If you received a 1099-MISC in the mail and aren't quite sure what to do next, you're not alone.

Every year, thousands of freelancers, landlords, and small business owners get this form and wonder:

Is this income taxable? What do I do with it? And why didn't I get a form W-2 instead?

Form 1099-MISC (short for "Miscellaneous Information") is one of the IRS's many information returns, used to report payments that don't fall neatly into salary, wages, or contractor fees. Think rent payments, legal settlements, royalties, or even cash prizes.

In this guide, we'll break down exactly:

We'll also show you how to avoid common 1099-MISC mistakes, and when it makes sense to bring in expert help, like a trusted tax advisor or accounting partner.

Let's dive in.

If you've received income outside of a traditional job, say, from renting out property or receiving a legal settlement, there's a good chance the Internal Revenue Service is expecting you to report it using Form 1099-MISC.

So, what is 1099-MISC exactly?

The IRS Form 1099-MISC, or Miscellaneous Information, is an IRS tax form used to report non-employee payments that don't fall under typical wages or salaries. It covers a wide range of income types and is commonly used by businesses, landlords, attorneys, and even healthcare providers. It's not just a form; it's a critical piece of how the IRS tracks taxable income outside a paycheck.

If you're a business owner, freelancer, landlord, or payer who made qualifying payments to an individual or entity in the past tax year and those payments weren't for employment, you may be required to file a 1099-MISC.

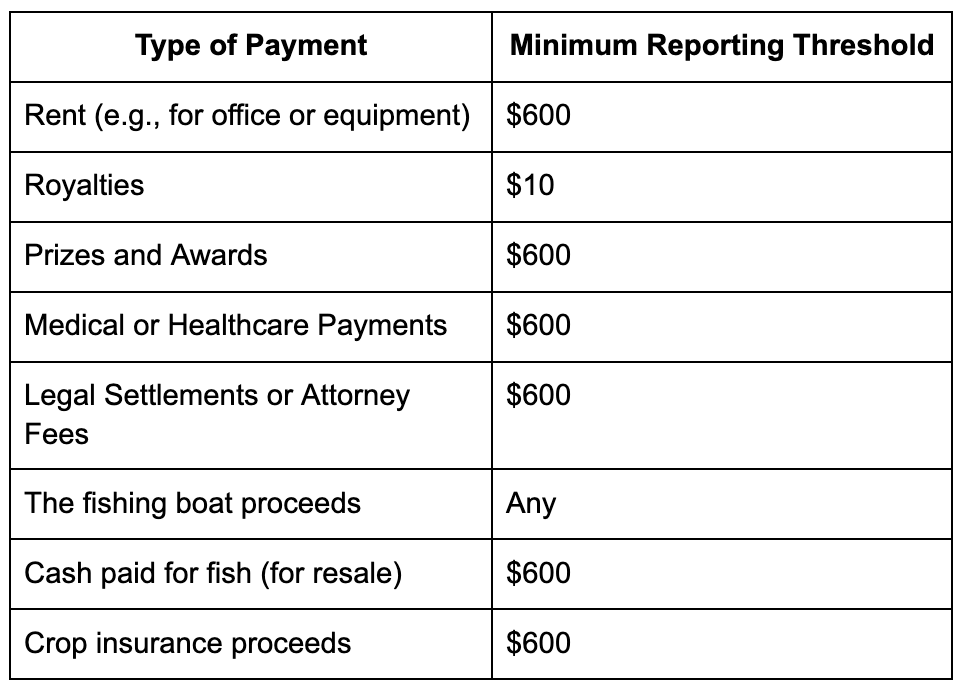

The IRS threshold is generally $600 or more in a calendar year for most categories. The responsibility to file lies with the payer, not the recipient.

Common filers include:

Here's what typically triggers a 1099-MISC:

These aren't "gray area" cases. The IRS uses this 1099 form to ensure income from these categories is declared and taxed accordingly.

Here's where many taxpayers get confused.

A form W-2 is issued to employees as a wage and tax statement, and taxes are automatically withheld. A 1099-MISC is for non-employees, and no taxes are withheld; it's up to the recipient to report and pay what's owed.

So, if you receive form 1099-MISC, it likely means:

This is why many small businesses outsource tax preparation; navigating IRS forms like the 1099-MISC can get complex fast.

Until 2019, Form 1099-MISC was used to report both miscellaneous income and nonemployee compensation (NEC). But starting in 2020, the IRS split those responsibilities to reduce confusion.

Now:

If you're self-employed and receive money for services rendered, you'll likely receive a 1099 form, specifically the 1099-NEC, not MISC.

Even though it's just a single page, the 1099-MISC tax form plays a big role in IRS compliance. It helps the government ensure that income earned outside of jobs, whether passive, one-time, or industry-specific, doesn't go unreported.

Failing to issue a required 1099-MISC can result in:

Whether you're issuing or receiving one, understanding what Form 1099-MISC is and how to use it correctly can make a big difference in how smoothly your tax season goes.

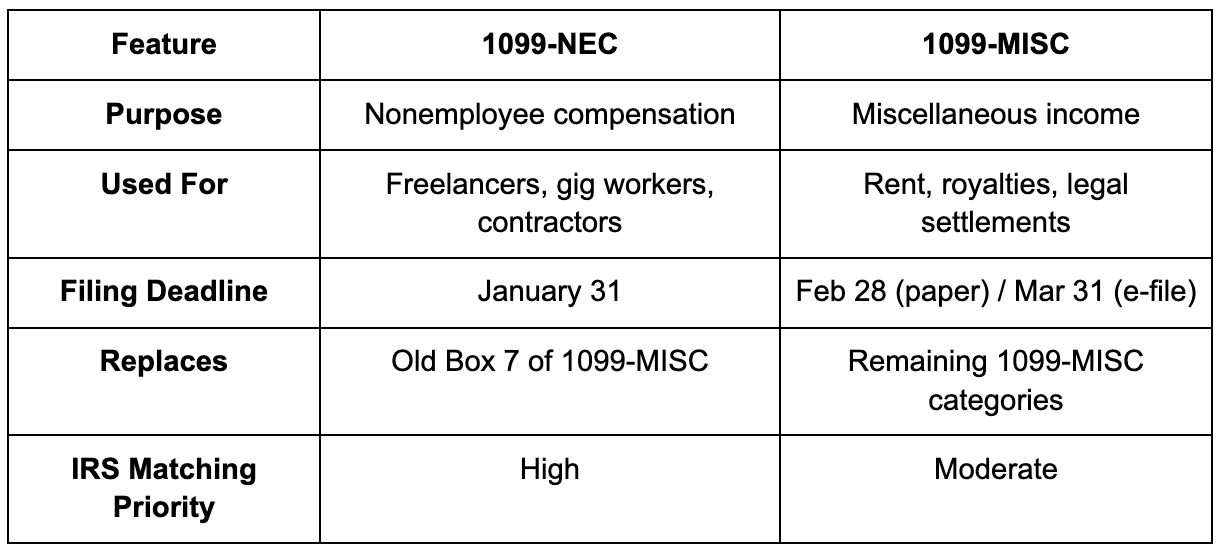

As we saw earlier, Form 1099-MISC has long been used to report a variety of non-wage payments, rent, royalties, legal fees, and even cash prizes. But starting in 2020, the IRS brought back an old form with a specific purpose: Form 1099-NEC (Nonemployee Compensation).

At a glance, both forms 1099-MISC and 1099-NEC report payments made to non-employees. But the difference between them is more than just semantics; it affects filing deadlines, tax compliance, and whether the IRS flags your tax return for further review.

Before 2020, businesses used Box 7 of the 1099-MISC to report payments made to independent contractors. The issue? The IRS required two separate filing deadlines for the same form: one for Box 7 (end of January), and another for the rest of the form (end of February or March if e-filed). This created confusion and delayed matching at the IRS.

To reduce mismatches and streamline reporting, the IRS reintroduced Form 1099-NEC, specifically to report contractor payments, removing them from the 1099-MISC entirely.

Now, the two forms serve distinct purposes with different due dates and filing logic. Form 1099-MISC is no longer used for contractor payments.

To stay compliant and avoid penalties, here's how to know which form to use:

Use form 1099-NEC to report if you:

Use form 1099-MISC to report if you:

📌 Note: Payments made through credit card or PayPal are usually reported on form 1099-K by the processor, not by you.

Using the wrong form or missing a deadline isn't just a minor paperwork error. It can lead to:

If you're issuing 1099s for the first time or are unsure about which form applies, working with a professional accountant can save you time and trouble. Getting it right the first time is far easier than dealing with IRS notices later.

TL;DR: Which Form Should You Use?

If you're paying a contractor for services → Use form 1099-NEC to report

If you're paying rent, royalties, or legal fees → Use Form 1099-MISC to report

The forms might look similar, but they serve very different roles in tax reporting. Understanding which applies to your business is key to staying compliant and keeping both the IRS and your vendors happy.

If you're a business owner, landlord, or anyone who's paid out miscellaneous income, Form 1099-MISC is how you report those payments to the IRS and your recipient. But with so many boxes and rules, many filers get tripped up by avoidable mistakes.

Here's a step-by-step breakdown that makes the process clear, whether you're issuing one form or dozens.

First, don't download and print the form 1099-MISC from the IRS website; that version is for informational use only. You'll need the official scannable red-ink version, which you can:

In the top left corner, enter:

This info tells the IRS who is sending the payment and allows them to match your tax records.

In the recipient section, enter:

📌 Tip: Always collect a Form W-9 from the recipient before issuing a 1099-MISC. It includes all this information and protects you from filing errors.

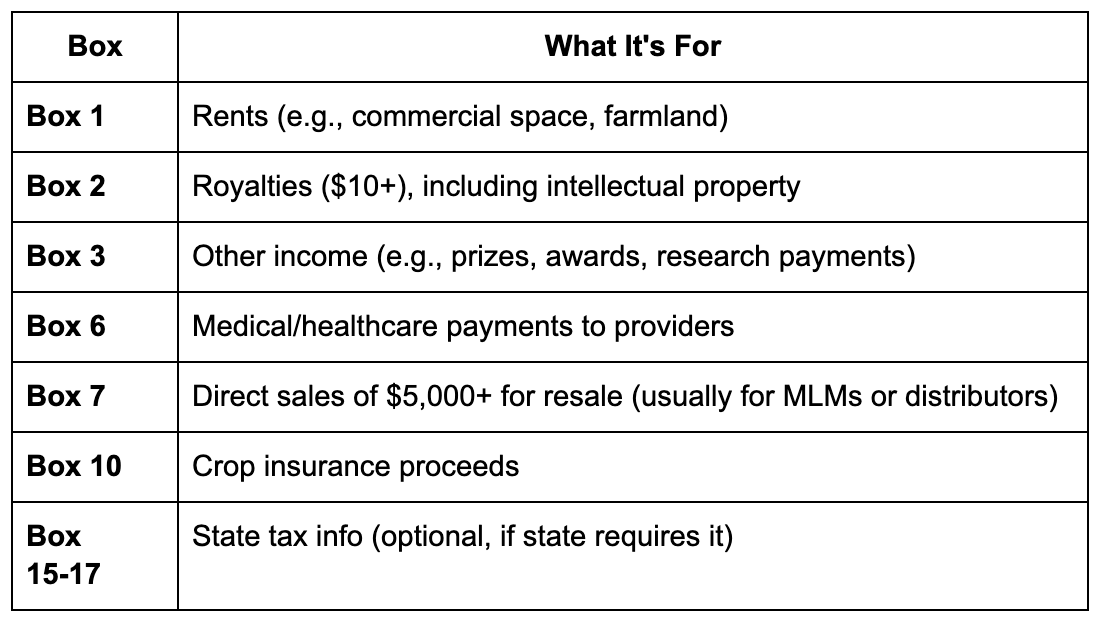

Here's where most mistakes happen: putting the payment in the wrong box.

Common 1099-MISC Boxes Explained:

Don't fill in Box 1 if you're reporting contractor payments; use box 1 of form 1099-NEC for that.

There are multiple copies of the 1099-MISC. Each one goes to a different place:

Filing deadlines:

📌 Reminder: If you miss deadlines, the IRS can charge late filing penalties starting at $60 per form, increasing the longer you delay.

Pro tip: If this still feels overwhelming, especially with multiple vendors or unclear payment categories, outsourcing this to a tax professional or a team like Madras Accountancy ensures full compliance and peace of mind.

You might receive a 1099-MISC if you:

Understanding what income must be reported on form 1099-MISC versus other forms is crucial for preparing your tax return:

If you also receive form 1099-MISC for different types of income, you'll need to report each type appropriately on your income tax return. Some income might go on different schedules or forms depending on the nature of the payment.

Sometimes you might receive a corrected form if the original contained errors. If you receive a corrected 1099-MISC after you've already filed your tax return, you may need to amend your return to reflect the accurate information.

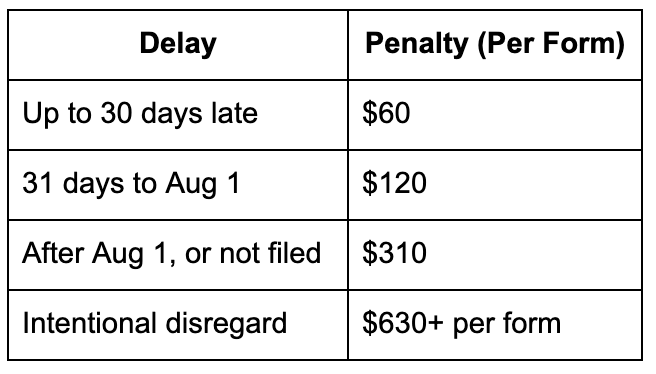

Many small businesses think of form 1099-MISC as "just a form," but the IRS takes it seriously. Filing late, submitting incorrect information, or failing to file altogether can lead to costly penalties, even if the error was unintentional.

Here's what you need to know about the risks and consequences:

If you miss the filing deadline, even by a few days, the IRS imposes penalties per form. The longer you wait, the worse it gets:

📌 Example: If you forget to file 10 forms after the deadline, you could owe $3,100+ in penalties, even if you eventually send them.

If you file a form 1099-MISC with a missing or incorrect Taxpayer Identification Number (TIN), the IRS may issue:

To avoid this, always request a Form W-9 from your payees and double-check TINs before filing.

Failing to file 1099s for vendors or service providers could raise red flags during an IRS audit, especially if you deduct those payments as business expenses.

In some cases, you may also be required to begin backup withholding, meaning you withhold federal income tax from future payments to that vendor until they provide a valid TIN.

Even if the IRS doesn't catch a mistake immediately, failing to issue a form 1099-MISC can cause issues for your vendors:

Professionalism and accuracy in tax reporting help build trust and protect your business reputation.

If you're running a business or working with contractors, understanding when to send you a 1099-MISC form isn't something you can afford to ignore. From late penalties to TIN mismatches, the risks of incorrect filing are real, and they can snowball fast.

But the good news? Staying compliant doesn't have to be overwhelming.

By planning, keeping clean records, and getting expert help when needed, you can turn 1099-MISC filing into a smooth, stress-free process, instead of a last-minute scramble when preparing your tax return.

Remember that the IRS form 1099-MISC is used to report specific types of miscellaneous income, and understanding what income is reported on a form versus reported on form W-2 or other tax documents is crucial for accurate tax reporting.

That's where a trusted partner like Madras Accountancy comes in. Their team helps small businesses across the U.S. handle tax filings, stay compliant, and navigate IRS forms like 1099-MISC with confidence.

Whether you're filing for the first time or cleaning up past mistakes, they'll walk you through it, clearly, correctly, and on time.

👉 Explore how Madras Accountancy can simplify your tax season

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.