtaining an Employer Identification Number (EIN) is best practice because:

Applying for an EIN is free and can be completed on the IRS website.

Commingling personal and business funds can:

To maintain separation:

Choosing to operate under default single-member LLC taxation has practical upsides, but it's not without limitations. Here is a clear side-by-side comparison to help you evaluate if this structure fits your business stage and goals:

When Default SMLLC Taxation is a Good Fit:

Question: How is a single member LLC taxed by default and what does "disregarded entity" mean?

Answer: Single member LLCs are taxed as "disregarded entities" by default, meaning the IRS ignores the LLC structure for tax purposes and treats it as a sole proprietorship. All business income, expenses, and deductions flow through to the owner's personal tax return using Schedule C. The LLC doesn't file a separate tax return, and the owner pays self-employment taxes on net profits. This default taxation provides simplicity while maintaining limited liability protection for business operations and assets.

Question: Can single member LLCs elect different tax treatments and what are the options?

Answer: Single member LLCs can elect S Corporation or C Corporation tax treatment by filing Form 8832 (Entity Classification Election) or Form 2553 (S Corporation Election). S Corporation election allows LLC owners to potentially reduce self-employment taxes by taking reasonable salaries and receiving remaining profits as distributions. C Corporation election subjects the LLC to corporate tax rates and double taxation but offers benefits like retained earnings and employee benefit deductions. Most single member LLCs benefit from default disregarded entity status unless specific circumstances warrant different treatment.

Question: What self-employment tax obligations apply to single member LLC owners?

Answer: Single member LLC owners must pay self-employment taxes of 15.3% (12.4% Social Security + 2.9% Medicare) on net business profits exceeding $400 annually. This applies to the full amount of LLC profits, unlike S Corporation elections where only salary portions face employment taxes. Self-employment tax calculations use Schedule SE, and owners can deduct half of self-employment taxes paid as an adjustment to income. Quarterly estimated tax payments help avoid underpayment penalties on both income and self-employment tax obligations.

Question: What business expenses can single member LLCs deduct on their tax returns?

Answer: Single member LLCs can deduct ordinary and necessary business expenses including office rent, equipment purchases, professional services, marketing costs, travel expenses, and home office deductions. Common deductions cover business insurance, professional memberships, educational expenses, business meals (50%), vehicle expenses, and depreciation on business assets. Startup costs up to $5,000 can be deducted immediately, with excess amounts amortized over 15 years. Maintain detailed records and receipts to support all business expense deductions claimed on Schedule C.

Question: How does single member LLC taxation differ from multi-member LLC taxation?

Answer: Single member LLCs file taxes as disregarded entities using Schedule C on personal returns, while multi-member LLCs must file Form 1065 partnership returns and issue K-1s to members. Multi-member LLCs cannot elect disregarded entity status and face more complex tax compliance requirements including partnership agreement considerations, capital account maintenance, and potential liability for partnership audit rules. Single member LLCs have simpler record-keeping, fewer filing requirements, and more straightforward tax planning, making them attractive for solo entrepreneurs and small businesses.

Question: What are the quarterly estimated tax payment requirements for single member LLCs?

Answer: Single member LLC owners must make quarterly estimated tax payments if they expect to owe $1,000 or more in taxes for the year. Payments are due on January 15, April 15, June 15, and September 15, covering both income tax and self-employment tax obligations. Calculate payments using Form 1040ES based on current year projections or 100% of prior year tax liability (110% if prior year AGI exceeded $150,000). Underpayment penalties apply when quarterly payments fall short of required amounts, making accurate projections essential.

Question: How should single member LLCs handle business banking and record-keeping for tax purposes?

Answer: Single member LLCs should maintain separate business bank accounts despite disregarded entity tax status to preserve limited liability protection and simplify record-keeping. Keep detailed records of all business income and expenses, maintain receipts and invoices, and use accounting software or spreadsheets to track financial activity. Document business purposes for expenses, especially those that could have personal use components like meals, travel, or home office expenses. Proper record-keeping supports tax deductions and provides protection during potential IRS audits.

Question: What happens to single member LLC taxation when adding additional members?

Answer: Adding members to a single member LLC terminates disregarded entity status and requires filing partnership tax returns (Form 1065) beginning with the tax year when the second member joins. The LLC must obtain an Employer Identification Number if operating under the owner's Social Security Number, establish partnership accounting methods and tax year, and create operating agreements addressing profit/loss allocation and member responsibilities. This change increases compliance complexity and may require professional tax assistance to navigate partnership taxation rules properly.

Operating as a single-member LLC offers simplicity, flexibility, and liability protection while letting you manage your business on your terms. However, taxes remain one of the most significant costs in running a business, and how you manage your LLC's structure, deductions, and compliance directly impacts your cash flow and peace of mind.

Whether you're deciding if default taxation fits your stage, considering an S Corp election to reduce self-employment taxes, or planning for growth while maintaining clean books, it pays to get your strategy right early.

Understanding how LLC owners can choose different tax elections and how your business structure affects your taxes helps you make informed decisions about your entity for federal tax purposes and your overall tax situation.

At Madras Accountancy, we help founders, freelancers, and growing businesses manage their bookkeeping, tax filings, and structure planning with precision. From day-to-day compliance to strategic advisory, we handle the complexities so you can focus on building your business.

👉 Let's keep your LLC tax-smart. Contact Madras Accountancy today.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.