Most people think about taxes only when it's time to file. But smart individuals and businesses know that what you do before tax season often matters more than what you do during it.

That's where tax planning and preparation services come in.

Tax planning is about making financial decisions throughout the year to reduce your overall tax liability. Tax preparation is about execution, ensuring your returns are filed accurately and on time. Together, they form the backbone of long-term financial efficiency and compliance.

In this guide, we'll break down what these services include, who benefits most from them, and how to choose the right partner to manage both. Whether you're a self-employed freelancer, a growing startup, or just someone tired of tax season surprises, understanding how these tax services work can save you serious money and stress.

Tax planning and tax preparation are two sides of the same coin; they serve very different purposes. Understanding the distinction is the first step to managing your taxes proactively rather than reactively.

Strategic tax planning focuses on minimizing your tax liability before it's time to file. It's a forward-looking process that evaluates your income, deductions, business decisions, and investments throughout the year to structure them in the most tax-efficient way possible.

Common income tax planning strategies include:

Effective planning requires a deep understanding of both current IRS rules and how they apply to your specific financial situation, whether personal or business.

Tax preparation happens when it's time to file, typically between January and April, or on your fiscal year-end. It involves collecting your financial records, calculating your tax liability, and submitting federal and state returns as well as sometimes local returns.

Quality tax preparation services go beyond just filling out forms. They:

While many DIY tools can help with basic returns, tax experts bring a level of accuracy and confidence that's especially valuable when stakes are high, such as business filings, self-employment taxes, or multi-state reporting.

Tax planning and preparation aren't just for the wealthy or large corporations. Individuals and small businesses often stand to gain the most both in tax savings and in avoiding unnecessary penalties from working with a qualified tax professional. Here's a detailed look at who benefits most from these services:

If you run a business, work as a freelancer, or earn 1099 income, your tax obligations are significantly more complex than those of a typical W-2 employee. You're responsible for calculating and paying self-employment tax, filing quarterly estimated payments, and tracking every deductible expense.

Most business owners aren't just dealing with one income stream; they're juggling contractor payments, office costs, home-office deductions, and possibly even payroll or state business tax compliance. Year-round tax planning services can help you:

Without proactive planning, many small business owners leave thousands on the table or worse, face IRS scrutiny due to accidental missteps.

High-net-worth individuals face unique challenges once their income crosses certain thresholds (typically $200,000+), as the tax code becomes significantly less forgiving. You may be subject to:

A qualified accountant or tax preparer doesn't just file your individual tax returns; they help you structure your finances to minimize your effective tax rate, legally and ethically. This could involve adjusting how you receive income (e.g., salary vs. distributions), strategically timing asset sales, or making use of donor-advised funds for charitable giving.

If you have income from rental properties, capital gains from investments, or passive business interests, your financial picture is far from straightforward. Tax planning becomes essential to:

Misclassifying income or missing depreciation schedules can cost you heavily, not just in taxes owed, but also in penalties. A tax planner helps ensure that real estate and investment income is structured in your favor.

Big life events can reshape your tax liabilities, often in unexpected ways. This includes:

A well-timed planning session can help you take advantage of credits (like the Child Tax Credit or Education Credits), plan for changes in filing status, and avoid costly missteps. For example, selling a home without understanding capital gains exemption could result in an unexpected tax bill.

Even if your tax situation isn't complex, working with a professional reduces the risk of missed deductions, reporting errors, or triggering an audit. For many individuals, the value lies in the confidence and time savings that come with professional support.

A good tax advisor can:

In short, if you have more than a single W-2 income stream, or if you're managing a business, investment portfolio, or navigating financial change, tax planning isn't optional; it's essential. And the earlier you begin, the more options you'll have to reduce your tax burden legally and strategically.

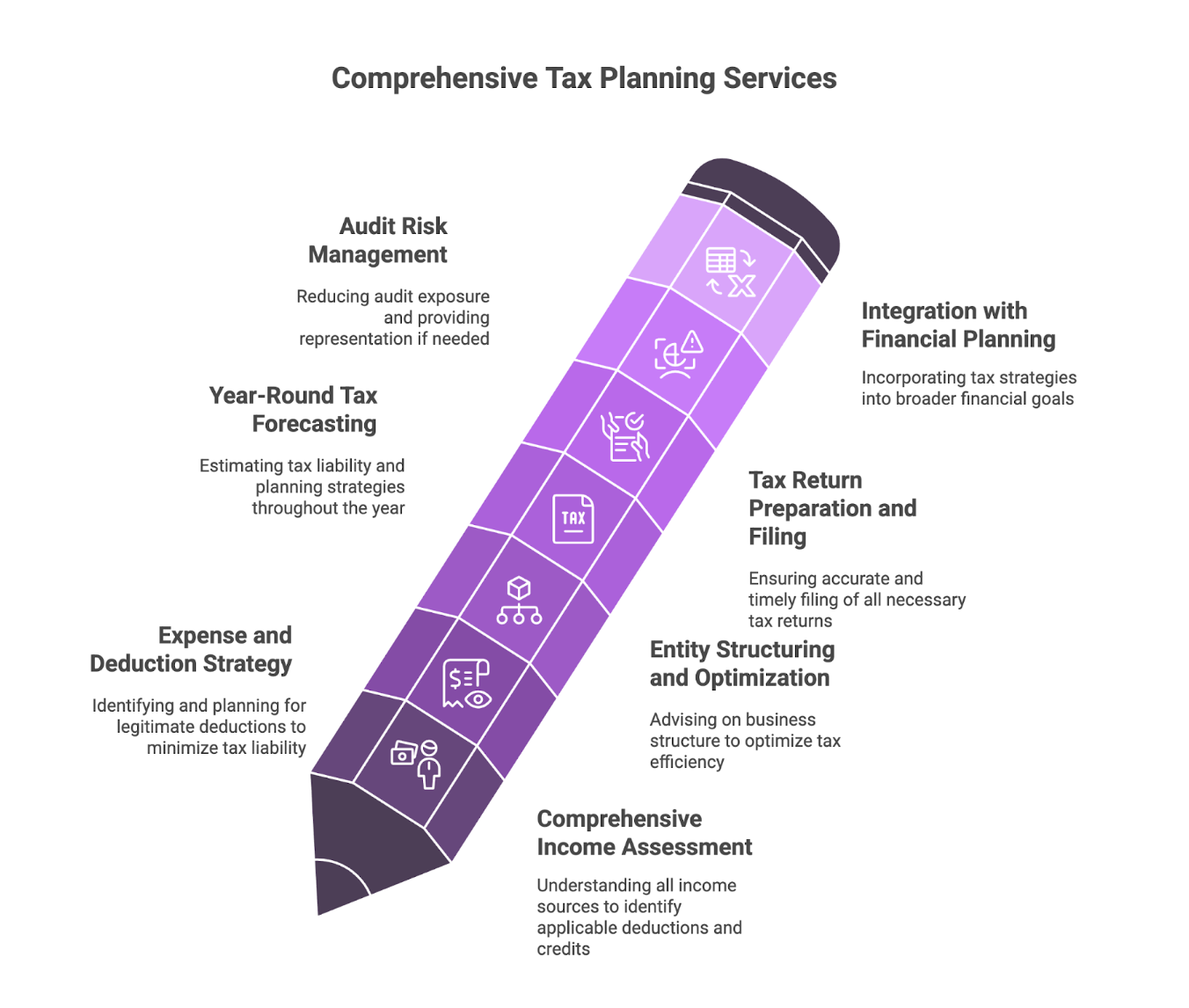

Tax planning and preparation isn't just about filing returns; it's a strategic, year-round process that blends compliance, forecasting, and optimization. When done right, these services go far beyond paperwork and help you keep more of what you earn.

Here's a breakdown of the essential components you should expect from professional tax planning and preparation services:

The first step in any tax planning engagement is a complete understanding of your income sources. This includes:

Understanding your full income picture helps certified public accountants identify which deductions, credits, or tax structures apply and which ones are likely to create audit risk if handled incorrectly.

Not all expenses are equal, and many are overlooked. A skilled CPA or preparer will:

Especially for small businesses or high-income individuals, deductions are the first line of defense against overpaying.

For business owners or freelancers, the way your business is structured (sole proprietorship, LLC, S corp, C corp) directly impacts your tax bill.

Tax planning services may include:

The structure that served you when starting may not be ideal once you're earning six or seven figures, and a proactive advisor will spot the tipping point.

Waiting until March or April to think about taxes is a mistake. Good planning is done before the year ends.

A strategic tax planner will:

Tax prep is reactive. Tax planning is proactive. The best services combine both.

This is the compliance part, but it's where accuracy is critical. A quality preparer will:

Filing mistakes can cost you dearly, either through missed refunds or IRS letters.

Good tax professionals reduce your audit exposure. Great ones are prepared if it happens.

Many tax planning services offer:

You don't want to face the IRS alone, but with good planning, you usually won't have to.

At higher income levels or for business owners, taxes can't be separated from your overall financial strategy.

That's why some tax planning services also include:

This is where the right tax partner isn't just filling forms, they're actively shaping your long-term wealth.

For individuals with significant assets, integrating tax planning with wealth management becomes crucial. This comprehensive approach helps make informed decisions about your financial life and ensures you're maximizing new opportunities while minimizing tax exposure.

An effective estate plan works hand-in-hand with tax planning strategies. Key considerations include:

For business owners, separating corporate tax planning from personal finances often leads to missed opportunities. A holistic approach considers:

This integrated approach ensures that your overall wealth management strategy optimizes both business and personal tax outcomes, creating a cohesive plan for long-term financial success.

For U.S. startups, founders, and small businesses, navigating taxes isn't just about compliance; it's about building financial resilience. That's where Madras Accountancy steps in.

Their team combines deep accounting expertise with a startup-first mindset, giving you the support of a full-stack finance team, minus the overhead.

Here's what makes outsourcing to Madras an advantage:

Madras Accountancy specializes in working with early-to-growth-stage companies, including Delaware C Corps, LLCs, and bootstrapped ventures.

Whether you're pre-revenue or scaling, they can support:

Our focus isn't on generic forms; it's on accounting that understands your cap table, burn rate, and growth roadmap.

Many U.S.-based startups today operate with international contractors or remote teams. That creates compliance headaches, especially with TDS, 1099s, or foreign payment reporting.

Madras Accountancy brings cross-border expertise to:

So you don't have to choose between speed and safety.

You don't just need someone to file your income tax return. You need:

Madras delivers those answers with proactive updates, not just once-a-year emails. It's built for people who run lean and don't have time to explain their business model to a generalist CPA.

Beyond tax planning, they help U.S. founders:

Because in today's ecosystem, your accounting isn't just about taxes, it's a signal to investors, a tool for decision-making, and a moat for operations.

Tax planning and preparation isn't just about meeting deadlines; it's about building financial clarity, avoiding penalties, and making confident business decisions.

Whether you're a solo founder, running a lean startup, or scaling with cross-border teams, proactive tax strategy can unlock real savings and peace of mind.

But doing it alone (or with a generalist) often leads to missed deductions, reactive decisions, and unnecessary stress.

At Madras Accountancy, we go beyond number-crunching; we help U.S.-based founders make smarter tax and financial decisions, all year long.

✅ End-to-end tax planning & filing

✅ Specialized support for U.S. startups & remote teams

✅ Transparent pricing, modern tools, and proactive advice

Ready to outsource your accounting, without outsourcing control?

Get in touch with Madras Accountancy and let's make taxes work for your growth.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.