Government contractors face higher levels of scrutiny than most businesses. When public funds are involved, transparency and accountability are not optional. This is where the Yellow Book comes in.

The Yellow Book, officially titled Government Auditing Standards, is published by the U.S. Government Accountability Office (GAO). It outlines the standards for conducting audits of government organizations, programs, activities, and functions, as well as those of contractors receiving federal funds.

For government contractors, especially those dealing with large contracts or cost-reimbursement agreements, Yellow Book audits are more than a formality. They are often required for continued eligibility, compliance, and successful contract renewals.

This guide explains what Yellow Book audit standards are, who they apply to, what they include, and how contractors and their CPA partners can prepare for them.

The Yellow Book is the GAO’s framework for conducting performance audits, financial audits, and attestation engagements involving government entities or entities receiving government funds. It was first issued in 1972 and is updated periodically. The most recent revision is the 2018 edition, which became fully effective for audits beginning on or after July 1, 2019.

The official name is Government Auditing Standards, but it is widely referred to by the color of its cover.

The Yellow Book sets ethical principles, competence expectations, documentation requirements, and reporting standards. It also establishes how independence must be maintained by auditors and how audit quality should be controlled and monitored.

If your business receives significant federal funding, especially through grants or cost-reimbursement contracts, you may be subject to audits that must comply with Yellow Book standards.

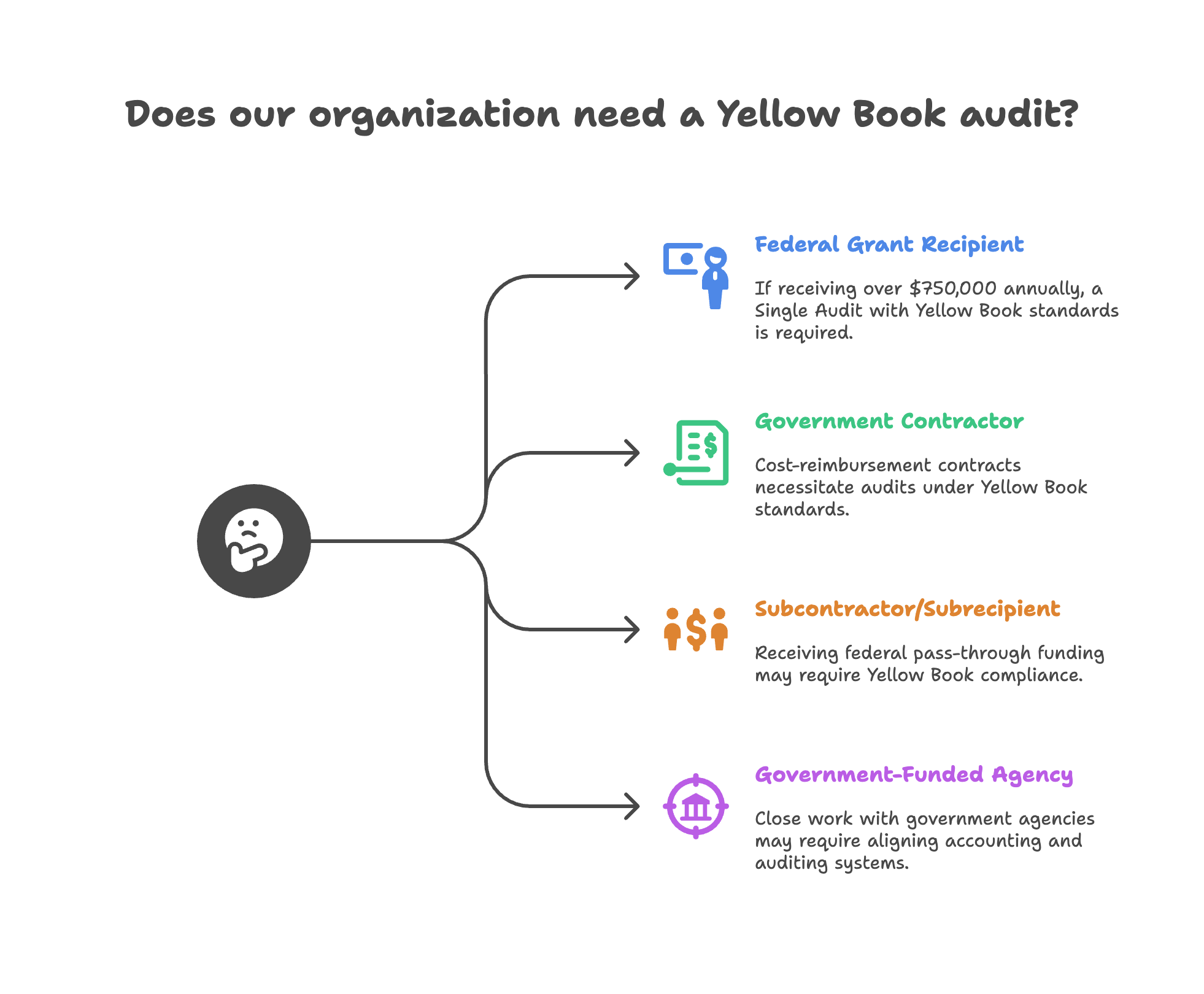

Key scenarios include:

Failure to comply with Yellow Book requirements can result in audit findings, delayed reimbursements, contract penalties, or even suspension from government programs.

CPA firms performing audits of such contractors must also follow these standards, which makes it essential that both the contractor and the audit firm understand their obligations.

Yellow Book audits are required in several common situations:

If your organization receives federal grant money exceeding the audit threshold (currently $750,000 annually), you are likely subject to a Single Audit, which incorporates Yellow Book standards.

If you are a private company with cost-type contracts, where the government reimburses actual costs incurred, audits must be conducted under Yellow Book standards.

Entities receiving federal pass-through funding from states or prime contractors may also need a Yellow Book-compliant audit.

While the Yellow Book primarily governs government agencies, contractors working closely with them are expected to align their accounting and auditing systems accordingly.

Auditors and auditees must follow principles of:

Contractors need to operate under these same values when interacting with auditors.

Yellow Book requires auditors to maintain both in fact and appearance independence. This means:

Contractors must be aware of this when selecting or working with audit firms.

Auditors must collectively possess the technical knowledge, skills, and experience to perform Yellow Book audits. Training requirements include:

Firms lacking Yellow Book experience may fail to meet these standards, which can disqualify an audit.

Firms conducting Yellow Book audits must:

This ensures audits meet the standard and can withstand federal scrutiny.

These focus on whether financial statements are presented fairly and in accordance with GAAP. For contractors, this typically includes:

Used to assess whether programs are operating efficiently, effectively, and economically. Though less common for private contractors, some may be subject to these evaluations under specific contract terms.

These are often requested when contractors need independent validation of cost allocation systems, billing procedures, or internal control structures. Common reports include:

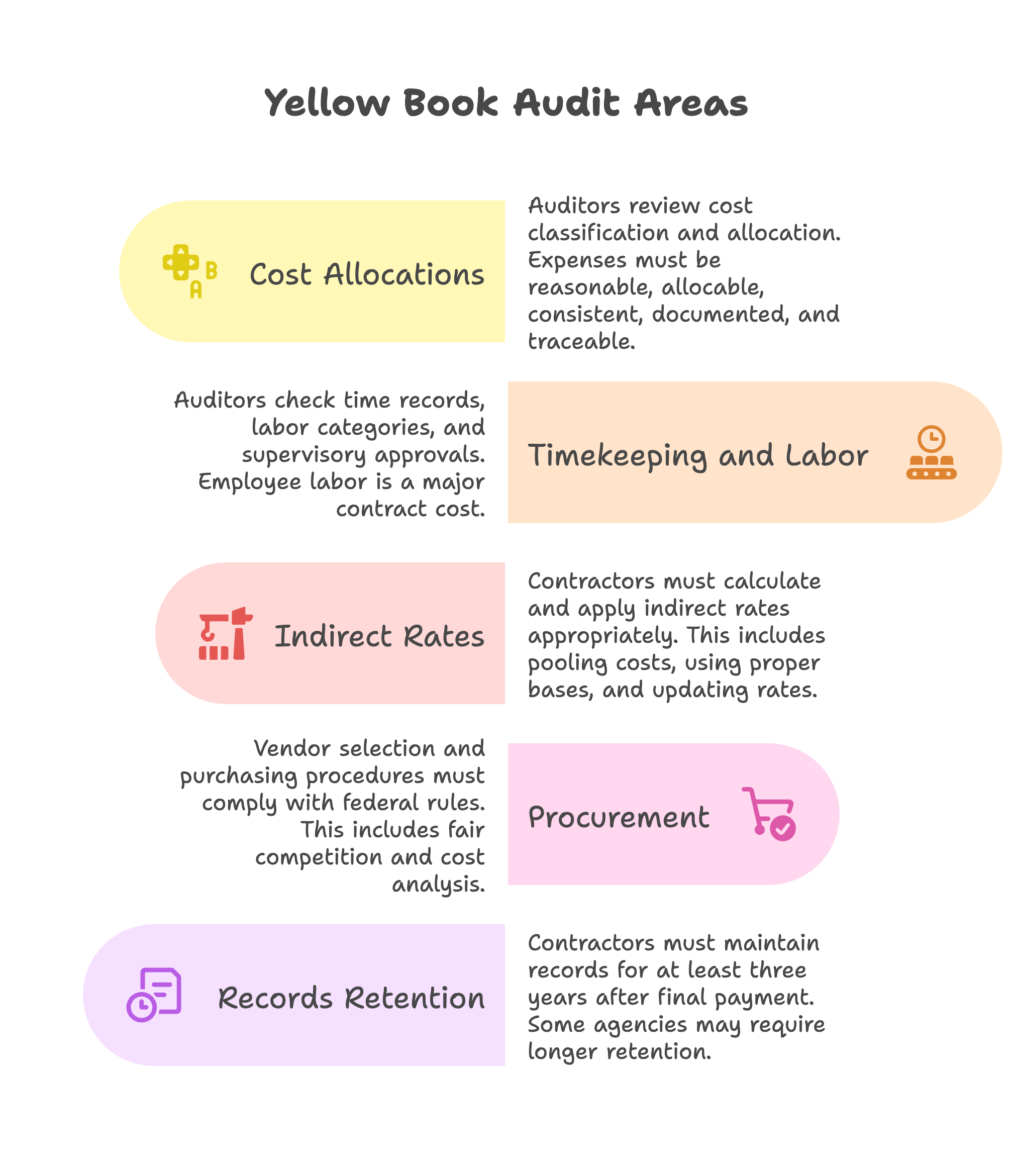

Auditors review how contractors classify and allocate costs. Expenses must be:

Employee labor is often a major contract cost. Auditors check:

Contractors must calculate and apply indirect rates appropriately. This includes:

The contractor's vendor selection and purchasing procedures must comply with federal rules. This includes:

Contractors must maintain records for at least three years after final payment. Some agencies may require longer retention.

Preparation and transparency go a long way in ensuring a smooth audit.

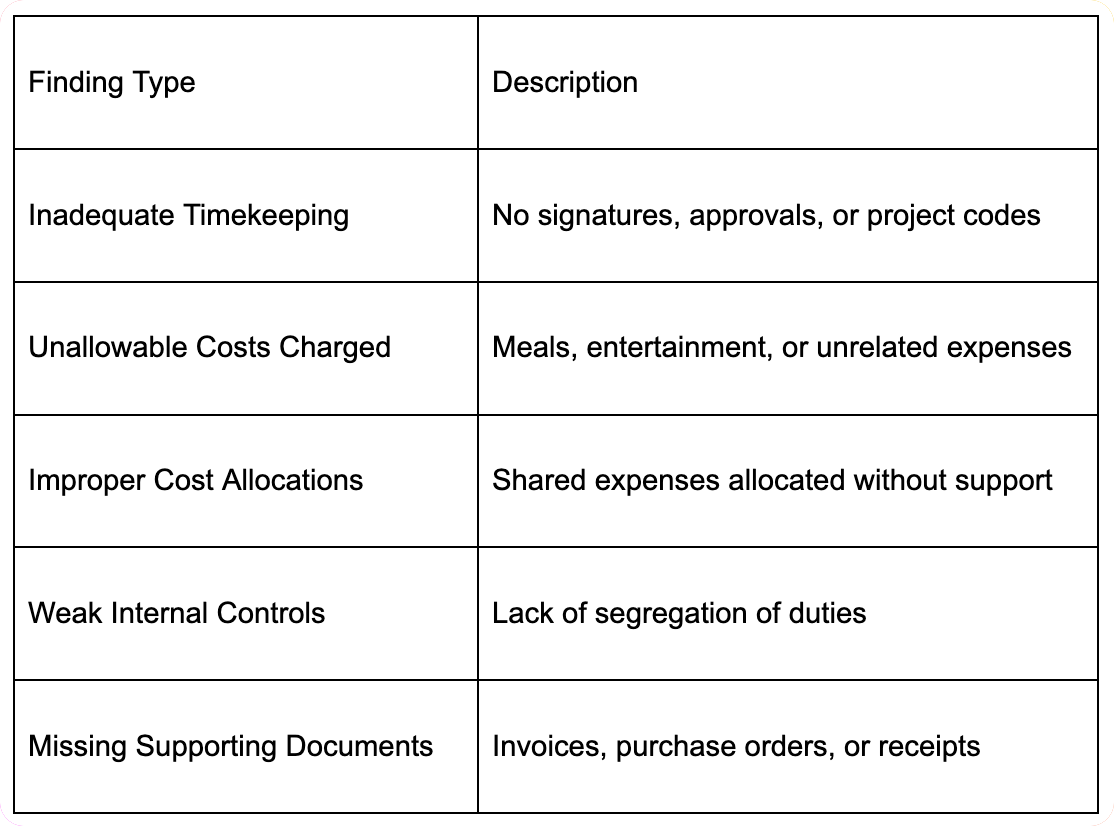

Here are some frequent deficiencies identified during contractor audits:

Each finding must be addressed through corrective action, which may involve repayment, reclassification, or policy changes.

CPA firms play a central role in:

Firms must meet all Yellow Book qualifications, including training, independence, and peer review. Contractors should vet their CPA partners thoroughly.

Create and update accounting policies tailored for government contracts, including:

Systems like Deltek Costpoint, Unanet, and JAMIS are built for government compliance and integrate cost pools, timesheets, and billing workflows.

Do not wait for the audit to identify problems. Have internal or external accountants review:

Ensure your team understands government compliance rules, particularly in finance, HR, and procurement functions.

If it is not documented, it did not happen. Retain clear records for every transaction, especially those billed to the government.

Yellow Book audit standards are not just technical guidelines. For government contractors, they are a crucial element of doing business with federal agencies. Understanding and implementing these standards ensures your company remains compliant, protects public funds, and positions your business for contract renewal and growth.

CPA firms experienced in Yellow Book audits can be valuable partners in managing risk, improving internal controls, and ensuring audit readiness year-round.

Question: What are Yellow Book audit standards and which government contractors must comply with them?

Answer: Yellow Book audit standards, formally known as Government Auditing Standards issued by the Government Accountability Office (GAO), establish requirements for audits of government entities and programs receiving federal funding. Government contractors must comply when receiving federal awards exceeding $750,000 annually (Uniform Guidance threshold), participating in major federal programs, or when specifically required by contract terms. Yellow Book applies to defense contractors, healthcare providers receiving Medicare/Medicaid, educational institutions with federal grants, nonprofits with federal funding, and state/local governments receiving federal assistance. Compliance ensures accountability for federal fund usage, taxpayer protection, and program effectiveness evaluation. Professional auditors conducting Yellow Book audits must meet specific qualification, independence, and continuing education requirements.

Question: How do Yellow Book standards differ from Generally Accepted Auditing Standards (GAAS)?

Answer: Yellow Book standards build upon GAAS by adding enhanced independence requirements, expanded reporting obligations, additional performance audit standards, and specific government audit considerations. Key differences include stricter independence rules covering financial relationships, consulting services, and personal connections. Yellow Book requires additional reports on internal control and compliance with laws and regulations beyond standard financial statement audits. Continuing education requirements mandate 80 hours every two years with specific government auditing content. Enhanced documentation requirements include fraud awareness, abuse detection, and government-specific risk factors. Professional judgment must consider public accountability, stewardship responsibilities, and transparency expectations exceeding private sector audit standards. Yellow Book audits often involve broader scope including operational efficiency, program effectiveness, and compliance with federal regulations.

Question: What are the specific independence requirements under Yellow Book standards?

Answer: Yellow Book independence requirements are more restrictive than GAAS, prohibiting non-audit services that could impair independence including bookkeeping, financial information system design, appraisal services, and management functions. Prohibited services cover human resource functions, investment advice, legal services, and internal audit activities. Personal relationships restrictions include immediate family employment prohibitions and extended family financial interest limitations. Rotation requirements may apply for certain engagements while management participation prohibitions prevent auditor involvement in client decision-making. Professional judgment must evaluate independence threats and implement appropriate safeguards or decline engagements when independence cannot be maintained. Documentation requirements include independence assessments, threat evaluation, and safeguard implementation. Annual independence confirmations and ongoing monitoring ensure continued compliance throughout audit engagements.

Question: What types of reports are required under Yellow Book audit standards?

Answer: Yellow Book audits require multiple reports including the standard financial statement audit report plus additional reports on internal control over financial reporting and compliance with laws and regulations. The internal control report identifies significant deficiencies and material weaknesses in internal control design and operation. The compliance report addresses violations of laws, regulations, contracts, and grant agreements that could have direct and material effects on financial statements. Management letter communications identify less significant control deficiencies and recommendations for operational improvements. Additional reporting may include questioned costs identification, findings and recommendations for compliance violations, and views of responsible officials responses. Professional reporting standards require clear distinction between significant deficiencies, material weaknesses, and compliance violations with appropriate recommendations for remediation.

Question: How should auditors plan and conduct risk assessment for Yellow Book audits?

Answer: Plan Yellow Book audit risk assessment by evaluating government-specific risks including compliance with federal regulations, grant agreement requirements, internal control adequacy, and fraud susceptibility. Assess risks related to federal program compliance, cost allowability, cash management, procurement procedures, and reporting requirements. Consider previous audit findings, monitoring reports, regulatory examination results, and management turnover affecting risk levels. Evaluate control environment considering public accountability, governance structure, and management commitment to compliance. Professional risk assessment includes fraud risk factors unique to government environments, such as political pressure, budget constraints, and public scrutiny. Technology risks cover system security, data protection, and compliance with federal IT requirements. Documentation should support risk-based audit approach and resource allocation decisions.

Question: What continuing education requirements apply to Yellow Book auditors?

Answer: Yellow Book auditors must complete 80 hours of continuing professional education every two years, with at least 24 hours directly related to government auditing, the government environment, or the specific program being audited. Continuing education must enhance professional competence in government auditing, including knowledge of government accounting, auditing standards, internal control concepts, and applicable laws and regulations. Acceptable education includes formal training programs, conferences, seminars, self-study courses, and graduate coursework relevant to government auditing. Professional development should cover emerging issues, technological changes, and regulatory updates affecting government audit practice. Documentation requirements include training certificates, course descriptions, and relevance to government auditing responsibilities. Audit firms must ensure all engagement team members meet continuing education requirements before assignment to Yellow Book audits.

Question: How do procurement and federal award compliance requirements affect Yellow Book audits?

Answer: Procurement and federal award compliance significantly affect Yellow Book audits through testing requirements for allowable costs, procurement procedures, cash management, and federal program compliance. Auditors must evaluate compliance with Uniform Guidance (2 CFR 200) requirements including cost principles, procurement standards, and administrative requirements. Testing covers competitive bidding procedures, vendor selection processes, contract administration, and conflict of interest policies. Additional compliance areas include cash management systems, financial reporting accuracy, and subrecipient monitoring procedures. Professional procedures must address questioned costs, compliance violations, and internal control deficiencies affecting federal award administration. Single audit requirements may apply for entities expending $750,000 or more in federal awards, requiring additional compliance testing and reporting responsibilities.

Question: What are common findings and recommendations in Yellow Book audits of government contractors?

Answer: Common Yellow Book audit findings include inadequate segregation of duties, weak internal controls over federal award administration, non-compliance with procurement requirements, and deficient cost allocation systems. Frequent issues cover inadequate documentation supporting cost allowability, violations of federal award terms and conditions, weak subrecipient monitoring procedures, and inadequate cash management systems. Technology-related findings include insufficient cybersecurity controls, inadequate data backup procedures, and weak access controls over financial systems. Professional recommendations typically address control environment improvements, policy and procedure development, staff training enhancement, and compliance monitoring system implementation. Corrective action plans should include specific deadlines, responsible parties, and measurable outcomes. Follow-up procedures ensure implementation of recommendations and resolution of compliance violations.

A practical comparison of hiring a freelancer vs using a dedicated offshore accounting team, focusing on continuity, quality control, security, and scaling.

How CPA firms outsource payroll and 1099 work to reduce penalties and admin load, with a clean workflow for approvals, filings, and year-end reporting.

Practical do's and don'ts for CPA firms outsourcing accounting work, based on common failure points and what successful rollouts do differently.